The push to fully fund New Jersey government workers’ pensions is in jeopardy amid a contentious clash between state employee unions and lawmakers that is leaving investors wondering what’s next.

Lawmakers face a Monday deadline to authorize a ballot measure, which if approved by voters in November would require the state to pay what it owes to pension plans that have less than half of what’s needed to cover obligations. Senate President Steve Sweeney, a Democrat and union official who sponsored the bill, said Thursday he won’t put it up for a vote until he wins an agreement on transportation funding. He accused two unions of trying to illegally coerce the vote.

The constitutional amendment would put the state on track to make full actuarially required contributions by 2022 and cut the unfunded liability by $4.9 billion over three decades. The quarterly payments would strain the state’s cash flow, Moody’s Investors Service and S&P Global Ratings said. Republican Governor Chris Christie, whose signature isn’t required, has called the measure a “road to ruin” that would mandate massive tax increases.

“Getting the funding up is going to be painful,” said Tamara Lowin, director of research at Rye Brook, New York-based Belle Haven Investments, which oversees $5.3 billion of municipal debt. “Making it a forced, fixed expense and making it senior to appropriation debt is a credit weakness, despite the fact that it will eventually bring the state to fiscal stability.”

New Jersey’s borrowing costs, no matter the outcome on the pension measure by Monday, are likely to stay elevated. The Garden State pays the second-highest yield premium on 10-year bonds among 20 states surveyed by Bloomberg.

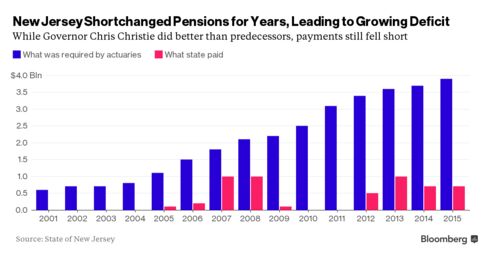

The state’s mounting pension liabilities have pressured its borrowing costs and ratings, second lowest among U.S. states after Illinois. Over the past decade, New Jersey paid about $24 billion less than it should have into the funds, freeing up cash to close budget shortfalls, spend or ease taxes, according to data compiled by Bloomberg.

S&P in March changed its outlook on New Jersey’s credit grade to negative from stable because of the pension tab and said that the ballot measure could result in limiting the state’s flexibility during economic downturns.

The ballot measure had appeared on track to go before voters in November. But lawmakers and Christie failed to agree on a package to finance transportation projects through increasing the gas tax. Passing the measure to fully fund pensions could be risky depending on how the roadwork issue is resolved, Sweeney said.

That’s raised the ire of public-employee unions. The New Jersey Education Association ran online ads Thursday featuring pictures of Sweeney that said “New Jersey Doesn’t Need Another Politician Who Lies” and urged members to tell him not to break his promise.

On Wednesday, Sweeney called threats from the NJEA and the Fraternal Order of Police to withhold campaign contributions unless the Senate passes the pension legislation as clear-cut examples of extortion. He sent letters to the U.S. attorney and state attorney general asking for investigations of the NJEA warning as a violation of state and federal bribery laws.

Christie, who usually receives the brunt of the criticism from the public unions because of his push to restructure benefits, wants to cut the sales tax in exchange for the gas tax move. “Combining that with passage of the constitutional amendment to require quarterly pension payments would be a devastating blow to future budgets that would cripple the state’s ability to fund much needed programs and services,” Sweeney said in a statement Thursday.

The impasse from transportation to pensions is “frustrating” but par for the course for investors in New Jersey, said Dan Solender, head of municipals in Jersey City, New Jersey, for Lord Abbett & Co., which manages $20 billion of the debt.

“There’s low expectation for major progress right now,” he said.

Bloomberg Business

by Romy Varghese

August 5, 2016 — 2:00 AM PDT Updated on August 5, 2016 — 7:10 AM PDT