A year after being cut to junk by all three major bond-rating companies, Chicago’s school system has won an influx of state aid, secured extra tax money for its pensions and quieted speculation that the crisis is so severe that bankruptcy is inevitable. Its bonds have rallied.

But as the Chicago Board of Education seeks permission to borrow as much $945 million, the nation’s third-largest district is far from in the clear. This year’s budget will only balance if teachers agree to pay more into their retirement plan and the gridlocked Illinois legislature passes an overhaul of the state pension system. School officials are still trying to secure needed credit lines to help pay bills and borrowing costs have ballooned after repeated downgrades, adding to the financial squeeze.

“They’ve put together a credible budget, although there’s some significant risk factors,” said Paul Mansour, head of municipal research at Conning, which oversees $11 billion of state and local debt, including some Chicago Board of Education securities. “They enter fiscal year 2017 with few, if any, reserves. They don’t have a line of credit in place, and they have uncertain market access.”

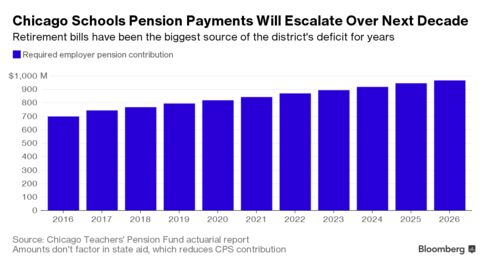

The system with almost 400,000 students is struggling to address one of the biggest crises in the $3.7 trillion municipal market, one that’s been decades in the making. For years, officials borrowed to pay bills, skipped pension payments and drew down savings, leaving the schools with nearly $10 billion of unfunded retirement liabilities and $7.6 billion of debt. The interest and principal alone will consume more than 10 percent of the budget.

“The financial position of the district is precarious,” said Mark Lazarus, who follows the Chicago schools for Moody’s Investors Service, which rates the board B2, five steps below investment grade. “There are a lot of uncertainties that are built into the budget that we’re going to be watching to see how they play out.”

The proposed spending plan counts on savings from phasing out the district’s practice of paying the bulk of the annual retirement-fund contributions that teachers are supposed to make. That cost $130 million last year, but the union has called rolling it back a pay cut and threatened to strike to stop that from happening.

Moody’s has a negative outlook on the board, signaling more downgrades are possible. That could raise interest costs in the future.

On Aug. 16, the board posted a notice for a public hearing to discuss the sale of as much as $945 million of general-obligation bonds for school-improvement projects. The board plans to vote on the budget and bond authorization at its Aug. 24 meeting.

“CPS is making great strides in improving the district’s financial stability, and we have a path forward to fiscal soundness in the years to come,” Emily Bittner, a district spokeswoman, said in an e-mailed statement.

That school district may benefit from rising demand for high-yield municipal bonds, which has buoyed the returns on debt issued by financially struggling governments including Puerto Rico.

When the Chicago school district last publicly sold bonds in February, it paid yields of as much a 8.5 percent, or three times the rate of a top-rated issuer, after Governor Bruce Rauner repeatedly called for allowing it to file for bankruptcy, which currently isn’t permitted under state law.

The bonds have since rallied. A portion of the federally tax-exempt bonds maturing in 2044 traded at an average of 106 cents on Aug. 17 to yield 6.1 percent, according to data compiled by Bloomberg. That’s up from 84 cents in February.

While the proposed budget doesn’t completely solve the district’s structural budget gap, it’s a “big step forward,” said Molly Shellhorn, vice president and senior research analyst at Nuveen Asset Management, which owns about $410 million of the bonds issued in February. The firm will look at future offerings, said John Miller, Nuveen’s co-head of fixed-income.

“It’s an essential service,” Miller said. “It has to stay open. The security, the essential service, and the credit spread within the context of a — we think — improving single B credit does make us feel fairly optimistic.”

As part of a six-month, stopgap budget reached in June, Rauner and lawmakers authorized a $250 million property-tax levy for the Chicago teachers’ pension and provided $131 million of additional state aid. The district gets another $215 million if Illinois passes a pension fix. That may prod both sides to work toward an agreement, said Eric Friedland, director of municipal research in Jersey City, New Jersey, for Lord Abbett & Co.

“Where in the past, there’s been a deadlock, now at least we’re reaching sort of a breaking point,” said Friedland whose firm holds $20 billion of municipal debt, including some of the board of education’s. “That’s certainly a better spot to be in than last year, when there was no momentum at all.”

Bloomberg Business

by Elizabeth Campbell

August 19, 2016 — 2:00 AM PDT Updated on August 19, 2016 — 6:52 AM PDT