2015 had been a year of low or no returns for major asset classes. Income asset classes such as preferred stock and municipal bonds did outpace the S&P 500 Index and did so without the volatility but others did not bode as well. What about 2016? Let’s look at the leaders for 2015 first:

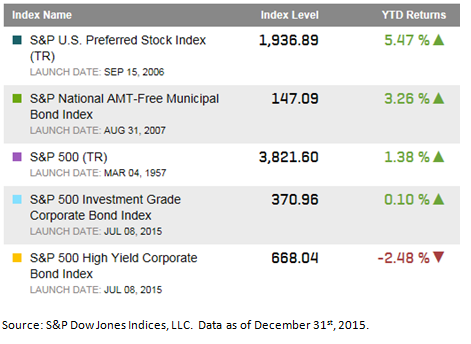

From a total return perspective the S&P U.S. Preferred Stock Index returned over 5.4% in 2015 with investment grade municipal bonds tracked in the S&P National AMT-Free Municipal Bond Index returning just over 3.25%. Investment grade corporate bonds issued by ‘blue chip’ companies tracked in the S&P 500 Investment Grade Corporate Bond Index barely held even and corporate junk bonds ended in the red. The traits of each market may give us a hint as to what 2016 may look like.

What might impact the 2016 investment grade bond market?

- A slow rising interest rate environment is generally expected by the markets. A change to that expectation could rattle the bond markets. Status quo could help hold yield spreads low and prices up.

- The high quality and relatively low volatility nature of investment grade bonds may remain attractive if the equity, commodity and junk bond markets continue to see volatility.

- Pension funds have longed for higher yielding but quality fixed income assets to match their obligations. That demand may help hold yield spreads in place for investment grade bonds.

- Investment grade municipal bonds have seen steady demand and that demand has not yet been offset with a sharp rise in new debt issuance. The supply/demand imbalance persists as we enter 2016 but could change over time if new issuance resurges. Beyond Puerto Rico, now affecting the municipal high yield segment, headline risk is low but bears watching. Overall, the low volatility, low default rate and tax-free income of municipal bonds may all continue to contribute to keeping demand up for this asset class.

- The investment grade corporate bond market is expecting less new issuance and some projections are for a steep drop in new issuance in 2016. This could impact the supply/demand equilibrium and help to hold yield spreads relatively low when compared to U.S. Treasuries. High quality and incrementally higher yielding corporate bonds may continue to draw investor interest as an alternative to U.S. Treasuries as a result.

- Floating rate preferred stock is an asset class designed to pay dividends that rise and fall with base interest rates. As rates go up, this may be a key driver of the asset class performance in 2016. Demand for fixed rate preferred stock could remain strong as alternatives that offer incrementally higher yields come with increased credit risk.

Table 1: Select indices and their 2015 total returns

What might impact the 2016 ‘junk’ bond markets?

- Yield spreads of junk bonds could widen further. This is even more dangerous to high yield bond holders than modest rate increases. Rising corporate bond default expectations could put pressure on yield spreads, pushing bond prices down on these fixed rate unsecured obligations.

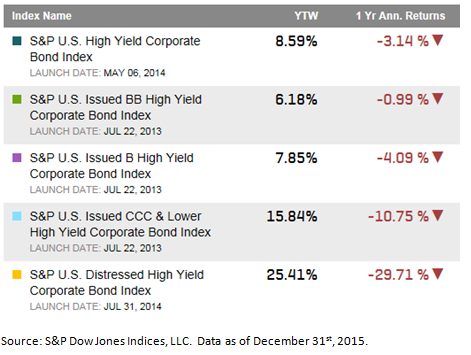

- The energy and materials sectors have played big roles in the performance of the overall junk bond market. Any rebound or continued depression of the price of oil could have a dramatic affect on these sectors. The single B and CCC segments of the market have been volatile as a result. Please refer to Table 3 for returns.

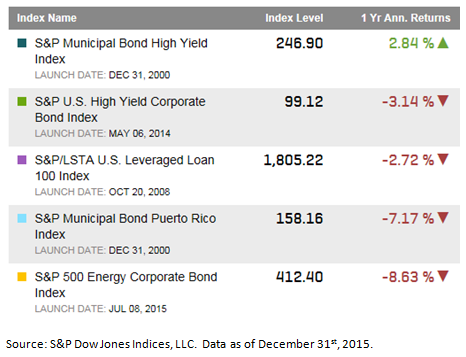

- Senior loans tracked in the S&P/LSTA U.S. Leveraged Loan 100 Index were down in 2015 along with their ‘junk’ bond counterparts. Another modest rate hike will help these senior secured floating rate notes. Generally, as rates go up these senior loans will pay higher interest rates. Historically, senior loans have had a lower default rate than corporate bonds. Over the last several years, holder protections, or covenants, have been favoring the borrowers, so if defaults do rise, this could impact this market. It should be noted that in a distressed situation, senior loans do get paid before unsecured debt. In general, the senior loan asset class has lower exposure to the energy and materials sector than the fixed rate high yield corporate bond asset class.

- Demand for yield in the municipal bond market continues to be strong. However, Puerto Rico has been a real and significant drag on performance for the bond funds that hold this paper. Beyond Puerto Rico, defaults have remained low. The taxable equivalent yield of high yield municipal bonds vs. high yield corporate bonds may continue to give the yield advantage to municipal bonds in 2016.

- The liquidity of the junk bond markets was tested in 2015. It is reasonable to expect more scrutiny of the liquidity of the lowest quality segments of the junk bond markets in 2016.

Table 2: Select high yield indices and 2015 total returns

Table 3: Select U.S. high yield corporate indices and their total returns

Seeking Alpha

By J.R. Rieger

Jan. 2, 2016 4:49 PM ET

Disclosure: © S&P Dow Jones Indices LLC 2015. Indexology® is a trademark of S&P Dow Jones Indices LLC (SPDJI). S&P® is a trademark of Standard & Poor’s Financial Services LLC and Dow Jones® is a trademark of Dow Jones Trademark Holdings LLC, and those marks have been licensed to S&P DJI. This material is reproduced with the prior written consent of S&P DJI. For more information on S&P DJI and to see our full disclaimer, visit www.spdji.com/terms-of-use.