Puerto Rico’s electric utility reached an agreement with insurance companies MBIA Inc. and Assured Guaranty Ltd. and bondholders to restructure its $8.2 billion of debt, marking a first step by the Caribbean island to reduce financial obligations that have left the government contending with a mounting fiscal crisis.

The deal brings together the Puerto Rico Electric Power Authority, the largest U.S. public-power provider, insurers and others such as hedge funds that hold 70 percent of its debt, the agency, known as Prepa, said in a statement late Wednesday. Its obligations would be cut by more than $600 million, with investors taking losses of about 15 percent by exchanging their bonds for new securities. The transaction aims to free up cash so the utility can modernize plants. The pact requires that lawmakers approve the deal by Jan. 22.

“It gives us liquidity, it gives us breathing room,” Lisa Donahue, Prepa’s chief restructuring officer, said in a telephone interview Wednesday night. “It gives us cash to invest in infrastructure and to provide, ultimately, sustainable clean power for Puerto Rico.”

The accord will result in the largest-ever restructuring in the $3.7 trillion municipal-bond market. It may be viewed as a potential guide for how other Puerto Rico agencies could cut their debts as the government rapidly runs out of cash.

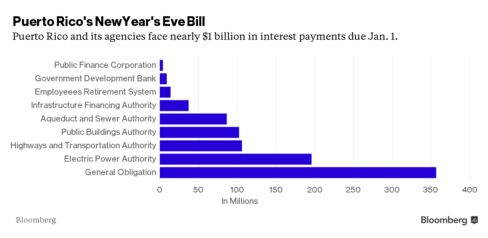

Puerto Rico, with a population of 3.5 million, owes $70 billion, more than any U.S. state except California and New York. Governor Alejandro Garcia Padilla is seeking to reduce that debt load by asking investors to take losses on their commonwealth holdings.

Averting Default

The agreement enables the utility to avoid defaulting on a $196 million interest payment due Jan. 1 and free up funds by refinancing $115 million of debt if lawmakers approve the deal next month. The insurers will provide a surety bond of as much as $462 million that will guarantee repayment in the event of a default.

MBIA’s National Public Finance Guarantee Corp. will provide as much as $344 million of that, according to a Dec. 24 financial filing from the company.

A Prepa bond maturing July 2026 traded Thursday at an average price of 58 cents on the dollar, up from an average 53 cents on Dec. 18, data compiled by Bloomberg show. The average yield was about 12 percent.

“The physical infrastructure of Prepa is in dire need of repair, so we’re happy they’ve made some progress,” Phil Fischer, Bank of America Merrill Lynch’s head of municipal research, said in an interview. “We really need to know the details to know whether or not it effectively solves the problem.”

Prepa has been negotiating for more than a year. The process shows the difficulty Puerto Rico faces in seeking to persuade investors to accept less than they’re owed on its bonds, which were sold by more than a dozen different arms of the U.S. territory. Garcia Padilla said on Dec. 9 that the commonwealth may default as soon as January because it has run out of cash.

Under the restructuring, investors holding about 35 percent of the debt will take a 15 percent loss by exchanging their securities for new ones repaid with revenue from a customer surcharge that flows directly to a trustee. The transaction must be executed by June 30. Other bondholders, such as individual investors, will have the option to participate.

Shares Rally

Shares of MBIA and Assured Guaranty climbed Thursday. MBIA jumped 10 percent to $6.87 by 11:03 a.m. in New York. Assured rose 3.7 percent to $27.76.

Dominic Frederico, Assured Guaranty’s president and chief executive officer, said Thursday that the deal lays the groundwork for a “settlement that fosters modernization, long-term sustainable rates for ratepayers and continued access to efficient capital markets financing for Prepa.”

Greg Diamond, a spokesman for MBIA, said the company didn’t have a comment beyond a financial filing Thursday that details the agreement.

The parties reached a tentative accord on Dec. 17 after Donahue flew from Puerto Rico to New York to craft a plan before an existing bondholder deal expired, according to a person with knowledge of the talks who asked for anonymity because the discussions are private.

The restructuring would be the first step in Puerto Rico’s goal to reduce its obligations. It follows Garcia Padilla’s failed attempt this month to persuade Congress to include a provision in a $1.1 trillion spending bill to allow commonwealth agencies to file for bankruptcy protection, just as U.S. local governments and publicly owned corporations can. Without the power to have debt written off in court, Prepa’s only option has been to negotiate with bondholders.

The consent of the insurers, who had balked after an earlier deal was struck by bondholders, is the final piece in a plan to ease Prepa’s debt payments so it can invest in rehabilitating a system that uses crude oil to produce electricity. It would give Prepa debt-service relief for five years of more than $700 million.

The deal still needs approval from Puerto Rico lawmakers, who are set to reconvene on Jan. 11.

“That’s our next big milestone that we’re working on,” Donahue said.

Bloomberg Business

by Michelle Kaske

December 23, 2015 — 8:31 PM PST Updated on December 24, 2015 — 8:40 AM PST