As municipal bonds head toward the strongest returns in the U.S. fixed-income markets this year, investors say the end of near-zero interest rates will do little to knock state and local-government debt off its stride.

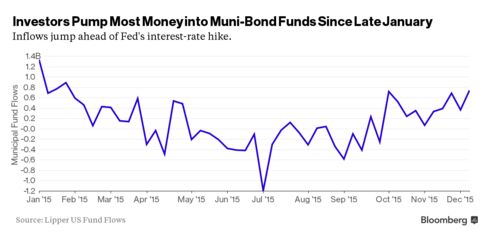

Money has been pouring into muni funds at the fastest pace since January. Defaults are falling for a fifth straight year. State and cities are being aided by an influx of tax revenue, thanks to rising real estate prices and falling unemployment. And the push to lift borrowing costs comes after a years-long refinancing wave may have run its course: Most analysts predict that new bond sales will hold steady or even fall in 2016.

“Demand for munis has been tremendous,” said John Bonnell, a senior portfolio manager in San Antonio at USAA Investment Management Co., which oversees $20 billion of local debt. “There’s just so much cash in our market looking to get invested.”

The $3.7 trillion muni market has returned 3.1 percent this year, on track for a second straight annual gain, as the income bondholders pocketed from interest outstripped any drop in prices, according to Bank of America Merrill Lynch’s index. That’s three times the return for Treasuries and compares with a 0.6 percent loss in the corporate-bond market amid a selloff in the riskiest securities in anticipation of higher borrowing costs.

Long-Awaited Move

The Federal Open Market Committee unanimously voted to set the new target range for the federal funds rate at 0.25 percent to 0.5 percent, up from zero to 0.25 percent. The Fed signaled that the pace of subsequent increases will be ”gradual” in a statement on Wednesday. The bond markets have long been preparing for Fed Chair Janet Yellen to raise interest rates from near zero, where they’ve been since the depths of the credit crisis in 2008.

A gradual tightening of monetary policy may be a boon to some segments of the market, if history is a guide. That’s because long-term rates often fall in anticipation of slower economic growth and diminished expectations for inflation, which erodes the value of fixed interest payments. From 2004 to 2006, the last time the Fed was boosting rates, munis maturing in 22 years or more saw annual returns of 6.5 percent, more than triple the gains on securities due in 3 years or less, according to Bank of America’s indexes.

U.S. Bancorp., USAA Investment Management Co., Barclays Plc and Citigroup Inc. are all projecting a so-called flattening of the municipal yield curve, or a narrowing of the gap between short- and long-term rates. When that happens, bonds with longer maturities tend to outperform.

Investors appear to be expecting just that. In the week through Dec. 9, they added $742 million into tax-exempt funds, the most since January, according to Lipper U.S. Fund Flows data. More than $3 billion has flooded into long-term muni funds over the past 10 weeks.

Fiscal Recovery

The influx comes as governments continue to recover from the financial toll of the recession, which led then to pay down debt from 2011 through last year. State tax revenue rose by 6.8 percent in the second quarter from a year earlier, according to the Nelson A. Rockefeller Institute of Government in Albany. A survey by the National League of Cities released in September found that 82 percent said they were better off than a year earlier, the most since at least 1990.

Piper Jaffray Cos. and U.S. Bancorp say the pace of securities offerings will slow next year, while BlackRock Inc. predicts it will be little changed. While Citigroup Inc. projects that issuance will rise to $413 billion from about $397 billion this year, Vikram Rai, the bank’s head of muni strategy in New York, says demand will be strong enough to keep prices in check.

“Demand is strong; issuance is low,” said Peter Hayes, who oversees $111 billion as head of munis at New York-based BlackRock, the world’s biggest money manager. “Our theme for next year is really about maximizing carry, or income, in an environment where rates are fairly benign and don’t rise dramatically.”

This is probably the “most well-advertised rate hike” in Fed history, said Dan Heckman, senior fixed-income strategist at U.S. Bank Wealth Management, which oversees about $130 billion. He sees two to three rate increases coming next year, including one in the first quarter.

“All in all, I think that this is still very muni-positive,” Heckman said Wednesday after the Fed decision.

Bloomberg Business

by Elizabeth Campbell

December 15, 2015 — 9:01 PM PST Updated on December 16, 2015 — 11:48 AM PST