When Philip J. Kennedy needed financing to buy low-income housing in a wealthy Dallas suburb, he bypassed Texas agencies for a tax-exempt bond issuer 700 miles away in Gulf Breeze, Florida.

Leaving the state allowed Kennedy’s non-profit American Opportunity Foundation Inc. to secure $35 million to buy Garden Gate Apartments in Plano, Texas, and a development in Fort Worth without answering questions from local authorities about AOF’s past difficulties repaying debt.

Scores of non-profit organizations like AOF are required to use government-created agencies when selling bonds. In return, the agencies charge fees. At times, these conduits aren’t in the same state as the projects they’re financing, giving officials on the ground little incentive to scrutinize the deals.

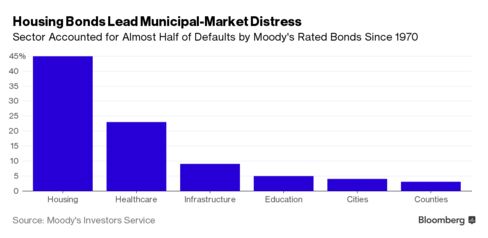

It’s all perfectly legal. But for investors, it can be risky. Such conduit deals account for nearly 60 percent of the defaults in the $3.7 trillion municipal-bond market, according to Municipal Market Analytics. In most cases, bondholders, not taxpayers, are on the hook if the projects flop.

Default History

Between 2000 and 2004, Kennedy’s AOF defaulted on 14 of 18 outstanding municipal bonds issued in the 1990s, affecting about 5,550 units, according to data compiled by Bloomberg. In 2014, AOF defaulted on bonds issued by a Texas affordable-housing agency to buy apartments in Houston, Dallas, and San Antonio. More than 1,700 apartments lost their subsidies, and rents at one complex climbed 22 percent.

Kennedy, 62, didn’t disclose AOF’s default history in materials submitted to Plano, and the town council didn’t ask him whether any of his projects had failed, according to a video of the meeting. The Florida agency that issued the bonds said its due diligence indicated that AOF “know what they’re doing.”

“If they had gone through the Texas finance authorities, like the state one, maybe someone at the state would have questioned whether they should be approved or not,” said Plano resident Jim Dillavou, a retired Deloitte LLP partner and critic of the city’s plan to develop more apartments. “By using a Florida outfit they avoided that scrutiny.”

In an interview, Kennedy said the decision to use a Florida agency wasn’t motivated by AOF’s past defaults in Texas, though it allowed him to avoid the need to win approval from the state’s bond-review board.

“It’s a very, very difficult process in Texas,” he said. “They’ve had a lot of issues with 501c3 defaulted deals and so they just make you jump through a lot of hoops.” Non-profit organizations are known as 501c3s, after the relevant section of the U.S. tax code.

Kennedy said he chose a Florida conduit because his original plan was to also buy an apartment complex in that state. That deal fell through, he said.

AOF was founded in Atlanta in 1983 to sponsor low-income housing. Kennedy became president in 1991. His compensation was about $360,000 in 2014, according to tax filings. AOF owns or has ownership interests in 14,000 apartment units, which are managed by outside firms that it hires.

West Coast

AOF has been successful on the West Coast, where one of its subsidiaries, AOF/Pacific, serves as as general partner and has small ownership interests in more than 100 affordable properties with more than 13,000 units. Many are financed with low-income housing tax-credits so there’s less leverage, Kennedy said.

AOF has also acquired, rehabbed and sold 125 single-family homes to first-time buyers.

“I’m not particularly proud of what I did in the 90s,” Kennedy said. “I’m proud of the way I hung in there and got it all worked out.”

Capital Trust Agency, the Florida conduit, has issued about $1.9 billion of debt for projects such as private-jet facilities and hotels. To raise the money for AOF, Capital Trust charged about $97,400 in fees.

Ed Gray, the executive director, said his agency reviewed financial statements and visited the apartment complexes in Plano and Fort Worth. About $81 million of the debt Capital Trust has issued has defaulted, according to data compiled by Bloomberg.

“I can’t speak to that,” Gray said of AOF’s default history. “I can only speak to projects that I’m aware of that they currently operate, and have found no lack of expertise.”

Little Regulation

Public agencies like Capital Trust operate in a little-regulated corner of the municipal market. They issue bonds for private companies and nonprofit organizations that would otherwise lack access to tax-exempt borrowing. Local taxpayers benefit from the fees and aren’t on the hook to repay the bonds, which are often used for riskier real-estate projects.

All 50 states have conduit issuers. Florida is one of seven that allow some conduits to issue debt for out-of-state projects, according to the Council of Development Finance Agencies. The practice has drawn criticism from some public officials, who say it can allow debt issuers to elude oversight by financing projects through authorities beyond their jurisdiction.

AOF’s Plano and Fort Worth debt was good enough for Bank of America Corp. The bank bought $26.1 million of the bonds, which yielded 5.5 percent. Fundamental Advisors, a New York-based private equity firm, bought another $11 million of subordinate notes that pay interest as high as 15 percent. AOF provided $600,000 in equity, according to Capital Trust. Melissa Kitlowski, a Bank of America spokeswoman, and Julie Oakes, a Fundamental spokeswoman, declined to comment.

Public Purpose

Gray of Capital Trust said AOF’s housing complexes were in good shape and generate enough income to support the debt.

“We felt this financing for these properties was a good public purpose for us to be involved and therefore when the applicant came to us to consider issuing the bonds, we did so,” Gray said.

Plano, whose median household income is 60 percent higher than the state’s, has a population of 280,000 and is located about 20 miles (32.2 kilometers) northeast of Dallas. It’s dotted with corporate campuses. In 2014, Toyota Motor Corp. decided to move its North American headquarters to Plano from California. Garden Gate, AOF’s apartment complex, is the town’s only subsidized low-income housing for families.

“All we’ve done is allowed them the ability to issue tax-exempt” debt, said Denise Tacke, Plano’s finance director. “We have no responsibility for repayment.”

Bloomberg Business

by Martin Z Braun

June 9, 2016 — 2:00 AM PDT Updated on June 9, 2016 — 7:24 AM PDT