The municipal-bond market’s rally is facing election year headwinds from Donald Trump.

The real estate developer and reality television star, who accepted the Republican presidential nomination Thursday night, has proposed slashing the top individual income-tax bracket from 39.6 percent to 25 percent, the lowest since 1931. That would sharply reduce the incentive to own tax-exempt bonds, whose yields have slipped to record lows as investors pour money into the safest assets and central banks hold down interest rates.

“He has a pretty aggressive tax reduction plan,” said Mikhail Foux, head of municipal strategy at Barclays Plc in New York. “Taxes going down is always bad for munis compared to Treasuries.”

U.S. presidential elections can have outsized significance for the $3.7 trillion municipal market — a haven of buy-and-hold investors looking for tax-free income — because they often result in changes to tax policy. Typically, Republicans cut taxes on the highest earners, while Democrats raise them.

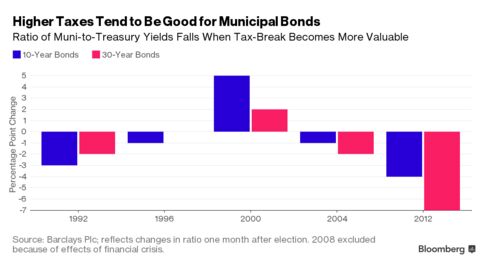

The benefit of owning state and local-government bonds over other fixed-income securities declines when levies are reduced and increases when they rise. Yields — which move in the opposite direction as price — fell relative to U.S. Treasuries after Bill Clinton’s victories in 1992 and 1996, and again after President Barack Obama’s re-election in 2012, according to Barclays. They increased after Republican George W. Bush’s victory in 2000, which led to tax cuts.

Top-rated 10-year municipal bonds yield 1.47 percent, or about 93 percent of what Treasuries with comparable maturities offer. For an investor in the top income-tax bracket, the tax equivalent yield is 2.6 percent, or about 1 percentage point more than Treasuries with the same maturity. At a top bracket rate of 25 percent, the tax-equivalent yield is 1.96, or about 0.5 percentage point more than Treasuries.

Municipal bonds have gained every year but one since President Barack Obama took office in 2009, according to Bank of America Merrill Lynch indexes, as the Federal Reserve held interest-rates near zero and taxes were raised on the highest earners.

Trump’s plan is estimated to cut federal revenue by $9.5 trillion and swell the debt by $11.2 trillion over the next decade, according to the Tax Policy Center, a joint venture of the Urban Institute and Brookings Institution. The proposal may be scaled back: he’s expected to release a revised plan that calls for reducing the top rate to between 28 percent and 33 percent, closer to what House Speaker Paul Ryan has endorsed, according to the Washington Post.

The demand for municipal bonds could also be eroded by Hillary Clinton’s proposals, though not by nearly as much. While her plans include higher taxes on incomes over $5 million, she has also endorsed establishing a minimum 30 percent levy on filers earning more than $1 million and capping the value of tax exemptions, which could reduce the tax-breaks given to owners of the debt.

Municipal yields could increase by more than 1 percentage point under Trump’s original plan and 0.35 percentage point under Clinton’s, assuming prices are driven by investors in the highest tax bracket, according to Morgan Stanley’s chief municipal strategist Michael Zezas.

But demand from lower-income investors could offset some of that: About 45 percent of returns that reported tax-exempt interest had adjusted gross incomes less than $200,000, according to the Internal Revenue Service. And enacting major tax overhauls are difficult, regardless of who controls Congress.

“It’s extremely difficult to get the consensus required for what might be called fundamental tax reform,” said Phil Fischer, the head of municipal research at Bank of America Merrill Lynch. “Nobody knows what that is any more.”

Barclays’ strategists predict that if Trump wins, the GOP would likely control Congress but wouldn’t have a super-majority in the Senate. After an initial period of volatility and a flight to safer assets, 10-year Treasury rates could rise as much as 0.5 percentage point because of fiscal stimulus generated by individual and corporate tax cuts. With municipal rates forecast to increase even more, that may lead investors to pull money from mutual funds that invest in state and local debt.

“We can expect outflows when rates increase significantly,” Foux said. “That’s historically what we see.”

Bloomberg Business

by Martin Z Braun

July 22, 2016 — 2:00 AM PDT Updated on July 22, 2016 — 7:09 AM PDT