Mutual funds in the $3.7 trillion municipal-bond market are flush with cash heading into 2016.

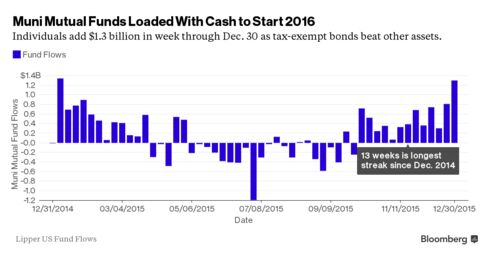

Individuals added $1.3 billion to funds focused on state and local-government debt in the week through Dec. 30, the most in almost a year, Lipper US Fund Flows data show. It marked the 13th consecutive week that they’ve gained money, the longest streak since the end of 2014.

The surging demand for tax-exempt debt means the market may be headed for its fifth-straight January gain, said Peter Hayes, head of munis at BlackRock Inc., the world’s largest money manager. In each of the past two years, the first month proved to be the best for returns: Munis rallied 1.8 percent in January 2015 and 2.3 percent in 2014, Bank of America Merrill Lynch data show.

“January is usually a positive performance month and we think this January will be positive,” said Hayes, who oversees $111 billion of the debt. “Demand should remain strong.”

Shaken Off

The muni market has posted six straight monthly gains, shaking off concerns about Puerto Rico’s escalating fiscal crisis as defaults decline and the finances of most governments continue to improve along with the economy. State and local debt was less volatile than stocks, commodities and other bonds in 2015, providing higher returns both on an absolute basis and when adjusting for price swings.

January tends to deliver a predictable performance. The market has rallied in all but six years since 1989, Bank of America data show. The last time it dropped was at the start of 2011, after analyst Meredith Whitney rattled investors with a prediction for widespread defaults that later proved off base.

Individual investors hold the majority of munis through private accounts or mutual funds. They sometimes chase performance by pouring money into the market when it’s rallying and withdrawing it during routs.

That phenomenon was on display after munis began a three-month losing streak in April 2015, when signs of economic gains increased speculation that the Federal Reserve would soon raise interest rates. Beginning that May, individuals yanked money from mutual funds for 11 straight weeks, the longest stretch of outflows in 18 months. The withdrawals subsided when the market rebounded and the Fed delayed its move.

‘Sweet Spot’

Most muni analysts expect moderate gains for 2016 as the Fed pushes forward with plans to tighten monetary policy further this year, after increasing rates last month for the first time since 2006. Yet with U.S. manufacturing contracting in December at the fastest pace in more than six years and the S&P 500 Index touching its lowest price since October, any positive return may make it stand out in the U.S. financial markets.

“It’s really the sweet spot for muni investors: The U.S. growing fast enough to improve credit quality, but not too fast to generate a lot of inflation,” said David Hammer, who runs a $583 million high-yield fund at Pacific Investment Management Co. in New York. “That means investors are going to focus on the income portion of their portfolio to drive total returns. Munis fit perfectly into that.”

Bloomberg Business

by Brian Chappatta

January 4, 2016 — 9:01 PM PST Updated on January 5, 2016 — 5:56 AM PST