- Moody’s Analytics says 15 states not prepared for a downturn

- Louisiana, North Dakota, Oklahoma fare worst in stress test

It’s been more than eight years since the last recession, but nearly a third of America’s states aren’t ready for the next one.

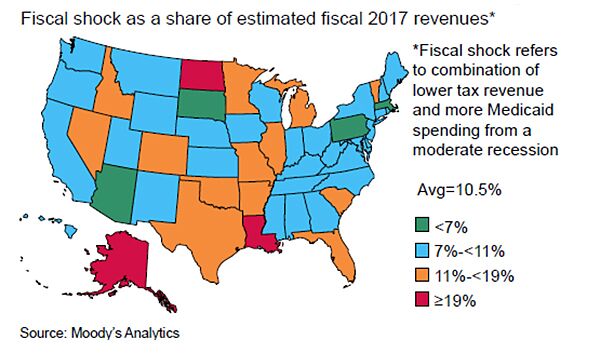

Fifteen state governments don’t have enough money saved to make up for the revenue that would disappear during a moderate recession, with Louisiana, North Dakota and Oklahoma the least prepared, according to stress tests conducted by Moody’s Analytics. New Mexico, Illinois, Colorado, New Jersey, Pennsylvania, Missouri, Kansas, Virginia, Vermont, Arizona, Arkansas and Connecticut were also judged ill-equipped.

Moody’s Analytics isn’t forecasting a recession, though it said another one is only a matter of time.

“A concerning number of states are still substantially unprepared for an economic downturn, and that level of unpreparedness will have economic repercussions if not addressed,” Moody’s Analytics economists led by Dan White wrote. “At the very least, states and local governments should be reviewing their reserve policies and checking on their adequacy following such a tumultuous fiscal period as the last decade.”

Despite the third-longest national economic expansion on record, soaring stock prices and an unemployment rate of less than 5 percent, many states are still having trouble balancing their budgets. Almost a dozen weren’t able to enact one by the time their new years started in July, and Connecticut still hasn’t. Pennsylvania did so, though lawmakers still haven’t figured out how to close the deficit that was left.

The median state rainy-day fund has enough to cover a little over 5 percent of the government’s general budget, according to Moody’s Analytics. That’s not too much more than what it was in 2008, which proved completely inadequate to offset the brunt of the Great Recession.

“This lack of preparation left some policymakers budgeting without a net at the worst possible time,” the analysts said in the report.

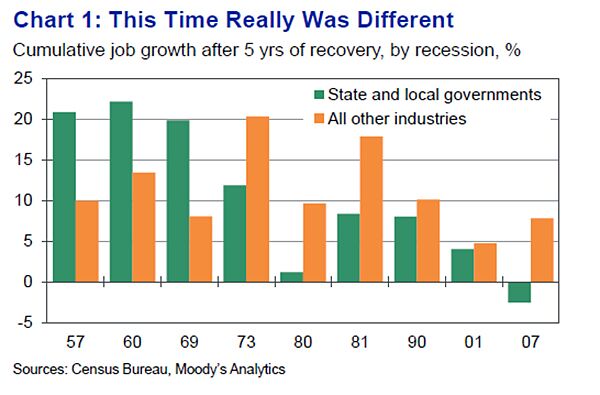

Once that recession struck, states and local governments shed almost 750,000 workers in the next five fiscal years, exerting further drag on the economy. Almost a decade later, municipal payrolls still haven’t returned to pre-recession heights, leveling off around 300,000 below the previous peak, according to Moody’s Analytics. State and local government employment is lower, on a per-capita basis, than at any time since the 1980s.

To come up with its list, Moody’s used state-by-state estimates of tax revenue shortfalls and Medicaid spending increases under a recession. The firm then compared that figure with the reserves held by each state as of fiscal year 2017. Moody’s Analytics regards states with a greater than 5 percentage point difference between actual and necessary reserves as unprepared.

Louisiana, the least prepared state, had a 24 percentage point difference between actual and necessary reserves. Alaska, the most prepared state, had 191 percentage points more in reserves than it would need under a moderate recession, according to Moody’s Analytics.

States are more vulnerable to recession now than in the past, according to Moody’s Analytics. Spending on Medicaid, the state-federal health-care program for the poor, is rising at a faster rate than revenue, becoming a much larger portion of budgets. Meantime, tax revenue collections have become volatile as states rely more heavily on progressive personal income taxes — and a smaller number of wealthy taxpayers — for revenue. Sales taxes are more stable but cover less of the service-oriented U.S. economy.

Energy and commodity states, like Alaska and Louisiana, and those that rely the most on progressive personal income taxes, such as California and New York, will experience more revenue volatility and should keep more in reserve, Moody’s Analytics said. Meanwhile, Arkansas, with a much less volatile tax or economic structure, needs to save less, according to the report.

On average, a state would need to have more than 10 percent of its budget in reserve to weather a modest recession without having to resort to potentially drastic fiscal measures. It would take 16 percent to handle one akin to the last.

States should also develop better guidelines for using the funds, Moody’s Analytics said. During the Great Recession, several states with “sizable reserves” used the money late or not at all as elected officials debated the true purpose of their reserves.

“As a result, several state rainy day funds were marginalized during one of the largest downpours in American history,” according to the report. “This forced some states to take more severe fiscal actions than they otherwise might have, which subsequently weighed on the pace of economic recovery.”

Bloomberg

By Martin Z Braun

October 17, 2017, 9:01 PM PDT