Chicago moved closer to keeping its largest pension fund from running out of money within the next decade.

The city council’s finance committee on Thursday approved raising the levy on water and sewer usage over the next five years to avert insolvency for the municipal pension, the most underfunded of the city’s four retirement systems. Last month, Mayor Rahm Emanuel outlined his plan to get the Municipal Employees’ Annuity and Benefit Fund of Chicago to 90 percent funded in 40 years. The hike still needs to be adopted by the full council, which next meets on Sept. 14.

“We are going from the potential of bankruptcy to the potential of solvency” for the pensions, Carole Brown, Chicago’s chief financial officer, said in response to questions from committee members. She acknowledged that the city will still need more revenue down the line. “It puts us on a path where we’re addressing the needs of not only this fund but every other pension fund.’’

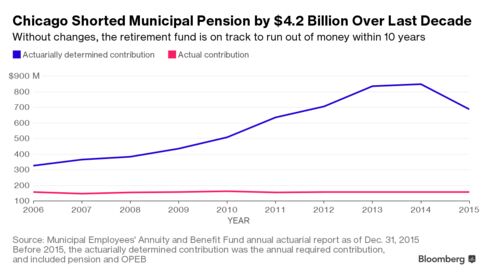

Chicago shortchanged its pension funds for years, neglecting to put aside enough money to cover the rising cost of benefits for retirees. That failure has left the city with $34 billion of retirement debt across its four funds. The strain of the unfunded liabilities pressures its budget and led Moody’s Investors Service to slash Chicago’s rating to junk last year.

The city’s bonds have rallied since Emanuel outlined the plan to hike the utility tax on Aug. 3. That move follows a record increase in the property tax, pushed through by Emanuel in October, to bolster the police and fire pensions. A telephone tax will help shore up the laborers’ retirement system. If the plan for the municipal fund is approved, all four funds will be on a path to solvency, according to city officials. The four pensions are only 23 percent funded, according to an annual financial analysis.

A portion of the city’s taxable debt, which matures in 2042, traded for an average of 92 cents on the dollar Thursday, compared to 87 cents on Aug. 3, the day Emanuel outlined his plan. The debt yields 6 percent, down from 6.5 percent.

Emanuel’s plan for the municipal fund also ramps up the city’s payments. Chicago will pay about $3 billion to the fund over the next six years. That compares to only $1 billion under the current funding schedule. In 2022, the city will start making the actuarially-required payment to get to 90 percent funded in 2057.

Chicago plans to seek state authorization to increase its pension payments and alter the employee contributions.

The council has to approve the higher utility rates. Over five years, water and sewer charges will rise by about 33 percent with the new tax. The higher levies will help cover the city’s municipal pension bills over the next six years. After 2022, the city will need to find additional revenue to cover the stepped-up payments.

Some council members expressed concern that the tax won’t fully cover the revenue needed over the full 40-year period. Brown and Alex Holt, the city’s budget director, acknowledged that the work isn’t done.

“We’re not going to ask taxpayers today to pay for an expense that’s 40 years down the line,’’ Holt said. “We need to work and put a sustainable plan into place that deals with the biggest increase, which is between now and 2023, and then we need to work towards putting additional sustainable revenues or additional reforms and savings in place to deal with this issue over the 40-year time period.’’

Bloomberg Business

by Elizabeth Campbell

September 8, 2016 — 11:14 AM PDT Updated on September 8, 2016 — 12:08 PM PDT