The worst municipal-bond rout in three years may have gone too far too fast.

Speculation that President-elect Donald Trump and a Republican-led Congress will slash taxes and ramp up spending sent bond prices tumbling globally since the Nov. 8 election, driving municipal yields to the highest in more than a year. The selling blitz has pushed the relative strength index, which uses past trends to gauge whether the market has moved beyond typical ranges, to the highest since at least 2009, signaling the securities are oversold and may be in for a rebound.

Investors may be overlooking another important indicator: the record-setting pace of bond sales will likely slow as higher interest rates give local governments less incentive to refinance outstanding debt.

“The market is actually putting the cart before the horse,” said Vikram Rai, head of municipal strategy at Citigroup Inc. “We are worried about a drop in issuance because refundings are going to be down, and the increase in new-money issuance will not be enough to offset the decline.”

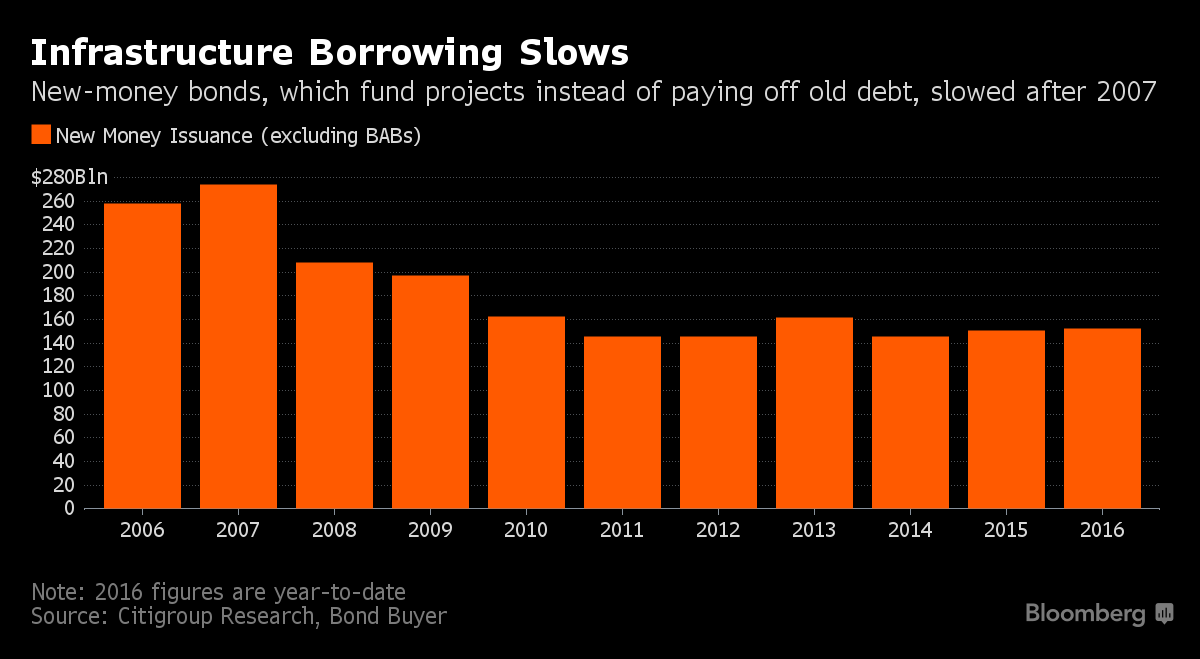

The amount of bonds eligible for refinancing in 2017 is set to shrink because municipalities slowed their issuance of new debt after 2007, according to Citigroup.

While longer-maturity state and local government bonds often have a “call option” that allows them to be bought back after 10 years, much of the debt issued a decade ago has already been refinanced through so-called advanced refundings, said Rai. That’s when a government sells bonds and uses the proceeds to purchase U.S. Treasury or agency securities, which are kept in an account that pays off the previously issued debt as it comes due or is called back.

Besides, with the Federal Reserve set to raise interest rates for the first time in a year, there will be fewer opportunities to refinance, according to Barclays Plc. Advanced refunding, which makes up almost half of refinancings, will “decline meaningfully” next year, Mikhail Foux, head of municipal strategy at Barclays, said in a note last week.

As the municipal market has its worst month since June 2013 — sending Bank of America Merrill Lynch’s index down 2.8 percent — some investors are wary of wading back in yet. This week, BlackRock Inc., the world’s largest asset manager, advised remaining on the sidelines, given that the exodus of cash may continue.

Further out, an expected drop in new bond sales may ease some pressure on the market. After hitting $250 billion already this year, total refundings will drop to $200 billion next year, according to Citigroup, while Barclays predicts an even deeper decline to about $185 billion.

The new-issue calendar has already started to dwindle as issuers brace for volatility stemming from an expected Fed hike next month. Municipal issuers plan to sell about $10 billion of bonds over the next 30 days, down from as much as $25 billion in mid-October, according to data compiled by Bloomberg. The actual number of sales may wind up being higher because some deals are announced only days ahead of time.

A buying opportunity may be at hand because the rout could exhaust itself in a few weeks, the Bank of America Merrill Lynch municipal research team led by Philip Fischer wrote in a report. Tax-exempt bonds are also becoming more attractive relative to their federal counterparts, with both 10- and 30-year municipals yielding more than Treasuries.

That could lure so-called crossover buyers, investors who typically prefer taxable securities but may purchase tax-free debt at discounted valuations, according to Barclays’ Foux.

Bloomberg

by Tatiana Darie

November 23, 2016 — 5:00 AM EST November 23, 2016 — 9:49 AM EST