Bank of America Corp. held its position as the top underwriter of U.S. municipal bonds during first quarter of 2016, edging out Citigroup Inc., as securities dealers competed for a shrinking number of new issues.

Bank of America managed the sale of $14.1 billion of long-term, fixed-rate state and local government debt through March 31, according to data compiled by Bloomberg. Citigroup handled $13.8 billion and JPMorgan Chase & Co. was a distant third at $7.9 billion, keeping the dominant banks with the same rankings they held in 2015.

“A lot of it is their experience and their ability to execute transactions — the marketing, distribution and underwriting abilities,” said Sue Perez, an assistant treasurer of Massachusetts. The state hired Charlotte, North Carolina-based Bank of America for its $1.1 billion sale in March, one of the biggest issues of the quarter.

The competition among underwriters increased as bond sales slowed from a year earlier, when states and cities rushed to refinance debt before the Federal Reserve began raising interest rates for the first time since 2006. That left them with fewer bonds to replace during the first three months of the year, even though borrowing costs remained near five-decade lows as the Fed held off on raising rates after its initial quarter-point increase in December.

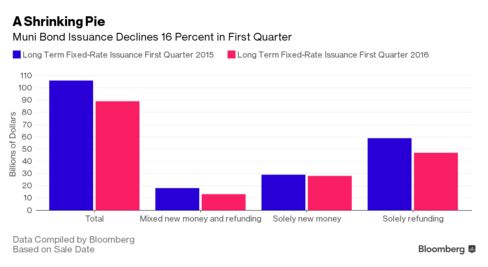

Municipal-securities issuance totaled $89 billion in the first quarter, down 16 percent from a year earlier. About $47 billion of the bonds were issued solely for refinancing, compared with $59 billion during the same period last year, the data show.

Another reason volume is down: Long-dated municipal bonds typically are callable in 10 years and new sales were slow a decade ago. Issuance totaled about $54 billion in the first quarter of 2006, the second-lowest since 2003.

“Refundings are massively down,” said Mikhail Foux, head of municipal strategy at Barclays Plc, which underwrites bonds. “We expected a down year, it’s sort of on track.”

Selena Morris, a Bank of America spokeswoman, and Scott Helfman, a Citigroup spokesman, declined to comment.

About 76 percent of the quarter’s bonds were sold through negotiated sales, in which a municipality picks an underwriter in advance instead of selling them to whoever offers the lowest interest cost during an auction.

Santee Cooper, South Carolina’s largest power producer, tapped Bank of America to lead a $540 million debt refinancing in January. The publicly owned electricity company, which provides energy to 2 million South Carolinians, rotates its lead banking roles between Bank of America and Barclays, said Jeff Armfield, the chief financial officer.

The utility has long history working with Bank of America banker Christopher Fink, who served as a financial adviser to the agency when he was at Morgan Stanley, said Armfield.

“What you always look for in an underwriter is somebody that’s going to put your interest at least equal with the interest of their bank, if not ahead of the interest of their bank,” he said.

Such ties provide more benefits than choosing the bank that offers the lowest cost, Armfield said. That provides the utility with expertise that can help it implement its financial plans, he said.

“Each utility within public power is unique in a lot of ways, ” he’s said.

Bloomberg Business

by Martin Z Braun

April 5, 2016 — 2:00 AM PDT