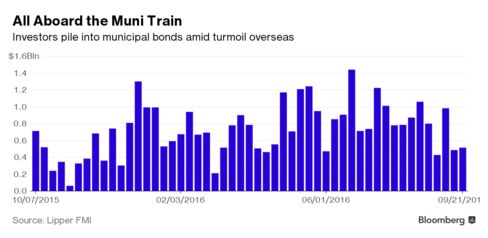

Investors have plowed money into municipal-bond funds for almost a year, allowing local governments to borrow at near record-low yields. That’s making it easier to ignore the cracks beneath the market’s surface.

This week may mark the 52nd straight one with inflows into state and local-government bond funds, the longest streak since 2010, according to Lipper US Fund Flows. Even with the influx, the securities are headed toward the biggest monthly loss since February 2015 on speculation the Federal Reserve may raise interest rates in December. If investors start yanking money out, that could weigh on prices because securities firms have pulled back from the market.

“There’s this anxiety that’s looming under the surface where people are saying, everything is going really well, there’s all these muni inflows but what happens if that stops suddenly?” said Katie Koster, a managing director in public finance investment banking for Piper Jaffray Cos. in Laguna Beach, California. “How will the markets react? They could seize up quite quickly.”

The municipal market has been whipsawed in the past when mom-and-pop investors dumped their bonds en masse. Prices tumbled in late 2010 amid concern the recession would trigger a wave of defaults, a fear that later proved unwarranted. The securities dropped again in 2013 during the so-called taper tantrum, when then-Fed Chair Ben Bernanke jarred investors with plans to scale back the central bank’s bond purchases.

The influx of cash for the past year has been fostered by stock-market volatility and negative interest rates overseas, which have made even rock-bottom municipal yields attractive by comparison. Foreign buyers, who don’t benefit from U.S. tax breaks tied to the debt, increased their holdings to $89.7 billion at the end of June from $74 billion three years earlier.

The streak of cash “shows strong investor demand for an income-producing asset class that has high credit quality, low volatility and continues to act as a diversifier against equity and equity-like risk,” said Sean Carney, head of municipal strategy at BlackRock Inc., which manages about $124 billion of municipal debt. “There’s no indication that flows are about to turn negative, just less robust.”

Municipals have produced a return of 4 percent in 2016, according to Bank of America Merrill Lynch data, thanks to a rally that came as the Fed held off on interest-rate increases that were anticipated this year. The central bank indicated this month that the case for tightening monetary policy has strengthened, and the securities posted a loss of 0.5 percent in September.

Despite the wall of cash that’s allowed even junk-rated borrowers to issue debt, governments continue to deal with mounting pension-fund shortfalls that are exerting a drag on their credit ratings. And the impact of a selloff could be exaggerated by the brokerage industry’s diminished role in the market since new regulations went into effect after the financial crisis: Dealers’ holdings fell to about $20 billion at the end of June, down by half from $40 billion in mid-2011, according to Fed data.

“Investors have to be careful about not lulling themselves into a false sense that this abundant liquidity in the market right now is driven by dealers,” said James Iselin, head of the municipal fixed income team in New York at Neuberger Berman, which oversees about $10 billion. “It’s really driven by investors and asset managers who have pumped a lot of money into the space.”

To prepare, he said investors should buy bonds from highly-rated governments even if they offer less yield than more speculative ones.

“Giving up a little bit more to be more flexible and nimble for an environment that could be less liquid, that’s a trade that investors should certainly think about right now,” he said.

But with the interest rates so low, investors have been doing the opposite, said Piper Jaffray’s Koster. “That could be a problem down the road.”

Bloomberg Markets

by Romy Varghese

September 28, 2016 — 2:00 AM PDT