Investors including OppenheimerFunds and Knighthead Capital Management filed an objection against Puerto Rico’s power utility

A group of investors in Puerto Rico have asked a federal court to intervene in the island’s storm recovery, posing the latest challenge to the way the territory is responding to Hurricane Maria.

Bondholders of the Puerto Rico Electric Power Authority filed an objection asking a federal judge to block the installation of an emergency manager, who they say doesn’t have the experience necessary for the job. They also said in their filing that Prepa leaders failed to execute a storm-response plan, exaggerated damages, and signed a no-bid, $300 million contract with an inexperienced firm that did little to restore Puerto Rico’s power lines.

Representatives for Prepa, Puerto Rico’s financial oversight board and the island’s governor didn’t immediately respond to requests for comment.

Federal officials and other stakeholders are also questioning Prepa’s work, including the authority’s no-bid contract with the Montana-firm Whitefish Energy Holdings LLC. The deal—which has since been canceled—prohibited audits and paid what critics say were inflated rates to Whitefish. Congress and the Federal Bureau of Investigationare reviewing the details of the deal.

While the Whitefish deal isn’t central to the creditors’ claims, their filing cited it as evidence of Prepa’s inefficiency and poor decision making. Instead of expediting the recovery, the utility created a bottleneck because Whitefish subcontracted with the same firms that otherwise would have sent workers to Puerto Rico under mutual-aid agreements Prepa has with other U.S. utilities, the filing said.

A Whitefish spokesman didn’t respond directly to the filing but sent a statement the company had released about its progress Friday afternoon. Whitefish said it brought 350 linemen to the island who have helped restore 30 miles of transmission lines, replaced or repaired more than 60 towers with helicopter airlifts, and brought power back to 500,000 people in and around San Juan.

Both Puerto Rican and federal officials have faced criticism for the recovery efforts since Hurricane Maria made landfall Sept. 20. Officials have often attributed delays to the severity of the storm, the island’s disconnect with the mainland U.S., and longstanding financial and infrastructure problems.

Nearly 3,000 people are still in shelters and about a fifth of the island doesn’t have access to clean water, according to the territory’s site Status.PR. A fifth of bank branches are still closed, and nearly half of cell sites are down.

The death toll rose to 55 as of Thursday. But that tally may underestimate the effect of the disaster, given more people are dying from illnesses and poor medical care that, while not officially attributed to the storm, resulted from the ensuing emergency that prevented people and hospitals from getting clean water and electricity.

It could take another month or two to restore power to just half the island, Trump administration officials said Thursday in front of the House Committee on Energy and Commerce. More than 85% of the grid was destroyed, and the storm’s total damage to Prepa is likely more than $5 billion, Prepa Chief Executive Ricardo Ramos has said.

The bondholders are disputing those figures. An analysis they commissioned from PA Consulting Group says more than 85% of the system’s assets are intact and restoration could cost less than $1 billion.

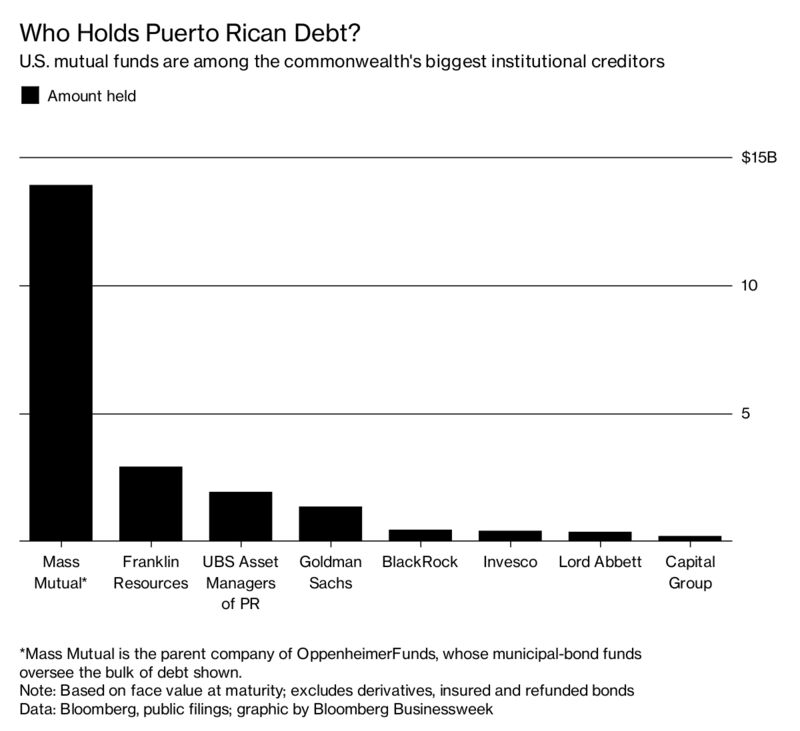

These investors, including OppenheimerFunds Inc. and Knighthead Capital Management LLC, hold more than a third of Prepa’s $8.3 billion in total outstanding debt. Puerto Rican investments have been a source conflict between Wall Street firms and the territory for years, especially after the island filed the largest-ever municipal bankruptcy last year.

The condition of Prepa’s assets will now become central to those conflicts. If the utility successfully claims the assets have been destroyed, it could make it harder for the investors to get paid.

“While there is no question that Hurricane Maria did extensive widespread damage to Puerto Rico, it is now clear that the vast majority of the assets of the PREPA system weathered the hurricane well and remain substantially intact,” the investors said in their filing with U.S. District Court for the District of Puerto Rico on Friday afternoon.

“The electric system could expeditiously be restored to pre-hurricane conditions with industry standard and responsible efforts,” the filing said.

Even though power generators were largely unscathed, federal officials have backed up local leaders in saying damage to transmission lines is especially difficult and expensive to fix in Puerto Rico. The main arteries cross mountainous terrain to connect power plants in the south to population centers in the north.

The federal oversight board, created by Congress after last year’s bankruptcy filing, tapped Noel Zamot, its top official for economic revitalization, to assume control of reconstruction as Prepa’s emergency manager. But the investors asked judges to block that appointment. Mr. Zamot has spent his career in national security, not in the utility industry, and that should be a prerequisite for his new job, the filing said.

The Wall Street Journal

By Timothy Puko

Nov. 3, 2017 7:34 p.m. ET

—Arian Campo-Flores and Andrew Scurria contributed to this article.