Puerto Rico’s release of a restructuring plan prompted a flurry of bond trades that show how investors are trying to make sense of what the proposal means for the recovery value of more than a dozen different securities.

A basic way to calculate an approximate recovery rate would be evaluating how much investors get in so-called Base Bonds relative to the par value of their securities, said Lyle Fitterer at Wells Capital Management and Matt Dalton at Belle Haven Investments. The Base Bonds would have payments guaranteed by the commonwealth along with statutory liens on sales-and-use taxes and levies on petroleum products. The commonwealth would only pay the proposed debt known as Growth Bonds if revenue exceeds certain projections.

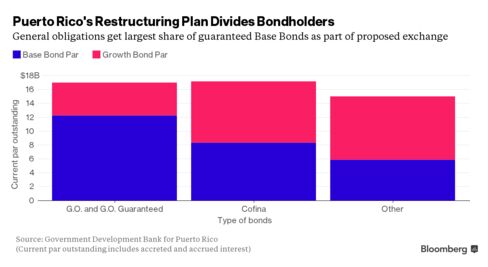

By that ratio, general-obligation investors would recover about 72 percent, as they exchange about $17 billion of debt for $12.24 billion in Base Bonds. Holders of sales-tax debt, known by the Spanish acronym Cofina, would recover about 49 percent, with $17.2 billion outstanding obligations exchanged for $8.4 billion of Base Bonds. Other investors, with $15 billion of debt, would have a 39 percent recovery.

Actual recovery rates aren’t quite as simple as looking at the Base Bonds because if the commonwealth again found itself strapped for cash, some investors would fare better than others. Those securities would be divided into four tranches: bondholders trading in general obligations and commonwealth guaranteed debt would be paid first, followed by senior Cofina debt, then subordinated Cofina bonds, and finally the remaining securities.

Bond Moves

The restructuring plan is beginning to adjust prices in some Puerto Rico bonds.

The commonwealth’s benchmark general obligations with an 8 percent coupon and maturing in 2035 extended declines on Monday, trading as low as 70 cents, down from 72.1 cents on Friday, data compiled by Bloomberg show. Yet others at lower prices gained. Debt due in 2031 with a 5.125 percent coupon climbed to as high as 62.75 cents, the highest since Jan. 12.

Commonwealth-guaranteed debt from the Puerto Rico Public Buildings Authority, which would be included in the group with the highest estimated recovery, traded at an average 54.9 cents on the dollar, the highest since Dec. 7.

Puerto Rico highway securities due in 2042 jumped to 22 cents on the dollar, about twice the price of last month and the highest since November, Bloomberg data show. Puerto Rico Infrastructure Financing Authority bonds maturing in 2041, which are in default, changed hands at an average 17.5 cents, the highest since December. Both would be considered in the lowest tier of recoveries.

The most-traded Cofina bonds declined, trading at an average 40.7 cents on the dollar from 41.6 cents on Jan. 27, Bloomberg data show. The securities, with a subordinate claim on sales taxes, are at the lowest price since Jan. 7.

Bloomberg Business

by Brian Chappatta and Michelle Kaske

February 1, 2016 — 11:05 AM PST