The COVID-19 pandemic has overturned global markets and impacted multiple bond sectors. One of the pandemic’s many knock-on effects is a shift in investor appetite for insured debt.

US credit rating agency, Kroll Bond Rating Agency (KBRA), released research which highlights the shift in investor appetite for insured debt as one of the many knock-on effects of COVID-19.

The current environment may present financial guarantors an opportunity to grow their insured portfolios to replace legacy exposure run-off.

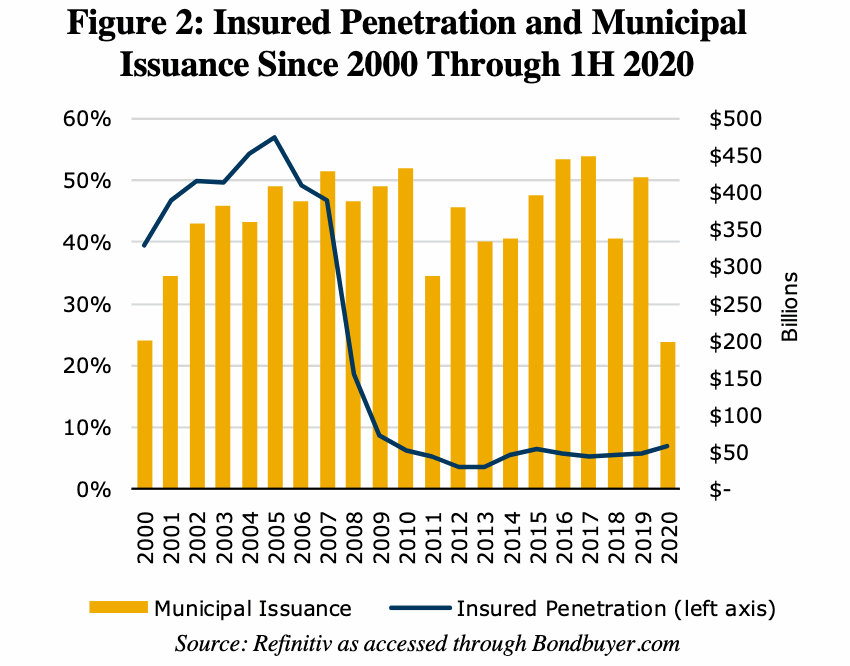

It was recorded that bond insurance penetration spiked sharply up to 7% in the first half of 2020, a level which has not been seen since the global financial crisis. However, KBRA notes that insured penetration remains well below historical highs of over 50%, with a return to that level seen as unrealistic.

The underlying causes of the rise in demand are widening credit spreads as well as increased investor concerns across many sectors of public finance. This is where the impact of COVID-19 continues to cause extensive financial and economic stress for issuers and heightened uncertainty.

Whilst putting capital as a replacement for the run-off of legacy exposure is a long-term positive for the financial guaranty industry, such a development would need to be balanced by adherence to conservative underwriting standards.

Additionally, since the GFC, the emphasis on in-house credit analysis instead of relying solely on a financial guaranty policy, has raised.

A combination of low insurance penetration and steady run-off of legacy portfolios have led to historical lows in leverage ratios for financial guaranty insurers.

KBRA will continue to monitor the impact of the demand for bond insurance on the municipal market and on the financial guaranty industry.

KBRA

5th August 2020 – Author: Steve Evans