Puerto Rico Governor Alejandro Garcia Padilla says the island won’t pay general-obligation debt coming due on Friday even with President Obama poised to sign a bill that enables the commonwealth to restructure its $70 billion debt load.

Puerto Rico and its agencies owe $2 billion of principal and interest. It may mark the island’s biggest default yet and the first time it’s skipped payments on general-obligation bonds, which are given the first claim on the island’s funds. The federal bill, called Promesa, enables the commonwealth to restructure its debt through a control board that will also weigh in on its spending plans. The measure also shields Puerto Rico from creditor lawsuits seeking repayment. The island’s electric utility agreed Thursday to extend an agreement with creditors so it can make its July payments.

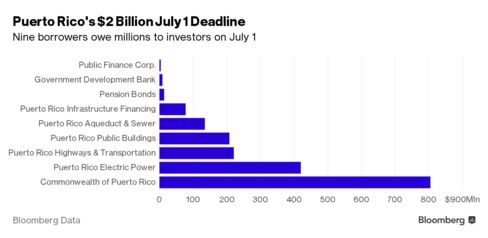

Following is a breakdown of what’s coming due on July 1, according to data compiled by Bloomberg:

General-obligations: About $816 million of principal and interest. Puerto Rico’s constitution stipulates that the government must repay general obligations before other expenses. Garcia Padilla said on Wednesday that the island won’t pay general obligations because there isn’t enough money to cover essential services and pay investors. The commonwealth has $13 billion of general obligations and a default on the securities would be the first payment failure from a state-level borrower on its direct debt since Arkansas in 1933.

Puerto Rico Electric Power Authority: $420 million of principal and interest. The island’s main electricity provider, called Prepa, will avoid defaulting Friday after it reached an agreement with its creditors. Bondholders and insurers will buy bonds from Prepa in a similar arrangement to how the utility averted defaulting on Jan. 1.

Puerto Rico Highways & Transportation Authority: $220 million of principal and interest. The highway agency repays its debt with gas-tax receipts and toll revenue. The authority is expected to pay investors on July 1 from reserve funds already held by the bond trustee, according to S&P Global Ratings. Future payment are uncertain because Puerto Rico has redirected a portion of the agency’s revenue to the general fund. HTA has $6.4 billion of bonds and notes outstanding.

Puerto Rico Public Buildings Authority: $207 million of principal and interest. The bonds are repaid with rents that public agencies pay for their office buildings and are guaranteed by the commonwealth. The authority has about $4 billion of bonds outstanding.

Puerto Rico Aqueduct and Sewer Authority: $135 million of principal and interest. Island lawmakers are working on legislation intended to allow the water agency to raise money by issuing debt through a newly created entity. If it can’t, the authority has said it may redirect funds used to pay debt to cover overdue bills to contractors and suppliers. It has $4 billion of bonds outstanding.

Puerto Rico Infrastructure Financing Authority: $78 million of principal and interest. Called Prifa, the agency has sold the island’s rum-tax bonds. Bond anticipation notes maturing July 1 are expected to default after Puerto Rico said it would instead use the revenue that normally repays Prifa debt to cover essential services instead. Prifa also defaulted on a Jan. 1 interest payment. It has $1.9 billion of bonds outstanding.

Puerto Rico Convention Center District Authority: $20.8 million of principal and interest. The authority has reserve funds with its bond trustee to make the July 1 payment, but those funds could dry up for the next payment due Jan. 1 because Puerto Rico is redirecting its revenue, according to S&P. The agency uses hotel-room tax receipts to repay debt. It has $397.7 million of bonds outstanding.

Puerto Rico Pension-Obligation Bonds: $13.9 million of interest. The taxable debt was sold to bolster the island’s nearly depleted pension fund. The bonds are repaid from contributions that the commonwealth and municipalities make to the retirement system. It has $2.9 billion of bonds outstanding.

Government Development Bank for Puerto Rico: $9.1 million of interest. The bank has restricted withdrawals unless they are used for essential services. The bank defaulted May 1 on nearly $400 million that was due. It has $5.1 billion of debt outstanding.

Puerto Rico Public Finance Corp.: $4 million of principal. Since August the agency has failed to pay investors and was the first Puerto Rico agency to default after the legislature failed to appropriate needed funds. It has $1.1 billion of debt outstanding.

Bloomberg Business

by Michelle Kaske & Sowjana Sivaloganathan

June 30, 2016 — 9:39 AM PDT Updated on June 30, 2016 — 11:13 AM PDT