- Electronic networks account for majority of dealer trading

- Regulator says data provides first look at role of ATSs

Even on staid municipal bond desks, the days of traders working the phones are rapidly fading.

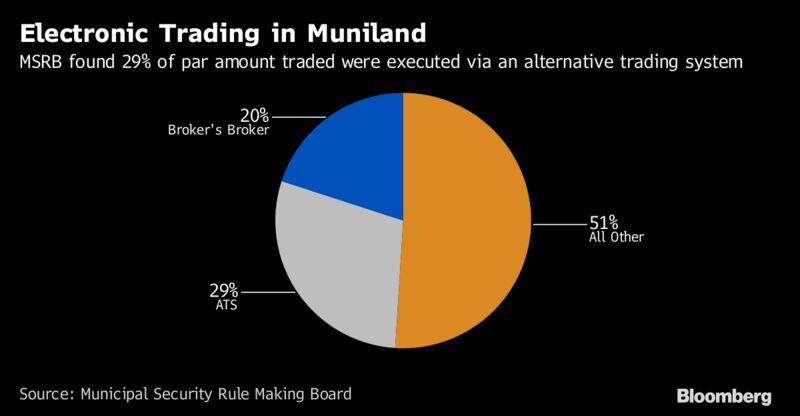

Electronic-trading platforms, known as ATSs, for securities firms and big investors account for 59 percent of all state and local debt trades between dealers, according to data released by the Municipal Securities Rulemaking Board. Dealers can choose to trade one of three ways — through ATS, broker’s brokers or directly with each other.

“Our data provide the market’s first view of the extent to which ATSs are used in the muni market,” John Bagley, the Chief Market Structure Officer at the MSRB, said in a statement. “These platforms, which disseminate quotes and expand access to bond inventories, can help improve liquidity and market efficiency. They can also help dealers obtain the best pricing for investors.”

The MSRB first began data collection on the amount of trading executed on ATSs in July of 2016. In the past twelve months, 29 percent of total inter-dealer par amounts traded were executed through an alternative trading system.

While a majority of inter-dealer trades used ATSs, 34 percent were still conducted directly between dealers and 7 percent through a broker’s broker.

Bagley said that ATSs can provide a way for “dealers to access bids and offers from a wide range of market participants,” given that securities firms have cut their bond inventories by about 50 percent over the past decade.

Bloomberg Markets

By Danielle Moran

November 9, 2017, 9:30 AM PST