Chicago debt rallied after Mayor Rahm Emanuel released his plan to increase water and sewer levies to shore up the retirement plan for municipal workers, a move to avert insolvency for the city’s largest pension fund.

Without the fix, the fund that serves more than 70,000 workers and retirees is on track to run out of money within a decade. Less than a day after Emanuel laid out the plan at Chicago’s investor conference, the municipal market applauded the proposal. The city’s most-actively traded debt traded at 87.98 cents on the dollar Thursday, the highest average price since April 2015, according to data compiled by Bloomberg. The taxable debt that matures in 2042 yields 6.4 percent.

“This is exactly the type of plan we were looking for,” said Ty Schoback, a senior analyst at Columbia Threadneedle Investments, which holds Chicago debt among its $26 billion of municipal securities. “If the tax is successfully ratified by City Council, it will be the last heavy political lift to get all the city’s pensions on track to full funding over the long run.”

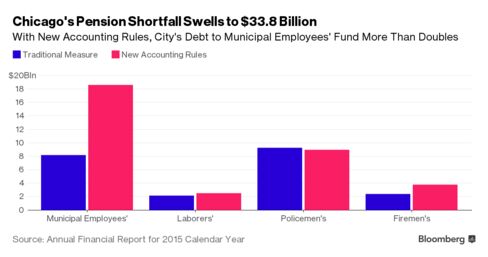

Chicago hasn’t paid enough to pensions for years. Over the last decade alone, the city shorted the municipal fund by more than $4 billion, according to an annual actuarial report. The fund has to liquidate assets to pay out benefits. Combined, the police, fire, municipal and laborers’ pensions face $34 billion of unfunded liabilities. The strain is weighing on Chicago’s ability to offer services to residents. More than 35 cents of every dollar of the budget goes to pay debt and pensions, according to Moody’s Investors Service, which slashed Chicago’s rating to junk last year because of the pension crisis.

To rebound to investment grade, Moody’s wants Chicago to reverse the trajectory of its pension problem. The city would need to raise about $1 billion a year to see a reduction in retirement costs the following year, according to the credit rater. Moody’s is reviewing the municipal plan, David Jacobson, a spokesman, said in an e-mail on Wednesday.

In October, Emanuel pushed through a record property tax hike to fund the police and fire retirement funds. In May, he released a plan, that’s still subject to state approval, to get the laborers’ pension to 90 percent funded by 2057.

Under Emanuel’s proposal to investors on Wednesday, the city would increase its contributions to the municipal fund by no less than 30 percent over five years. New employees would have to pay 3 percent more to their retirement fund, and employees hired after January 2011 would have the option to retire earlier, but would pay more to their pensions.

While this is a very positive action, there’s still work that needs to be done, said Paul Mansour, head of municipal research at Conning, which oversees $11 billion of state and local debt, including Chicago securities.

“It’s a very dynamic challenge that needs to be adjusted or looked at annually based on investment returns, longevity risks, and any other plan changes,” Mansour said. “It’s encouraging that they’re stepping up and raising revenue and addressing it. Will it be enough? Probably not. Until you meaningfully reduce the rate of growth in benefits, this is going to be a material credit concern for many years to come.”

The City Council needs to approve the tax hike, and the state needs to authorize the change in city and employee contributions, but Emanuel expressed confidence that the plan will succeed.

“It’s good to see some action taken,” said Dan Solender, head of municipals in Jersey City, New Jersey, for Lord Abbett & Co., which manages $20 billion of the debt. “It’s been a long wait.”

Bloomberg Business

by Elizabeth Campbell

August 4, 2016 — 10:30 AM PDT