There was a tremendous amount of volatility in the quarter in terms of state ratings. This is unusual because state ratings tend to be sticky – it takes major deterioration to cause a downgrade. States have vast resources and the ability to institute revenue increases and reduce budgets. States are also prohibited from filing for bankruptcy – they cannot just fold up and go away – which is true of most municipal issuers as well. States can manage spending by reducing funding to state instrumentalities and municipalities in the state as well as by reducing services provided, thus reducing the budget. However, as has been cited in our past commentaries, the factors that have caused state ratings to be weakened and eventually downgraded include (1) the severe underfunding of pensions due to overpromising and falling short on both required contributions and investment returns; (2) slow or declining revenue and economic growth combined with dipping into reserves rather than cutting budgets or raising revenues – also referred to as structural imbalance; and (3) exposure to the oil and gas industry, which has led to volatile revenue and economic growth and financial operations.

Five states were downgraded during the third quarter:

- Alaska was downgraded by Moody’s to Aa2 due to political instability, structural imbalance, outsized pension liabilities, and economic difficulties caused by low oil prices -basically, for all the reasons cited above!

- Mississippi was changed by Fitch to AA from AA+ due to weaker than expected operating performance and, in this case, a change of methodology in Fitch’s rating of states.

- Kansas was downgraded by S&P to AA- due to structural budget pressures, drawdown of reserves, and deferral of pension contributions.

- West Virginia was downgraded by Fitch to AA because of economic and fiscal challenges associated with the state’s dependence on the coal industry, and Fitch continues to maintain a negative trend on the state’s rating as a consequence of significant domestic and international momentum to reduce coal utilization.

- Finally, Illinois was again downgraded by S&P to BBB on September 29thafter just having been downgraded by the agency in June. The downgrade reflects continued weak financial management and increased long-term and short-term pressures tied to declining pension funding levels. Illinois pensions are 41% funded, compared with an average funding level of 75% for the states, per a recent Pew Charitable Foundation brief.

New Mexico’s Aaa rating was put under review for a downgrade by Moody’s because of an extremely large revision in 2016 and 2017 revenues, resulting in a large drawdown of reserves. The New Mexico legislature has a history of promptly addressing issues and has scheduled a special meeting. Expect a downgrade if the structural imbalance is not addressed. Although not a downgrade, the flooding in Louisiana (Aa3/AA by Moody’s and S&P, both with negative trends) devastated a state already weakened by exposure to the oil and gas industry. However, the long-term ramifications remain to be seen, as the economic stimulus from rebuilding may help the state’s revenues.

Pennsylvania received a reprieve in the form of Moody’s changing the negative trend to stable on its Aa3 rating. The revision of the commonwealth’s outlook to stable recognizes that Pennsylvania’s problems – while sure to persist – are unlikely to lead to sharp liquidity deterioration, major budget imbalances, or other pressures consistent with lower ratings for US states. After the revision to stable, Pennsylvania resorted to interfund borrowing, which is a credit negative, though Moody’s maintained the stable trend.

Alaska’s AA+ S&P rating was removed from CreditWatch negative – which indicates S&P was conducting a review that may have resulted in a downgrade; instead, it put in place a negative trend – a contrast to Moody’s downgrade action. Both agencies recognize that the state has a sizable structural imbalance, i.e., annual expenses exceed annual due to low oil prices and dependence on the oil industry; but the state still has substantial reserves. However, Moody’s views more negatively Alaska’s political instability resulting from ineffective governance and a divided legislature, which impacts long-term decision making.

States continue to be pressured, though there are bright spots.

Hawaii was upgraded by Moody’s and S&P to Aa1 and AA+, respectively, due to economic and revenue growth resulting in restoration of strong reserves and strong fiscal management. Minnesota was upgraded to AAA by Fitch – above the Moody’s and S&P ratings of Aa1 stable and AA+ positive – due to its broad-based economy, low debt, stable employee benefits, and strong, flexible finances and management.

To put this in perspective, the average rating for a state is AA and has recently been trending down. Generally, a state rating in the single-A category is considered very low.

Ten states are rated AAA by all three rating agencies. They are: Delaware, Georgia, Iowa, Maryland, Missouri, North Carolina, Tennessee, Texas, Utah, and Virginia. They stand in contrast to those states that have not been faring so well and that we have expounded on in the past. These include Illinois (rated Baa2, BBB, BBB+) – plagued by huge pension and revenue issues, New Jersey (A2/A/A) – dealing with revenue, economic, and pension issues, Kentucky (Aa2, A+, AA-) – affected mostly by pension issues, and Connecticut with all three ratings in the double A category at Aa3, AA-, AA-, but the ratings are tenuous due to the inability of the state to come up with long-term solutions as it continues to lose population.

The continuing pressure on state ratings puts other areas on our radar screen, including the increasingly visible burden of OPEB (other post-employment benefits), in addition to pension benefits, that will now need to be disclosed in a concise manner in accordance with GASB 74 and 75, to be instituted for fiscal years ending after June 15, 2016 and June 15, 2017, respectively. Many states and municipalities fund on a pay-as-you-go basis, so to estimate future obligations may add, or rather make more visible, significant liabilities. Governments can change other post-employment benefits more easily than pensions, which are constitutionally mandated; however, OPEB burdens are growing.

We will also be sensitive to state agencies and municipalities that may experience reduced funding from the state. We will evaluate credits to make sure there is financial flexibility in the form of strong reserves and revenue flexibility – which are characteristics of highly rated bonds. For example, the State of Maryland has announced it will be reducing funding to counties in the state. For the most part, Maryland counties are strong, although like most counties they have few revenues and numerous social service spending obligations. State institutions of higher education and state housing agencies have traditionally been hit by state reductions; however, these institutions are currently displaying resilience, and many should be able to handle reduced state funding.

Other developments over the quarter were:

Zika spread to the United States and may have credit implications for Puerto Rico and Miami – these situations will be watched for long-term implications. We will also watch for spread of the virus to other locales. Immediate effects may be a decline in tourism and population, while longer-term implications could be increased social service spending. These outcomes will depend on preventative measures, which may be helped by recent congressional approval of Zika funding.

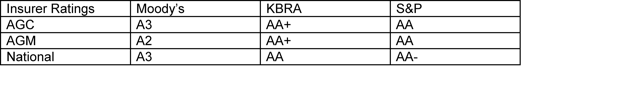

Bond insurance industry strength was affirmed after rating agencies reported that bond insurers’ exposure to numerous defaulted entities in Puerto Rico would not affect their claims-paying ratings. Moody’s, KBRA, and S&P all published reports or updates in the quarter.

The City of Chicago, suffering from pension problems and political gridlock, approved a rate increase for its water and sewer utility to help prop up one of its severely underfunded pension funds. We will be watching to see if this move causes contagion risk to other city utility systems.

One reason municipal utilities have gotten stronger is limits on the ability of municipalities to use utilities as a cash cow. This trend came about at least 20 years ago when utilities needed market access to fund improvements to their systems to comply with clean water and clean drinking water acts. Rating agencies and investors looked unkindly on unlimited and unscheduled transfers, so there was pressure to make transfers predictable. Consequently, transfers to the general fund of a municipality from its utility are generally limited to something akin to a tax or a fixed percentage of revenues. This provides certainty for the utility to accumulate funds for operations, maintenance, and capital improvements as well as reserves for unexpected events – and to maintain strong credit ratings. As has been widely reported, there is considerable underfunding of our nation’s infrastructure, including water and sewer systems. Thus, we expect increased debt issuance from the sector, so any extra “tax” on the system to fund something outside of the system will be scrutinized for its overall burden on the utility involved.

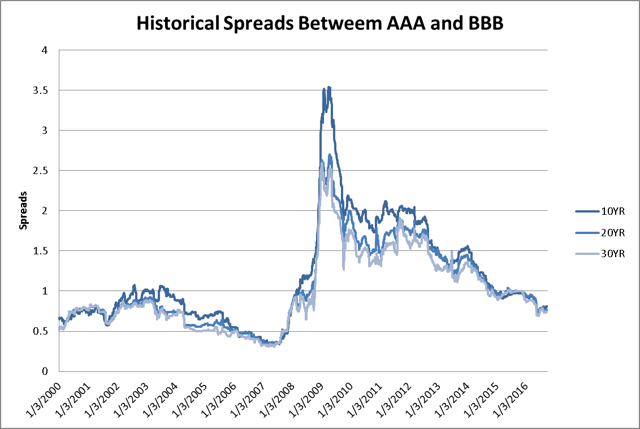

Our strategy of investing in higher-rated bonds will continue as we move into a rising interest rate environment. Some pundits think that because municipal bonds are generally so safe, lower-rated and longer-dated bonds will provide enough yield to compensate; however, credit spreads tend to widen with rising interest rates. You can see the narrowing spread as interest rates decline in the following chart, which compares the yields of AAA-rated bonds with BBB bonds over time.

Source: RBC Capital Markets, LLC

Interest rate increases contribute to outperformance of higher-quality credits. Although the absolute return may be negative, the performance of AA and AAA-rated bonds will be better than that of lower-rated bonds.

This is why Cumberland Advisors invests predominantly in AA bonds and single A-rated bonds that are stable or improving.

David Kotok

Registered investment advisor, portfolio strategy

Cumberland Advisors

By Patricia Healy, CFA

Oct.23.16