General-obligation bonds, long seen as one of the safest niches of the U.S. municipal market, are starting to look like one of the riskiest and it’s all because of Puerto Rico.

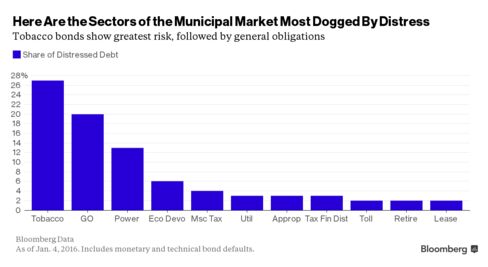

There was $64.2 billion of distressed state and local debt outstanding as of Jan. 4, or about 1.7 percent of the total, according to data compiled by Bloomberg. General-obligations, which are backed by a promise to repay instead of earmarked revenue or taxes, accounted for $12.9 billion, or 20 percent, the second-largest category after securities backed by legal-settlement money from tobacco companies. The financially drowning island was almost exclusively to blame: All but $400 million of it was issued by Puerto Rico.

The U.S. territory of 3.5 million hasn’t skipped any payments on its general-obligation bonds, which have the highest priority under its constitution. It opted to default on other debt this month instead. The securities are classified as distressed because in August the government decided to stop putting money into the account that’s used make interest and principal payments, a step it took to conserve cash.

Bloomberg’s tally is a broader category than outright defaults because it includes cases where borrowers draw down reserves below specified levels or violate other terms of the loan agreements.

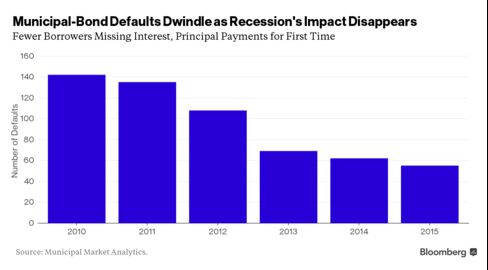

The figures mask an otherwise positive turn in the municipal market, where borrowers’ finances have been given a lift by rising real estate prices and the economy’s more than six-year expansion. Last year, just 55 issuers missed bond payments for the first time, the fewest since at least 2010 and down from 62 in 2014, according to Municipal Market Analytics Inc. The amount of debt involved totaled $3.85 billion, down from $9.4 billion a year earlier.

A cumulative picture emerges from the the Bloomberg data, which include bonds that have been distressed for years. Among them are $200 million of still outstanding debt from Detroit and $100 million from Jefferson County, Alabama, both of which filed for bankruptcy after the recession. While such filings remain a rarity, the decisions rattled some investors’ confidence in struggling municipalities general-obligation bonds, which have traditionally been seen as secure because governments can raise taxes to pay them.

“Some of the actions taken in the high profile bankruptcy cases, to hit bonds hard and challenge all legal structures, are evidence of increased risk for GO bonds and all bonds when distress hits,” said Peter Bianchini, managing director with Mesirow Financial Inc. in San Francisco.

Smoking’s Risk

The single most-distressed category, accounting for $17.6 billion of the debt, is tobacco bonds, which state and local governments sold to get an advance on the money they’re due to receive from the 1998 legal settlement with cigarette companies. Those payments are tied to cigarette shipments, which have declined more than anticipated since the securities were first sold. As a result, many may not be repaid on schedule.

Ohio’s Buckeye Tobacco Settlement Financing Authority disclosed last month, for example, that it had to draw in $35.85 million of reserves to pay part of the interest due Dec. 15.

Further down the distressed list are public power systems ($8.1 billion), economic and industrial development projects ($3.9 billion) and securities backed by specific taxes ($2.8 billion), according to data compiled by Bloomberg.

The scale of the figures in some cases represent the length of time it takes to resolve a default.

“The numbers have been creeping up,” said Matt Fabian, an analyst with Municipal Market Analytics. “Situations are lingering and lingering. Builds up to a large pile of problems after a few years.”

Bloomberg Business

by Darrell Preston

January 6, 2016 — 9:01 PM PST Updated on January 7, 2016 — 4:55 AM PST