Puerto Rico had a strategy over the past decade to paper over its deficits: Issue billions of dollars worth of tax-free municipal bonds.

OppenheimerFunds Inc. had a strategy over the same period to deliver outsized returns to its muni mutual-fund shareholders: Buy billions of dollars worth of the commonwealth’s high-yielding debt.

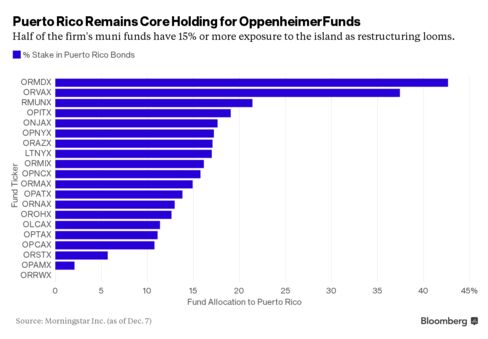

For both the Caribbean island and the New York-based investment firm, 2015 marked an abrupt change in course. Puerto Rico is locked out of the public markets after its governor said it couldn’t pay all its debts. OppenheimerFunds is starting to see cracks in its long-held strategy of buying bonds that offer high yields. Ten of its 20 muni funds have at least a 15 percent stake in junk-rated Puerto Rico. Nine of those rank in the bottom 10 percent of their peer group this year, according to data compiled by Bloomberg through Dec. 10.

In a year when high-yield muni funds earned the top returns, OppenheimerFunds’s underperformance shows the disconnect between the market for Puerto Rico bonds and the $3.6 trillion of other state and local government securities. The island’s $70 billion of debt offers interest that’s exempt from federal, state and local income taxes, which attracted managers that have funds focused on a single state.

Starkest Examples

The OppenheimerFunds Maryland portfolio is the firm’s starkest example of following that strategy, with a 43 percent allocation to Puerto Rico securities, according to Morningstar Inc. data. It has trailed 94 percent of peers this year, Bloomberg data show. The firm’s Virginia fund is the next-most-concentrated, with a 37 percent stake in commonwealth debt. It has lost 2.65 percent in 2015, the worst of any muni mutual fund, even though it pays the second-highest dividend yield.

The only fund with a greater exposure to Puerto Rico than those two is the Franklin Double Tax-Free Income Fund, which buys territory debt, according to Morningstar. It has declined 2.1 percent this year.

“In bond funds, the total return is mostly driven by yield,” said Beth Foos, an analyst at Morningstar in Chicago. “But investors really have to pay attention to the portfolio and the makeup of the funds, because when you’re getting a higher yield for a particular security, there’s a reason why.”

Taking Risks

Meredith Richard, a spokeswoman in New York for OppenheimerFunds, said the company had no comment on its performance this year.

OppenheimerFunds has a “Puerto Rico Roundup” section of its website that provides the firm’s latest thoughts on the island’s fiscal crisis. The last post came on Dec. 11. It discussed a bill proposed last week by Senators Chuck Grassley, Orrin Hatch and Lisa Murkowski that would assist the commonwealth, as well as the Supreme Court’s decision to rule on the constitutionality of the island’s Recovery Act.

“We have seen the Puerto Rico securities held by our funds deliver highly competitive levels of tax-free income and what we believe to be high value relative to the risk they incur,” the website says. “We hope our shareholders have seen this, too.”

Speculative Investments

Out of 602 open-end muni mutual funds tracked by Bloomberg, OppenheimerFunds has seven of the 10 highest-yielding offerings. That’s because over the years, in addition to taking on Puerto Rico securities, the firm’s money managers have invested in airline-backed debt, small private colleges, tobacco bonds and real-estate development deals, all of which feature speculative qualities.

The strategy has often paid off because their funds pay out more interest than their competitors, padding returns. The $2.1 billion Oppenheimer Rochester AMT-Free Municipals Fund, with a yield that’s over 1 percentage point higher than any other peer, has ranked in the top 10 percent returns among peers over a one-, three- and five-year period, Bloomberg data show.

That used to be the norm across its suite of funds. Yet the $5.6 billion Oppenheimer Rochester Fund Municipals portfolio, with the third-highest dividend of any open-end muni offering, returned in the bottom 10 percent of comparable funds in the past one- and three-year stretches, the data show.

Only Segment

The difference between the two funds? The former has an 11 percent allocation to Puerto Rico, according to Morningstar. The latter has a 21.4 percent stake.

Puerto Rico bonds have plunged 7.3 percent this year, the only segment of the municipal market to lose money in 2015, according to Standard & Poor’s Dow Jones Indices data. And it might not get immediately better for investors in the coming months as the island veers closer to a restructuring of its debt.

“It’s hard to assume much in the way of positive price surprises in the near-term for any Puerto Rico securities,” Matt Fabian and Lisa Washburn at Concord, Massachusetts-based research firm Municipal Market Analytics wrote in a Dec. 7 report.

Puerto Rico bonds may have room to rally as the island’s path to restructuring becomes clearer. Some securities have been trading at dollar prices lower than the recovery rates assumed by Moody’s Investors Service. Any gain would be a boon to investors currently putting money into OppenheimerFunds’s muni offerings.

Puerto Rico Electric Power Authority securities reached the highest price since June 2014 after some investors agreed to take losses of 15 percent. Tax-exempt debt due in July 2017, which fell to 49.7 cents in July, climbed to 68.5 cents in November. OppenheimerFunds is the largest holder of the bonds, Bloomberg data show.

January Payments

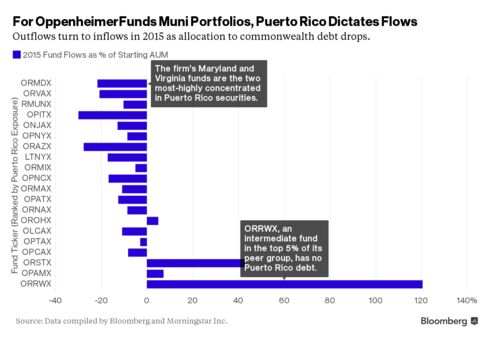

Shareholders don’t appear to be waiting for a rebound. They’ve yanked almost $3 billion from the company’s 20 muni funds in 2015 through Nov. 30, according to Bloomberg data, which analyzes the change of assets net of performance. That outflow represents 11.4 percent of the $26.2 billion they had to start the year. Muni mutual funds as a whole have added $10.6 billion in 2015, Lipper US Fund Flows data show.

The firm’s three muni funds with the least exposure to Puerto Rico, however, saw net inflows through the first 11 months of the year, Bloomberg data show.

The commonwealth faces $958 million of bond payments in January that it may fail to make, even after the unprecedented step of clawing back revenue from some debt to pay general obligations. Add to that squabbling among lawmakers in San Juan and Washington about the best path to resolve the crisis, and it follows that fund flows show individuals are leery about investing in Puerto Rico.

“Holders not prepared for strange doings, confusion, and political interference should not still be holding Puerto Rico securities,” MMA’s Fabian and Washburn wrote.

Bloomberg Business

by Brian Chappatta

December 13, 2015 — 9:00 PM PST Updated on December 14, 2015 — 11:51 AM PST