Even if U.S. lawmakers return next week and push through their Puerto Rico rescue with unusual speed, it may not come fast enough to save the island from its biggest default yet.

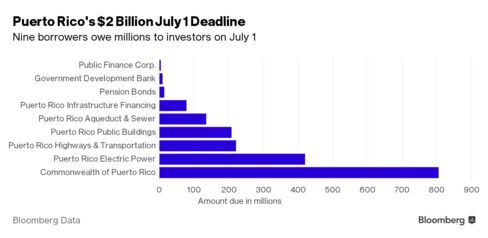

The legislation would put Puerto Rico’s budget and, potentially, a restructuring of its debt in the hands of a federal oversight board appointed by congressional Republicans and President Barack Obama — a body that’s virtually impossible to set up before $2 billion of debt payments come due on July 1. And the bill doesn’t provide any additional federal money to the U.S. territory, whose government says it’s simply too broke to pay.

“I don’t think we would expect that Congress would enact anything that’s quick enough to solve the July 1 debt service problem,” said Phil Fischer, head of municipal research at Bank of America in New York. “There’s a lot of uncertainty about what will be paid and how.”

Puerto Rico’s cascading series of defaults will enter a new phase next month if it skips payments for the first time on general-obligation bonds, which the island’s constitution says must be repaid before everything else. With $805 million due on those securities, Governor Alejandro Garcia Padilla has said the commonwealth can’t cover what it owes without shutting off services crucial to the island’s 3.5 million residents, nearly half of whom live in poverty.

While the lapse would expose the island to a court fight with bondholders — who had little recourse when it defaulted on securities with weaker legal protections — they may still have to wait. A local law shields the government until January from lawsuits in Puerto Rico, while the bill that cleared the House Natural Resources committee last month by a 29-to-10 vote would halt them until February.

The Congressional bill “remains a work in progress, and is unlikely to be finalized and effective in time to prevent July 1 defaults,” Alan Schankel, a managing director in Philadelphia at Janney Montgomery Scott, wrote in a report Thursday. “But it is the best potential next step in the pursuit of economic and fiscal stability for Puerto Rico.”

Puerto Rico bonds are already trading with the expectation that they won’t be repaid on time and in full. General obligations maturing in 2035, one of the most frequently traded securities, changed hands Wednesday at an average 65.6 cents on the dollar to yield 12.9 percent, data compiled by Bloomberg show. That price has tumbled from 93 cents in March 2014, when they were first sold to investors.

The commonwealth’s fiscal crisis has been escalating since last June, when Garcia Padilla said the administration couldn’t afford to repay $70 billion of debt left by years of borrowing to cover budget shortfalls as the economy contracted and residents left at record pace for the U.S. mainland. It has since failed to cover $370 million due on bonds sold by the Government Development Bank and $150 million for two other agencies as it conserved cash.

Help has been slow to emerge from Washington, which has allowed other deadlines to come without stepping in.

In December, despite the governor’s warning of an impending humanitarian disaster, Congress failed to include any aid when it passed a key spending bill. While the House may take up the island legislation as soon as next week, Rep. Rob Bishop, the chairman of the Natural Resources Committee, has said he doesn’t view July 1 as a crucial time limit to pass it.

Winning Concessions

Left on its own, Puerto Rico has been negotiating with bondholders and insurance companies to escape from some of its debt. It has already struck such an agreement with creditors of the Puerto Rico Electric Power Authority, the government’s electricity provider. When the GDB defaulted last month, it reach a tentative deal with hedge funds holding $900 million of the bank’s securities to eventually pay just a fraction of what is owed.

Garcia Padilla has typically waited until days before a payment is due to announce whether it will be made. Liz Kenigsberg, with the public relations firm SKDKnickerbocker in New York, which represents the GDB, didn’t have an immediate comment.

The administration will probably negotiate with general-obligation creditors through the end of June, said Mikhail Foux, head of municipal strategy in New York at Barclays Plc.

“The market won’t get any clarity pretty much until the 25th hour,” Foux said. “There’s very little trading because people are effectively just waiting for what’s going to happen.”

Garcia Padilla has said he will choose to keep essential government services in place over covering debt bills. If his budget is approved by Puerto Rico lawmakers, that’s exactly what will happen: For the fiscal year that begins in July, he’s proposed spending just $209 million on debt service, a fraction of the $1.39 billion that’s supposed to be paid from the government’s general revenue.

A default in July may eventually force the issue into court, Bank of America’s Fischer said.

“Now we get to a very significant issue on July 1 in regard to constitutionally-protected bonds and this is a big deal in terms of the laws of Puerto Rico,” said Fischer. “Is the constitution binding on the governor with regard to debt-service payments in an absolute sense? We’re going to find out.”

Bloomberg Business

by Michelle Kaske

June 2, 2016 — 2:00 AM PDT Updated on June 2, 2016 — 6:35 AM PDT