Bondholders such as Nuveen Asset Management are some of the biggest beneficiaries of the resurgence in air travel among U.S. consumers, and they don’t see an end in sight.

Debt issued to fund airport improvements are outperforming the broader $3.7 trillion municipal-bond market for an unprecedented fifth consecutive year. That’s likely to continue because the bonds have dedicated revenue streams and they still offer higher returns than top-ranked municipals, said John Miller, Nuveen’s co-head of fixed income in Chicago. He said he’s looking to buy more.

With the U.S. economy growing by about 2.5 percent in 2016, airlines will see enplanements, or the number of passengers arriving or departing at airports, rise by 4 percent, according to Moody’s Investors Service. The credit-rating company expects airports to exceed their budgeted growth and a few to win positive changes to their ratings or outlooks this year, said Earl Heffintrayer, a Moody’s analyst in New York.

“There is still a need in the marketplace to have that additional spread and that additional yield without an enormous amount of credit risk,” said Miller, whose company oversees about $100 billion in munis.

Securities in the Standard & Poor’s Municipal Bond Airport index are yielding 2.33 percent, compared with 1.98 percent for bonds in the national investment-grade index, according to J.R. Rieger, vice president of fixed-income indexes at S&P in New York. In October, the gap in the yield between the two indexes was 0.26 percentage point.

This year has been a good one for airports already: enplanements have increased by almost 5 percent, which was more than the 4 percent expected by Moody’s. Enplanements are key since they drive a range of cash-generating avenues from parking fees to beer sales at the terminal bars.

It’s been a good year for bondholders too. Airport debt has gained 3.5 percent through Dec. 8, beating the market’s 3 percent advance, Bank of America Merrill Lynch data show. A fifth straight year of outperformance would be the longest streak since the firm began tracking the data in 1993.

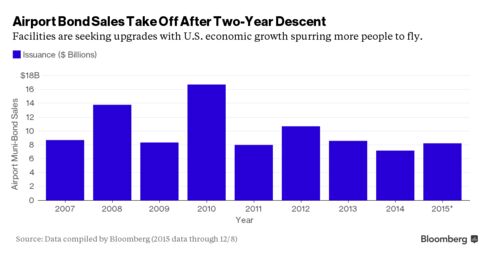

Issuance has been “subdued” and should remain so in 2016 apart from projects such as the replacement of the terminal at New York’s LaGuardia Airport, Miller said. Airports this year have issued $8.2 billion in securities, up from last year’s $7.2 billion, but are unlikely to reach the tally of $10.7 billion seen in 2012, data compiled by Bloomberg show.

Moody’s median rating for airport bonds is A2, four steps lower than the median Aa1 grade for U.S. states. Airports with higher grades serve a vital purpose in large markets, while lower-ranked ones face more competition, Heffintrayer said.

Jet Fuel

Fuel costs comprise “an important component” for airport bonds to outperform the overall market next year, said Alan Schankel, a Janney managing director in Philadelphia. The price of jet fuel declining by 44 percent since 2011 has helped support the airlines’ profitability, and consumers saving on gas for their cars have more money to spend on travel, he said.

Lower fuel costs prompted airlines to add more seats this year, and airports in Fort Lauderdale and San Diego were among the fastest growing as tourists passed through them, Heffintrayer said.

“We should continue to see strong performance across the board and especially in those regions that are more tourism dependent,” he said.

Although travelers from overseas may decline due to weakening economies in China, Latin America and Europe, U.S. passengers should compensate for that, Moody’s said.

Nashville Sale

An example of a medium-sized U.S. airport that has seen a “tremendous amount of growth” partly due to tourism is Tennessee’s Nashville International Airport, Heffintrayer said.

Investors have noticed. Tax-free 10-year revenue bonds sold Tuesday by the authority running the airport were priced to yield 2.31 percent, 0.29 percentage point over top-ranked munis. That’s lower than the 2.55 percent for similarly rated revenue debt. Moody’s and S&P gave the securities the fifth-highest rank, A1 and A+ respectively.

Metropolitan Nashville Airport Authority received $1.1 billion in orders for $200 million in bonds, said Lauren Lowe, director at the agency’s financial adviser PFM Group.

The airport expects enplanements in 2016 to rise by 5 percent from the previous year, following an annual growth of 4.4 percent over the past five years, according to bond documents.

The bond deal “showed a lot of investor confidence in this market and in what we’re doing here at the airport and in our future growth,” said Robert Wigington, president and chief executive officer of the authority.

Bloomberg Business

by Romy Varghese

December 9, 2015 — 9:02 PM PST Updated on December 10, 2015 — 4:54 AM PST