America’s states and cities are finally seizing on record-low interest rates to finance needed work on roads, bridges and schools.

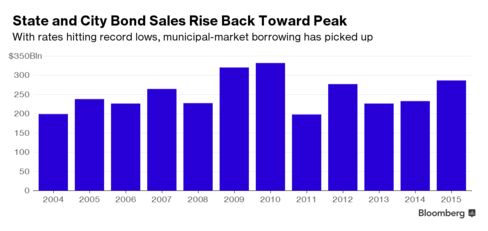

After borrowing costs tumbled worldwide as central banks sought to jump-start their economies, agencies from New York to California have sold about $272 billion of bonds this year and are funneling more into construction projects, instead of just paying off higher-cost debt. That’s put the municipal market on track to approach the record level of sales reached in 2010, when the federal government was seeking to hasten the nation’s recovery by footing some of the bills on debt issued for public works.

“That’s going to be the story for the year — rebuilding infrastructure,” said Mikhail Foux, head of municipal strategy in New York for underwriter Barclays Plc, which forecasts that issuance may reach $400 billion this year.

The spree shows how local U.S. agencies are benefiting from turbulence in global financial markets that’s kept the Federal Reserve from raising interest rates since its initial increase in December — a move that at the time spurred speculation states and cities were missing an opportunity. The need for such spending has been injected into the U.S. presidential campaign, with both Democrat Hillary Clinton and Republican rival Donald Trump promising hundreds of billions of dollars for the country’s fraying infrastructure.

While localities for years pocketed savings by refinancing, this year they’ve stepped up borrowing for planned public works — many of which were put on hold as officials struggled with budget shortfalls that persisted long after the recession ended in 2009. So-called new-money deals — which fund projects instead of paying off old debt — accounted for 40 percent of the sales through early August, compared with 35 percent for the same period last year, according to Bank of America Merrill Lynch.

The new issues this year included those for a terminal at New York’s LaGuardia Airport, improvements at Chicago’s schools and work on Texas’s roads. Next month, Alabama plans to offer $550 million of debt backed by highway funding it’s set to receive from the federal government, allowing it to begin work without waiting on Washington.

Irvine Ranch Water District, an agency serving 380,000 customers in California’s Orange County, this month issued its first new-money bonds since December 2010. The timing of its $117 million deal, some of which retired older securities, was driven partly by the market, said Rob Jacobson, the district’s treasurer. The proceeds are being used for a facility to treat waste-water remnants called biosolids, which are currently processed elsewhere.

“It turned out to be an excellent time,” Jacobson said. “The market is fantastic.”

The longest-maturing securities, which come due in March 2046, yielded 2.23 percent, 0.74 percentage point above benchmark munis. The 10-year securities yielded 1.29 percent, 0.64 percentage point less than top-rated bonds, data compiled by Bloomberg show.

The pace of new bond deals is expected to stay brisk. There were $16 billion scheduled over the next month, an increase from the $6.9 billion that were planned for 30 days out at the start of July, data compiled by Bloomberg show.

On Friday, Fed Chair Janet Yellen said the case for raising interest rates is getting stronger, and speculation has increased that the central bank will tighten monetary policy: the futures market predicts a 56 percent chance that rates will be increased in December, compared with the 45 percent odds given a month ago.

The increased supply hasn’t diminished the municipal market’s rally, which has driven yields — which move in the opposite direction as prices — to record lows. With negative rates in Japan and Germany, even the diminished payouts have been a draw to investors looking. U.S. state and local-government debt funds have taken in cash for almost a full straight year, according to Lipper US Fund Flows data.

Barclay’s Foux said more bonds may be on the way if either Trump or Clinton follow through on their promises to fix crumbling roads and bridges.

“It’s going to be a massive boost,” he said.

Bloomberg Business

by Romy Varghese

August 26, 2016 — 2:00 AM PDT Updated on August 26, 2016 — 7:24 AM PDT