Puerto Rico is seeking to cut its debt load by 46 percent in its first offer to investors, a proposal that may face revisions as bondholders fight to get the most repayment.

The commonwealth unveiled its plan on Monday to reduce the island’s obligations and help restart an economy that’s failed to grow in the past decade. The proposal for a voluntary exchange would cut the island’s debt to $26.5 billion from $49.2 billion, put off all interest payments until the 2018 fiscal year and affect even general-obligation bonds, which have the strongest repayment pledge, according to a restructuring proposal posted on the Government Development Bank website.

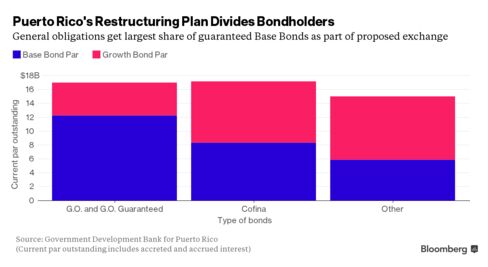

The plan may pit the commonwealth’s investor groups against each other. In the proposal, general-obligation bonds get more money back than sales-tax debt, called Cofinas by their Spanish acronym. Cofina investors may take issue with that, said Lyle Fitterer, head of tax-exempt debt in Menomonee Falls, Wisconsin, at Wells Capital Management, which oversees $39 billion of municipal bonds, including Puerto Rico securities. The island, which doesn’t have access to municipal bankruptcy, may need a legal framework to bring all of the island’s creditors together, Fitterer said.

“I’m sure they’re not going to outright agree to this,” Fitterer said. “What happens to all the retail bondholders if they don’t consent to it? They’re probably going to need to have some legal means of getting this accomplished rather than some sort of consensual agreement, because I would think there’s going to be a lot of arguing amongst bondholders.”

Puerto Rico and its agencies racked up $70 billion in debt by borrowing for years to fill budget deficits.

Governor Alejandro Garcia Padilla in June said the commonwealth would seek to reduce its obligations by asking investors to accept losses on their securities and wait longer to get repaid. Two agencies already have defaulted on payments, and the island faces a $2 billion principal and interest payment due July 1.

Puerto Rico warned that it may place a moratorium on debt payments if the parties cannot agree on a restructuring plan by May 1, when a $422 million GDB payment is due.

Garcia Padilla has asked that the commonwealth and its agencies be given access to bankruptcy protection so officials may reorganize its debt. Republicans in the U.S. House of Representatives are holding a hearing Tuesday to explore the case for setting up a Puerto Rico financial-control authority.

Almost all of Puerto Rico’s debt would be affected by the reduction, including general obligations, sales-tax bonds, GDB debt, pension bonds and debt sold by the island’s highway authority.

‘Sustainable Solution’

“This proposal is a reflection of our commitment to work with our creditors on a sustainable solution that does not place the burden on one stakeholder group alone,” Victor Suarez, Puerto Rico’s secretary of state, said in a statement. “A crisis of this magnitude must be addressed in concert, otherwise we risk our ability and the opportunity to escape the spiral of a stagnating economy, endless deficits and increasing debt.”

Puerto Rico general obligation bonds with lower coupons traded up in price Monday, while a GO with an 8 percent coupon dropped in value: One with a 5.75 percent coupon and maturing 2041 changed hands at an average 61.8 cents on the dollar, up from 60.5 cents on Friday, data compiled by Bloomberg show. The one with the 8 percent coupon and maturing 2035 traded as low as 70 cents, down from an average 72.1 cents.

Principal-Recovery Opportunity

The plan caps annual debt payments at 15 percent of government revenue. Creditors also would get the opportunity to recover the principal amount of their investments. Investors and the commonwealth now will negotiate the proposed terms and potentially alter the plan, said Matt Dalton, chief executive officer of Rye Brook, New York-based Belle Haven Investments, which oversees $3.8 billion of municipal bonds, including Puerto Rico securities.

“Ultimately you’ve got to believe that there’s compromise somewhere between 46 percent and something less than that,” Dalton said. “They’ve put the offer out there, now it’s time to work it up from there.”

If history is any guide, a distressed government’s initial plan often doesn’t resemble the final deal.

Detroit proposed paying as little as 15 cents on the dollar to holders of unlimited-tax general obligations during the city’s bankruptcy, yet agreed to a 74 percent recovery rate after negotiations.

Restructuring Proposal

Puerto Rico’s restructuring proposal asks that creditors exchange existing securities for two new securities: a “Base Bond,” with a fixed rate of interest and amortization schedule through 2035, and a “Growth Bond,” which is payable only if the commonwealth’s revenue exceeds certain levels. The new securities also would provide creditors with enhanced credit protections, such as a commonwealth guarantee and statutory liens and pledges with respect to certain revenue.

A basic way to calculate an approximate recovery rate would be evaluating what investors would get — in what’s known at Base Bonds — relative to the par value of their securities. General-obligation investors would recover about 72 percent, as they exchange about $17 billion of debt for $12.24 billion in Base Bonds.

Holders of sales-tax debt, known by the Spanish acronym Cofina, would recover about 49 percent, with $17.2 billion outstanding obligations exchanged for $8.4 billion of Base Bonds. Other investors, with $15 billion of debt, would have a 39 percent recovery. The new bonds would be repaid with revenue already backing the existing bonds as well as $325 million of annual oil-tax revenue.

The $49.2 billion of tax-supported debt would be swapped into $26.5 billion of Base Bonds and $22.7 billion of Growth Bonds. Interest payments on the Base Bonds would begin in January 2018, rising to 5 percent per year by 2021, when principal payments would begin. The Growth Bonds would be payable only if Puerto Rico’s revenue collection exceeds projections.

Growth Bonds

By sharing in the island’s economic recovery, creditors would have the opportunity to recoup the principal amount of their investments through the growth bonds, according to the proposal. The first payments, if any, would be made beginning in the 10th year after the close of the exchange offer.

“We don’t know what the revenue potential is for Puerto Rico simply because the tax collections are so terrible and public policy and governorship has been so bad,” Fitterer said.

The exchange offer assumes creditor groups will participate at “very high” levels and the federal government will maintain its current percentage of support for the commonwealth. If not enough investors participate in the debt swap or if the federal government materially reduces its support, then the terms of the exchange offer will have to be revisited and creditor recoveries adjusted accordingly, the commonwealth said.

Bloomberg Business

by Michelle Kaske and Brian Chappatta

February 1, 2016 — 5:39 AM PST Updated on February 1, 2016 — 11:03 AM PST