The number of municipal-bond dealers declined in 2015 as shrinking underwriting fees, record-low trading and growing regulatory costs led firms to abandon the $3.7 trillion market or merge with larger competitors.

Guggenheim Securities closed its local-government bond business last month after profits shrank. In October, Bank of Montreal sold its division to Piper Jaffray Cos. And in June, Birmingham, Alabama-based Sterne Agee Group Inc. was purchased by Stifel Financial Corp., which acquired local rival Merchant Capital about five months earlier.

“All businesses are becoming more scaled because of regulatory and compliance” costs, Ronald Kruszewski, the chief executive officer of St. Louis-based Stifel, said in a telephone interview. “It’s difficult to be a niche player in any business in financial services today.”

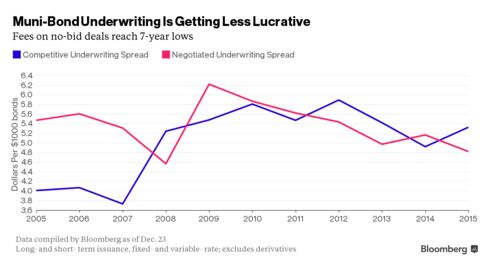

The pressures have steadily thinned the ranks of firms that sell municipal bonds, with more than one out of every five merging or closing over the last five years. Underwriting fees slipped in 2015 to the lowest level in seven years, spurred by competition that’s likely to keep driving the industry’s consolidation.

The contraction mirrors the cost-cutting that’s happening more broadly in the financial industry, where banks including Barclays Plc, Nomura Holdings Inc. and Bank of America Corp. have been cutting jobs as trading become less profitable. Morgan Stanley is eliminating about 25 percent of its fixed-income staff.

About 1,520 state and local bond dealers were registered with the Municipal Securities Rulemaking Board last month, down 6 percent from October 2014. Regional firms are buying competitors to expand their reach and snatch more business away from Wall Street’s biggest banks.

“It’s harder and harder for smaller and middle-market firms to be profitable,” said Mike Nicholas, CEO of the Bond Dealers of America, a Washington-based trade group. “You’re going to continue to see mainly small regional firms looking for partners either in a merger or pure acquisition.”

While sales of municipal debt rose 16 percent to $420 billion this year, the fees banks earned for underwriting declined. Fees on negotiated deals, which comprise three-quarters of the market, fell to $4.80 per $1,000 of bonds, the lowest since 2008. In a negotiated sale, a municipality selects a bank in advance rather than offering bonds to the lowest bidder in an auction.

Low interest rates are one reason for the heightened competition. With yields holding near a five-decade low, trading has dried up because the buy-and-hold investors who dominate the tax-exempt market have been unwilling to part with securities that provide higher income. Trading volume fell during the third quarter to the lowest level since records began in 2005, according to the MSRB, the market’s self-regulator.

As a result, firms that want to offer the bonds to customers have been competing for underwriting business to get them, said Matt Fabian, a managing director at Concord, Massachusetts-based Municipal Market Analytics.

“With so little trading, in order to be able to deliver bonds to your investors you need to underwrite them,” Fabian said. “That only has increased competition.”

Crisis Legacy

The legacy of the 2008 credit crisis is also having an impact. Since then, states and cities have eschewed the once-lucrative financings that paired floating-rate bonds and interest-rate swaps, which hit governments with unexpected costs after markets seized up. In part because of that crisis, firms have been dealing with new regulations that have increased expenses or threaten to make the businesses less profitable.

Rules placed on financial advisers have limited the ability of underwriters to pitch transactions to state and local governments. The U.S. Securities and Exchange Commission has been cracking down on banks that fail to police whether their government clients are making adequate financial disclosures after bonds are sold. And pending or newly adopted rules will require dealers to disclose trading markups and take steps to ensure that clients receive the most favorable available prices for their securities.

“There’s something new being pumped out every week by the SEC or the MSRB,” said Nicholas. He said one of his member firms reported that its legal and accounting costs have more than doubled since 2008.

Bigger Seen Better

That’s given an advantage to larger dealers that have more ability to bear the expense, helping to hasten consolidation by companies such as Stifel. In addition to buying Sterne Agee and Merchant, Stifel expanded in California last year by acquiring De La Rosa & Co., the biggest independent California-based investment bank that focused on municipal debt. In 2011, it purchased the San Francisco-based underwriter Stone & Youngberg.

The acquisitions vaulted Stifel to eighth-biggest municipal underwriter in 2015, according to data compiled by Bloomberg. Five years ago, it ranked 14th.

Minneapolis-based Piper bought Bank of Montreal’s municipal division to boost its sales, trading and Illinois business. That follows its purchase two years ago of Seattle-Northwest Securities Corp. Piper ranked 10th in U.S. municipal bond underwriting this year, up from 11th in 2014, according to data compiled by Bloomberg.

“We’re in a strong position because our public-finance business is so well diversified, by geography, industry sector and client type,” said Piper CEO Andrew Duff in a telephone interview.

Bloomberg Business

by Martin Z Braun

December 29, 2015 — 9:01 PM PST Updated on December 30, 2015 — 4:39 AM PST