Build America Mutual and Assured Guaranty see opportunity with the drop in local government creditworthiness

The decimated municipal-bond insurance industry is having a renaissance.

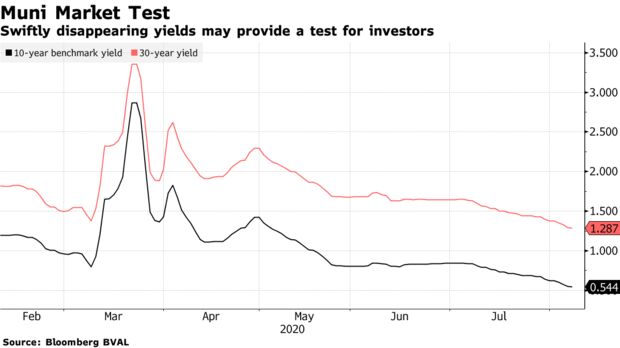

Weakened by Covid-19, state and local borrowers are using insurance at their highest rates in more than a decade. This type of upfront protection offers a promise from insurance companies to pay investors if the municipality defaults. Overall, the share of newly issued muni debt carrying insurance reached 7.13% in the second quarter and was 6.8% in the third quarter, up from an average of 4.72% in the decade before the pandemic, according to Municipal Market Analytics data.

Fueling the trend is a drop in local government creditworthiness that has left public officials looking for ways to keep down borrowing costs. That dynamic has spelled opportunity for the two active municipal bond insurers, Build America Mutual and Assured Guaranty Ltd., and helped the muni market run smoothly, despite significant stress.

For investors, however, the increased need for insurance is a growing concern, especially since insurance firms are only willing to back certain types of bonds.

“The bond insurers are only underwriting policies for bonds they believe are not going to default,” said Nicholos Venditti, senior portfolio manager at Wells Fargo Asset Management.

Most governments continue to borrow without insurance and the risk of default remains low, limiting how much buy-and-hold investors benefit from the sacrifice in yield that comes with insurance. Out of an estimated 50,000 issuers in the roughly $4 trillion municipal market, there have been only about 50 new defaults since the pandemic began.

Among recent issuers, Oregon State University used bond insurance to secure lower interest rates on about $300 million in taxable long-term bonds issued this month to help pay for capital projects and manage the pandemic’s financial impact, said spokesman Steve Clark.

The school didn’t attach insurance to its last two pre-pandemic bond issues, but revenues from housing, dining and athletics have fallen as a result of Covid-19 as has international student enrollment. The majority of prospective investors preferred an insured bond issue, Mr. Clark said, and the rate the school was able to get fell by 0.08 percentage points after adding insurance.

Mr. Clark said the decision to use insurance wasn’t based on the pandemic or its impacts on the school but on investor feedback and a desire to lower borrowing costs.

A recent stress test by Merritt Research Services found that if universities lost a quarter of their revenues, 44% of public schools and 39% of private schools would exhaust any available financial cushion unless they made cuts. In the same scenario, about a fifth of hospitals would run out of cash, the firm found.

“In a sector like higher education where all credits tend to get painted with a negative brush…to some degree putting insurance on top of it is attractive to some investors who then don’t have to do all the research,” said Dan Hartman, managing director at PFM Financial Advisors LLC, which counsels government borrowers.

Mr. Hartman estimated that an A-rated borrower might pay $500,000 for insurance that would lower rates on a $100 million 20-year bond issue by 0.05 to 0.1 percentage points after factoring in the cost of insurance. The savings in that scenario could amount to roughly half a million present-day dollars, stretched out over the life of the bond, he said.

Issuers aren’t the only ones buying more insurance; investors are also choosing to add protection to their uninsured holdings.

Asset manager Lord Abbett this spring bought insurance on some of its munis after ratings firms placed negative outlooks on the issuers, said partner and director Daniel Solender. The extra protection will enable the bonds to remain in the firm’s high-grade portfolios in the event of a downgrade or help the firm find buyers if it chooses to sell, Mr. Solender said.

The return of significant insurance to the muni market comes more than a decade after that industry was decimated in the financial crisis.

Extra Protection

Bond insurance is more popular than at anytime since the last recession but remains farbelow pre-crisis levels.

In the wake of the crisis, bond insurance firms that had sold protection on residential mortgage-backed securities lost their AAA credit ratings, creating a host of problems for the state and local borrowers they insured.

Build America Mutual and Assured Guaranty said they are well positioned to weather pandemic-related downgrades or losses. Both firms have increased prices on some insurance products, according to people familiar with the matter.

S&P Global Ratings credit analyst David Veno said Build America Mutual and Assured Guaranty each have enough capital to cover the insurance payout scenarios resulting from the pandemic and maintain their financial stability. Both are rated AA by S&P.

Build America Mutual, which started in 2012, sticks to government-backed bonds and steers clear of nonprofit hospitals and private universities, which also issue debt in the municipal market.

“We sort of have stuck to our knitting all along, so that’s the backdrop of why we are less concerned about the severity of loss in our portfolio going forward,” said Chief Executive Seán McCarthy.

Mr. McCarthy said that while he believes the likelihood of default on this type of debt is very low, it isn’t zero, creating a benefit even for buy-and-hold investors.

“When you take out a life insurance policy, you don’t think you’re dying next year,” he said.

Assured Guaranty, the only insurance firm from the financial crisis to remain active, now has a portfolio comprising 96% municipal debt and insures about $232 billion, less than half the amount it did before the crisis. “We believe our insured portfolio is in good shape to weather this economic disruption,” said Robert Tucker, a spokesman.

It remains to be seen in what shape insurers will emerge from the pandemic, said Josh Esterov, a senior insurance analyst at CreditSights. Any gains from the increase in business could be eroded by payment delinquencies on bonds in the insured portfolio.

“Is this good or bad? It’s going to depend on the level of delinquencies,” Mr. Esterov said.

The Wall Street Journal

By Heather Gillers

Oct. 22, 2020 5:30 am ET