The debt of U.S. states last year remained below its all-time high from 2013, showing officials were hesitant to borrow even with interest rates near record lows and the recession six years in the past.

States’ net tax-supported debt edged up 0.6 percent in 2015 to $512.5 billion, according to a Moody’s Investors Service report released Friday. In 2014, the figure fell for the first time in almost three decades, from the record high of $516 billion.

After contending with a long recovery from the recession, states and cities have used the $3.7 trillion municipal-bond market in recent years largely for refinancing instead of running up new debt for public works. There hasn’t been a more attractive time in decades for lawmakers to issue long-term bonds: the yield on a Bond Buyer index of 20-year municipal general-obligation bonds fell in February to the lowest since 1965.

“The recent slowdown in debt levels highlights states’ reluctance to take on new debt despite continued annual increases in tax revenue,” analysts for Moody’s wrote in the report. “Several factors will likely suppress growth in state debt burdens in the next year, including the recent decline in commodity markets along with longer term trends of continued uncertainty over federal fiscal policy and healthcare funding.”

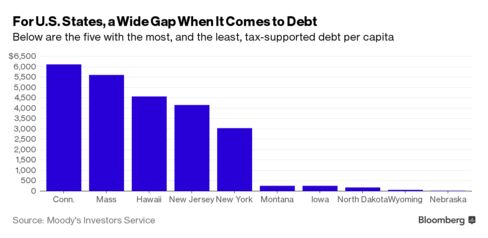

Connecticut retained its spot at the top of Moody’s debt medians, with $6,155 of net tax-supported debt per resident. That’s up from $5,491 in last year’s report.

Massachusetts, Hawaii, New Jersey and New York round out the top five, like the year before, each with more than $3,000 per person. Nebraska, Wyoming, North Dakota, Iowa and Montana have the smallest burdens, at less than $250 per resident.

Kansas’s debt load in 2015 jumped about 40 percent, the most of any U.S. state, after it issued $1 billion of pension bonds. South Dakota’s grew 20 percent.

Puerto Rico, the U.S. territory on the brink of the municipal market’s largest-ever restructuring, wasn’t included in the report due to lack of available data. It had $15,637 of tax-supported debt per person in Moody’s prior report.

Bloomberg Business

by Brian Chappatta

May 5, 2016 — 9:01 PM PDT