The busiest U.S. mass transit agency, which carries 8.5 million people on a given weekday, wants to change that by joining a growing marketing push among local governments to pitch bonds to investors who are looking to do well by doing good. It’s planning to issue $500 million of so-called green bonds next week, the first time it’s offering securities certified for projects that help curb the pace of global warming.

“It’s a way to easily publicize programs they they’re doing that may fall under the public radar,” said Rob Fernandez, director of environmental, social and governance research at Boston-based Breckinridge Capital Advisors, which manages $24 billion. “The other benefit is that it’s seen to broaden their investor base.”

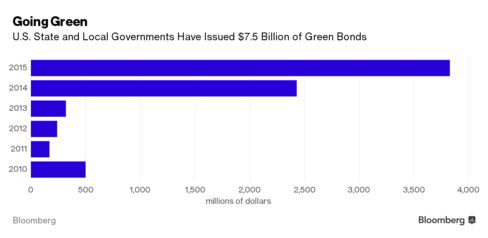

U.S. state and local governments have issued about $7.5 billion of green bonds since 2010, according to data compiled by Bloomberg. The designation is helping borrowers in the $3.7 trillion market appeal to buyers who use social factors such as the environment, education and health care to guide their decisions.

Last year, Columbia Threadneedle Investments, a unit of Ameriprise Financial Inc., started a U.S. Social Bond Fund, mainly composed of tax-exempt debt. TIAA-CREFF Financial Services and Calvert Investments have social and green-bond funds, respectively, though most of their holdings are taxable securities.

Green bonds are issued by development banks, such as the World Bank, municipalities, utilities and corporations. Eligible projects fall into eight broad categories, including renewable energy, clean transportation and sustainable water management.

That makes them applicable to the municipal market, which has financed public works for years without the acknowledgment of an environmentalist brand. In 2014, state and local governments spent $320 billion on transportation and water infrastructure, three times more than the federal government, according to the Congressional Budget Office.

The people who seem most interested in social-impact investing are millennials and women, said James Dearborn, head of tax-exempt securities at Columbia Threadneedle. Its bond fund owned $250,000 MTA debt as of Sept. 30 2015.

“As the baby boom generation ages and begins to pass away, then we end up with a wealth transfer that takes place and a lot of people who will be getting the wealth of the baby boomers will be women, who outlive men generally, and millennials,” said Dearborn, who declined to comment on whether he’d buy any of the transit agency’s bonds next week.

“Obviously mass transit is about reducing the carbon foot print — fewer cars on the road, more people in trains and buses and light rail,” he said. “Also, if you look at the generalized ridership of mass transit, by and large you’re supporting lower-income individuals whose only means of transportation is public transportation.”

Seattle’s transit agency, the Central Puget Sound Regional Transit Authority, issued about $940 million of green bonds in August, the largest-ever green muni issue. Proceeds were used to expand Seattle’s light-rail system and refinance higher-cost debt.

Says Who?

To comply with green bond principles, issuers need to show to non-profit standards setters like the London-based Climate Bonds Initiative how they determined the projects were eligible, ensure bond proceeds are spent on the designated projects and provide annual reports on the impact of the investments. Some issuers also hire outside consultants to review project selection and evaluation.

The MTA’s bonds, backed by system-wide revenue, will be certified under standards set by the Climate Bonds Initiative. The transportation agency hired Sustainalytics, an Amsterdam-based firm, to verify compliance with the guidelines.

“The certification process is a voluntary verification initiative which allows the MTA to demonstrate to the investor market, the users of the MTA’s transit and commuter systems and other stakeholders that the series 2016A bonds meet international standards for climate integrity, management of proceeds and transparency,” the MTA said in a preliminary bond offering statement.

The MTA’s subways, trains, and buses help reduce carbon emissions by getting commuters off the road. Two-thirds of New York state’s 19.7 million people live and work in the region it serves. The transit agency estimates it allows the region to avoid 17 million metric tons of carbon emissions, compared with the 2 million it produces to run the system.

“By leaving their cars at home and embracing mass transit, New Yorkers play a dramatic role in reducing carbon emissions,” MTA Chief Executive Officer Thomas Prendergast said in a statement.

While a green designation may help generate more demand by attracting environmentally-conscious investors, there’s no clear evidence that it lowers borrowing costs, said Vikram Puppala, an associate director at Sustainalytics.

“The formal green bond market allows investors who are already interested in investing in this product to identify them and be confident that the money is actually going to green projects,” he said.

Bloomberg Business

by Martin Z Braun

February 10, 2016 — 1:01 PM PST Updated on February 11, 2016 — 8:24 AM PST