Local governments across the U.S. are asking voters to approve about $70 billion of bond sales, the most in a decade, seeking to seize on improvements in their fiscal positions and near record-low interest rates to borrow for public works.

The jump is driven largely by California, which accounts for about $42 billion of the proposed debt, as officials seek to raise funds for schools, public transportation and affordable housing, according to financial-data provider Ipreo. Elsewhere, voters are being asked to back large issues for roads in Austin, Texas, schools in Denver and waterworks in Columbus, Ohio.

“The cost of borrowing is low,” said Mark Ferrandino, chief financial officer of Denver Public Schools, which is asking voters to approve $572 million, the second-biggest amount for schools in Colorado history. “It allows us to have our money go further.”

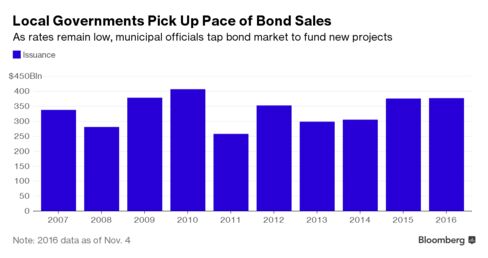

The increase signals that states and cities are backing away from the austerity that persisted for years as they contended with budget shortfalls left in the wake of the recession. Amid speculation the Federal Reserve will resume raising interest rates as soon as December, governments have stepped up their borrowing, issuing $387 billion of bonds this year. That’s the fastest pace since 2010, when municipalities rushed to sell federally subsidized bonds as the program expired.

There are large sales proposed around the country:

- California has a $9 billion school bond on the statewide ballot, while residents around San Francisco are being asked to support $3.5 billion of borrowing for the Bay Area Rapid Transit system. In Los Angeles, ballot measures would raise $3.3 billion for community colleges and $1.2 billion to ameliorate homelessness. Santa Clara County, where the Silicon Valley boom has pushed up the cost of living, is weighing a $950 million bond for housing;

- Austin, Texas’s booming capital city, is proposing $720 million of borrowing for roads, streets, bike trails and sidewalks. It’s the biggest issue outside of California, according to Ipreo;

- El Paso, Texas, is weighing almost $670 million of bonds to build schools;

- Columbus, the AAA-rated Ohio capital, wants to issue $460 million for its water and sewer system.

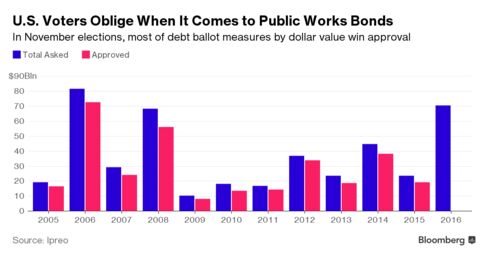

This proposed borrowing is the most since 2006, when about $82 billion went before voters. The uptick reflects the financial improvement among municipalities as the drop in unemployment and housing-price gains lift tax collections. Meanwhile, the yield on the Bond Buyer’s 20-year general-obligation index — while up from the record lows reached in July — is still just 3.27 percent.

“For many years, there was a spirit of austerity where municipal mangers felt pressure not to issue debt and not to leverage up,” said Eric Friedland, director of municipal research in Jersey City, New Jersey, for Lord Abbett, which manages $20 billion of local debt. “You get to a point now where infrastructure is crumbling, revenues are starting to increase, interest rates are relatively low and constituents are pressuring their leaders to actually fund more infrastructure projects.”

Such spending tends to be an easy sell: Since 2004, voters approved at least 75 percent of the proposed bond sales, based on the amount requested, according to Ipreo data.

The borrowing will only put a small dent in America’s backlog of infrastructure projects, an issue that Democrat Hillary Clinton and Republican Donald Trump have both promised to address if they’re elected president. The American Society of Civil Engineers estimates that the U.S. is on pace to spend $1.4 trillion less than needed on its roads, airports and other public works.

“We’ve dug ourselves a pretty deep hole,” said Brian Pallasch, managing director of government relations and infrastructure initiatives for the engineers’ group. “The problem is not going to be solved by one particular ballot measure or one particular congressional action. It’s going to be a series of them.”

Bloomberg Business

by Romy Varghese

November 8, 2016 — 2:00 AM PST