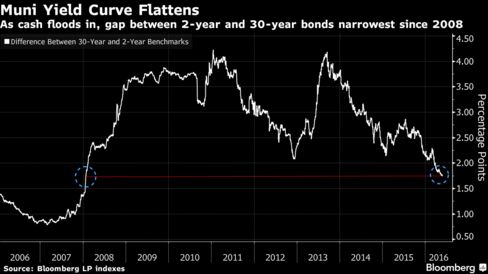

The difference between short- and long-term yields in the $3.7 trillion municipal-bond market is the smallest in more than eight years. With tax-exempt mutual funds flush with cash from the longest stretch of inflows in six years, managers have poured money into higher-yielding securities, pushing up the price. By the end of last week, that left 30-year yields just 1.75 percentage points more than those on 2-year securities, the smallest since January 2008, when the credit-market crisis was building. That difference, known as the yield curve, shows that investors are receiving little compensation for the risk of owning securities that don’t mature for decades.

Bloomberg Business

by William Selway

May 31, 2016 — 8:39 AM PD