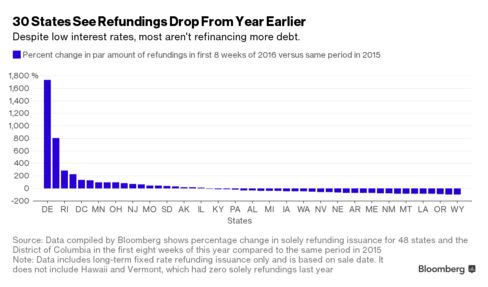

State and local governments in 30 U.S. states borrowed less for the sole purpose of replacing higher-cost debt than they did during the same period in 2015, causing them to miss out on an unexpected persistence of cheap money that may not last. They were slow to take advantage of interest rates that touched five-decade lows in February amid volatility in financial markets, only to edge back up as stocks rallied.

“2016 has produced something of a surprise for a lot of bankers, and I think it takes a while to crank up the machinery to do the refundings,” said James Dearborn, who oversees $29.5 billion as head of municipal bonds in Boston at Columbia Threadneedle Investments. “Maybe what we’re seeing is just that delay from the outset of the year.”

Local governments raced to refinance last year before the Federal Reserve increased borrowing costs for the first time since 2006, easing away from the near zero interest rates that had been in place since the worst of the credit crisis. After the Fed’s initial jump in December, turmoil in the global equity and credit markets has dashed most forecasts for higher rates this year. Investors now project a 10 percent probability the central bank will tighten monetary policy at its March 16 meeting, down from 50 percent at the end of 2015, according to pricing in interest-rate futures markets.

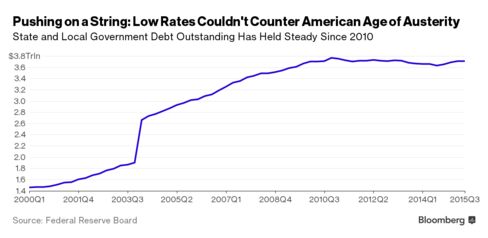

The slowdown in bond sales follows a years-long push by states and cities to cut costs because of the financial effects of the recession, which left officials hesitant to run up new debts. As a result, the $3.7 trillion municipal market is smaller than it was at the end of 2010, according to Fed data.

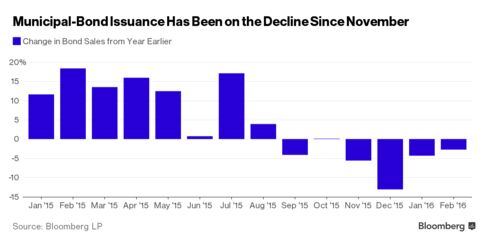

While issuance climbed in the first eight months of 2015, bond sales dropped each month since November compared with a year earlier, according to data compiled by Bloomberg. Municipalities sold about $27 billion of bonds for the sole purpose of refinancing during the first eight weeks of this year, compared with about $32.5 billion at the start of 2015, according to data compiled by Bloomberg.

There are about $15 billion of bond sales scheduled over the next 30 days, the most since November, Bloomberg data show. The actual amount may be even higher as some deals are made public only days ahead of time. The governments may have missed out on the best time to borrow: Yields on top-rated 10-year bonds have climbed to 1.77 percent from as little as 1.57 percent on Feb. 11, according to Bloomberg indexes.

Analysts and investors predict that the pace may pick up. Phil Fischer, head of municipal research at Bank of America Merrill Lynch, forecasts that there will be about $440 billion of municipal bonds issued this year, up from about $403 billion in 2015.

“We’re expecting a pretty hefty year of issuance,” Fischer said. “We’ve got more bonds to issue and rates are even lower now than they were last year.”

Issuance should be higher now, given how low rates are and the demand from investors for new securities, according to Dan Solender, head of municipals at in Jersey City, New Jersey for Lord Abbett & Co., which manages $18 billion of the debt.

“Going forward, if it’s in the money to do the refunding, you’d expect them to happen because the demand is pretty strong in the market,” he said. “And there’s plenty of room for more supply.”

Bloomberg Business

by Elizabeth Campbell

March 1, 2016 — 9:01 PM PST Updated on March 2, 2016 — 5:47 AM PST