General PPP framework

Overview

How has the concept of public-private partnership (PPP) developed in your jurisdiction? What types of transactions are permitted and commonly used in your jurisdiction?

There is no uniform statutory definition of PPP in the United States. The scope of transactions that each state may use to procure from, or partner with, the private sector for the delivery or operation of infrastructure varies from state to state. In some cases, including, perhaps most notably, the state of New York, with respect to transportation projects, some infrastructure-related procurement laws have not permitted the typical forms of contracts used in PPPs, requiring, for example, the separation of the procurement of the design of a project from the procurement of the constructions of the same.

Some authors trace back the development of the modern form of PPP to the power purchase agreements developed in the United States during the 1980s, which provided for a two-component compensation system: a capacity availability payment and an actual usage payment.

The market for PPP transportation projects began to develop in the 1990s with the SR-91, Dulles Greenway and Camino Colombia projects. However, when these projects ran into financial difficulty, the market for this kind of PPP project froze for several years. It was only in the mid- to late 2000s that the transportation PPP market in the United States began gaining new momentum. However, many PPP projects at the municipal level had existed for long before that, mainly in the water and waste water sectors. Correctional services companies have also built prisons and offered their services to all levels of government for several years.

Covered categories

What categories of public infrastructure are subject to PPP transactions in your jurisdiction?

The categories of public infrastructure that can be procured through the PPP model also vary from state to state. The most visible projects developed using this model are transportation projects. However, it is becoming more common to find social infrastructure projects being developed in the form of PPPs, particularly courthouses, prisons and schools.

Legislative framework

Is there a legislative framework for PPPs in your jurisdiction, or are PPPs undertaken pursuant to general government powers as one-off transactions?

Some states have PPP-specific enabling legislation; others rely on legislation relating to their procurement authority and common law. In some cases, the PPP enabling legislation is limited to specific categories of projects, such as transportation. In others, it allows the performance of all types of infrastructure projects.

Currently, most states and Puerto Rico have enacted PPP-specific legislation that permits PPP transportation or social projects. In some cases, the PPP-enabling legislation authorises specific projects on an ad-hoc basis. Some states have enacted pilot programmes authorising the procurement of a limited number of projects using the PPP model.

Relevant authority

Is there a centralised PPP authority or may each agency carry out its own programme?

This mostly depends on the approach followed by each state. In those cases where, for example, PPP enabling legislation is limited to specific types of projects, such as transportation, it is commonly the state’s department of transportation that is charged with the execution and performance of the applicable PPP project. In other states, a centralised PPP authority (which may be an authority created expressly to fulfil such a role, an office within a department of the state government or an existing instrumentality of the state) is in charge of coordinating the PPP policy for the state. In some cases, such an authority is also directly in charge of executing and performing the PPP directly with the private sector, and in others it is a sector agency (eg, the department of transportation) that executes the PPP under the supervision of the centralised PPP authority. States that have created centralised PPP authorities include California, Colorado, Georgia, Michigan, Oregon, Virginia and Washington. All of these authorities exist within the department of transportation or treasury. Among these states, the PPP authorities of California and Michigan have a broad sector mandate, while the other state authorities are focused primarily, if not solely, on transportation. In other states, the PPP programme has been entrusted to more than one authority. For example, in the case of Indiana, the power to execute transportation PPP agreements has been granted to two separate authorities: the Indiana Finance Authority, the state’s authority in charge of the centralised debt programme, with respect to toll road projects only; and the Department of Transportation, for a broader scope of ground transportation projects.

Procurement

Are PPPs procured only at the national level or may state, municipal or other subdivision government bodies enter into PPPs?

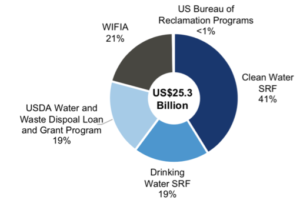

Owing to the distribution of powers in the United States, most PPP projects are procured at the state or local level. Some localities and other municipalities, such as city governments or transportation authorities, have traditionally entered into PPPs based on the powers assigned to them under home rule laws or the general powers granted to authorities. However, the federal government has also entered into PPP projects, mostly relating to social infrastructure (eg, through the Department of Veterans Affairs, the National Park Service and the Postal Service), but most importantly, the federal government has significantly encouraged the use of the PPP model, particularly in the transportation sector, through financing and grant programmes such as the Water Infrastructure Finance and Innovation Act (WIFIA), the Transportation Infrastructure Finance and Innovation Act (TIFIA), Railroad Rehabilitation and Improvement Financing (RRIF) and Infrastructure for Rebuilding America (INFRA) (formerly Fostering Advancements in Shipping and Transportation for the Long-term Achievement of National Efficiencies (FASTLANE)). The Federal government created the Build America Bureau to serve as a single point of contact and coordination for states, municipalities and project sponsors looking to explore ways to access federal financing programmes.

Remuneration

How is the private party in a PPP remunerated in your jurisdiction?

The permitted forms of remuneration for the private party vary depending on the state. However, commonly used forms of remuneration include construction milestone payments, availability payments and shadow tolls and user payments (eg, tolls). Although historically some PPP projects have been entered into on the basis of the private party being compensated with the right to collect and keep toll revenue, most of the recent projects are being pursued as availability payments.

Sharing revenue and usage risk

May revenue risk or usage risk be shared between the private party and the government? How is risk shared?

As discussed above, the form of compensation varies depending on the jurisdiction. Some jurisdictions, such as Texas, have incorporated the sharing of usage risk through the use of shadow tolls in public-private projects. In certain revenue-risk deals, it is not unusual for the public entity to retain a share of revenues and thus share the risk.

Government payment obligations

In situations where the private party is compensated in whole or in part through availability or other periodic payments from the government, are the payment obligations of the government subject to the relevant legislative body approving budgetary funding in the future?

State constitutions vary on the period for which a legislature may appropriate payment obligations. Appropriation risk is generally present in PPP agreements in the United States and addressed by remedies entitling the private party, among other alternatives, to suspend work or claim relief events.

Rate of return caps

Is there any cap on the rate of return that may be earned by the private party in the PPP transaction?

Some PPP agreements in the United States have included a mechanism whereby, if the project company refinances the project debt, and as a result thereof there is an improvement in the rate of return of the sponsors, some or all of the gain is passed through to the public entity. Customarily, if the normal operation of the project produces an improved rate of return, there is no rebalancing requirement. On the other hand, some PPP agreements include terms that limit the obligation of the public entity to compensate the project company for adverse actions or certain termination events by reference to a maximum rate of return, as reflected in the financial model used in connection with the closing of the PPP agreement, regardless of the actual financial performance of the project.

Restriction of ownership transfer

Is the transfer of direct or indirect ownership interests in the project company or other participants restricted?

Some PPP statutes establish restrictions relating to the transfer of ownership in the project company depending on the stage in the procurement of the project. For example, in some cases, once a consortium has been shortlisted to participate in the bidding for the project, its members cannot change prior to the award of the PPP agreement. In addition, even in the absence of statutory restrictions, it is customary for the PPP agreements or the bidding rules to include restrictions on transfers by the owners of the project company.

Procurement process

Relevant procedure

What procedures normally apply to a PPP procurement? What evaluation criteria are used to award a PPP transaction?

Generally speaking, statutes include planning and approval processes for PPP projects to determine in the first instance whether the project is worth pursuing. Statutes differ on how this process is performed, mostly based on whether a dedicated PPP authority exists or not. In some states, this process is also involved with respect to unsolicited proposals. Once the relevant authority has decided to procure a project under the PPP model, generally, a public bidding process is required under the applicable legislation. The most commonly used process involves a solicitation for expressions of interest together with a submission of qualification, following which the procuring authority selects a shortlist of bidders to which a request for proposal is issued. It is customary for the procuring authority to request comments and invite commentary by the shortlisted bidders before formally issuing the request for proposals.

Evaluation criteria vary from state to state. In some cases, a specific set of factors must be evaluated. In others, the generic best value for money test (in addition to satisfying the technical requirements of the project) is used.

Consideration of deviating proposals

May the government consider proposals to deviate from the scope or technical characteristics of the work included in the procurement documentation during the procurement process, without altering such terms with respect to other proponents? How are such deviations assessed?

Many jurisdictions within the United States allow proposers to offer alternative technical concepts on a confidential basis, and it is a common feature in many of the current PPP procurements. The authority may accept these deviations and determine whether the procuring authority will indeed receive better value for money by accepting the deviations, while at the same time satisfying the expected outcome from the original technical requirements. After receiving the confidential proposal, in advance of the proposer’s bid, the authority would then analyse if it is willing to accept it or not, based on value for money offered and satisfaction of its expected goals. Typically, before performing such an analysis, the authority will receive the confidential proposal and decide whether it indeed constitutes a deviation or not.

Unsolicited proposals

May government parties consider unsolicited proposals for PPP transactions? How are these evaluated?

Some PPP statutes, particularly in the most active states in the PPP market, permit receipt of unsolicited proposals. The proposal is, in most cases, subject to an analysis similar to that of projects that the states propose by themselves. If the authority decides to proceed with the project as proposed, it then has to proceed through the same procurement process as if it had proposed the project itself. In some cases, the proponent is entitled to either credit in the evaluation of the proposals or to a special stipend for its work.

Government stipend

Does the government party provide a stipend for unsuccessful short-listed proponents or otherwise bear a portion of their costs?

In the case of some states, the procuring authority is permitted to offer a stipend. Where this is permitted, the stipend is customarily paid to the extent that the unsuccessful proponents agree to assign their work product related to their bid to the procuring authority, which can then incorporate it into the project at hand or other projects.

Financing commitments

Does the government party require that proposals include financing commitments for the PPP transaction? If it does not, are there any mechanisms during the procurement process to ensure that the applicable PPP transaction, once awarded, is financeable?

It is customary in the United States for the procuring authority to require evidence of availability of financing as part of the proponents’ bids. Most commonly the requirement is to deliver financing commitments. However, in at least one recent case, the procuring authority has been satisfied with the delivery of highly confident letters.

Legal opinion

May the government ask its counsel to provide a legal opinion on the enforceability of the PPP agreement? May it provide representations as to the enforceability of the PPP agreement?

Typically, in the United States, the public entity does have its counsel provide a legal opinion and provide representations regarding the enforceability of the PPP agreement.

Restrictions on foreign entities

Are there restrictions on participation in PPP projects by foreign entities? May foreign entities exercise control over the project company?

Generally speaking, there are no specific restrictions regarding participation by foreign entities in PPP projects or controlling the project company. However, in the case of brownfield infrastructure projects that are deemed critical, depending on the amount of control that the private entity will exercise or whether the private entity is controlled by a foreign government, the transaction may be subject to review by the Committee on Foreign Investments in the United States, and the authority of the president of the United States to block the transaction if it is determined that it threatens to impair national security. The Exon-Florio provision (Title V, Section 5021 of the US Code, 23 August 1988), as amended, establishes a list of factors that the president must analyse in making a determination. It has been proposed to extend the authority under the Exon-Florio provision to greenfield projects. However, so far this proposal has not been adopted.

Design and construction in greenfield PPP projects

Form of contract

Does local law mandate that any particular form of contract govern design and construction activities? Does it mandate the choice of governing law?

Some PPP statutes mandate the use of specific forms of contracts. In some cases, the statutes create a specific form of PPP agreement or comprehensive agreement, and include the terms that have to be included therein. In such cases, even if the statute does not expressly say so, they create the obligation that the PPP agreement be governed by the law of the relevant state. Typically, a state is not amenable to accept a governing law other than the laws of such a state.

Design defect liability

Does local law impose liability for design defects and, if so, on what terms?

Generally, laws governing design defects in construction vary from state to state to a degree that would be well beyond the scope of this publication. However, although it is common that, in non-PPP projects, design professionals disclaim warranties of the adequacy of their services, some courts have held that, in the case of design-build contracts, unless expressly disclaimed, the design portion of the agreement is warranted in a similar fashion as the construction portion, based on the overall contract being a ‘construction contract’ and not treating each portion differently.

Warranties

Does local law require the inclusion of specific warranties? Are there implied warranties in cases where the relevant contract is silent? Does local law mandate or regulate the duration of warranties?

Although PPP statutes may imply or list as one of the terms of the PPP agreement the inclusion of warranties, generally the legislation defers on the terms of the warranties to the terms negotiated by the granting authority and the private parties. It will be particularly important for a party participating in a PPP project to confirm whether the local legislation overrides any warranty requirements generally applicable to public contracts and, if permitted, to consider including any disclaimer thereof.

Among the implied warranties that are generally found in state legislation, good workmanship may be the most common. State laws generally regulate the duration of warranties, particularly in connection with hidden defects. However, it is common that the terms of these warranties can be altered by the agreement of the parties.

Although, generally, the uniform commercial code is not applicable to construction contracts, it is important to consider whether the PPP agreement has a component that could be characterised by courts as a goods’ supply agreement. Some state courts have recharacterised certain construction agreements as dealing more precisely with the supply of goods. In such cases, implied warranties of merchantability, fitness for a particular purpose and good title could be made applicable to portions of the agreement. Therefore, the parties to a PPP agreement should consider whether they should be expressly disclaimed.

Damages for delay

Are liquidated damages for delay in construction enforceable? Are certain penalty clauses unenforceable?

Liquidated damages are generally enforceable to the extent that they are a reasonable estimation of damages that are difficult to calculate, and the intent of the clause is to compensate the non-breaching party and not to penalise the breaching party. On the other hand, clauses requiring the payment of a penalty owing to breaches are generally unenforceable.

Indirect or consequential damages

What restrictions are imposed by local law on the contractor’s ability to limit or disclaim liability for indirect or consequential damages?

Generally speaking, any disclaimer of a contractor’s liability that arises owing to its wilful misconduct or gross negligence is likely to be held unenforceable.

Non-payment

May a contractor suspend performance for non-payment?

This remedy is usually negotiated on a case-by-case basis.

Applicable clauses

Does local law restrict ‘pay if paid’ or ‘paid when paid’ clauses?

Payment terms are governed by different rules in each state. Some states deem some payment terms in construction contracts to be matters of public policy and, therefore, the terms provided for in the applicable statutes cannot be modified. In particular, some states have enacted ‘prompt payment’ statutes that would prohibit pay if paid or paid when paid terms in construction contracts, requiring contractors to review and approve invoices or pay them within a maximum period of time, regardless of whether payment from the owner has been received.

Are ‘equivalent project relief’ clauses enforceable under local law?

Equivalent project relief clauses are generally enforceable. However, to the extent that they run afoul of prompt payment statutes (eg, permitting a contractor to withhold payment to a subcontractor simply because the payment has been withheld by the owner and not on the basis of a specific breach by the subcontractor), equivalent project relief may be unenforceable.

Expansion of scope of work

May the government party decide unilaterally to expand the scope of work under the PPP agreement?

Subject to the right of the private party to request compensation for such a change, the government party typically may request changes to the scope of work under the PPP agreement. The terms of such a right to request changes are usually negotiated on a case-by-case basis.

Rebalancing agreements

Does local law entitle either party to have a PPP agreement ‘rebalanced’ or set aside if it becomes unduly burdensome owing to unforeseen events? Can this be agreed to by the parties?

This is not generally found in the United States. However, the general concept is more commonly addressed through a negotiated set of relief events forming the basis for compensation to the private party. We are not aware of a specific rebalancing requirement included in a PPP statute.

Liens laws

Are statutory lien laws applicable to construction work performed in connection with a PPP agreement?

Statutory lien laws are not necessarily overridden by PPP statutes, and therefore would be applicable to any work performed in connection with a PPP agreement. However, it must be noted that, to the extent that the asset on which work is performed is the property of the state, different rules may apply to such liens.

Other relevant provisions

Are there any other material provisions related to design and construction work that PPP agreements must address?

Different states may have different degrees of requirements related to the provision of construction bonds or other forms of performance assurance. Some PPP statutes override those requirements generally applicable to public contracts. However, in some states (or in states without a PPP statute), the generally applicable requirements may be applicable to PPP agreements, which may result in a significant financial cost.

Operation and maintenance

Performance obligations

Are private parties’ obligations during the operating period required to be defined in detail or may the PPP agreement set forth performance criteria?

There is no mandatory uniform treatment across states. In recently closed projects and projects that are currently in the procurement stage, a mixed approach of detailed obligations and performance criteria is being used.

Failure to maintain

Are liquidated damages payable, or are deductions from availability payments possible, for the private party’s failure to operate and maintain the facility as agreed?

There is generally no specific regime of liquidated damages or deductions in PPP statutes; they are determined on a case-by-case basis. As availability payment projects have become the most common model in use, it has become more common for PPP agreements to include a deduction regime.

Refurbishment of vacated facilities

Are there any legal or customary requirements that facilities be refurbished before they are handed back to the government party at the end of the term?

There is no particular legal requirement regarding the degree to which facilities must be refurbished before they are handed back to the government party. Recently closed projects and projects currently in procurement include handback requirements to varying degrees. In some cases, such handback requirements include the establishment of a reserve account, funded from payments received by the project company, starting a number of years before the end of term, which must be handed (in whole or in part) to the government in case the scheduled refurbishment of the project is not performed to the required level.

Risk allocation

Delay

How is the risk of delays in commercial or financial closing customarily allocated between the parties?

This varies from project to project. The project company typically is not excused from achieving commercial close, unless the state authority has failed to satisfy its obligations, including obtaining authorisations allocated to it. To the extent that a delay in financial close is not because of the project company (including, for example, trying to renegotiate the terms included in the financing term sheet used for the procurement of the PPP agreement, failing to obtain required approvals assumed by the project company, etc), some states have agreed to take on the risk of timely financial close by agreeing to cover differences in margin or interest rates assumed in the applicable financial model.

How is the risk of delay in obtaining the necessary permits customarily allocated between the parties?

If responsibility for the acquisition of the permit was allocated to the government party (which is typically limited to major environmental authorisations), a delay in obtaining such a permit typically entitles the private party to relief in the form of an extension of the time to perform its obligations. In some cases, the private party assumes the obligation to continue the approval process for some approvals initiated by the government party, and, in such cases, the private party then assumes the risk of timely issuance of such approvals.

Force majeure

How are force majeure and geotechnical, environmental and weather risks customarily allocated between the parties? Is force majeure treated as a general concept relating to acts outside the parties’ control or is it defined with reference to specific enumerated events?

In different jurisdictions within the United States, and at different times, PPP agreements have included a force majeure concept that is treated both as a general concept relating to acts outside the parties’ control and a list of specific enumerated events that have satisfied the typical concept of force majeure. Occurrence of a force majeure event typically entitles the private party to relief in the form of an extension of the time to perform its obligations, but not additional economic compensation. Weather conditions are usually covered by the concept of force majeure in those cases in which the private party is entitled to relief.

Discovery of geotechnical circumstances that were not shown in the reference information provided by the government party, or that could not be expected or learned after a reasonable investigation (the standard of which may vary from state to state), typically entitles the private party to relief in the form of an extension of time to perform its obligations and payment of additional compensation to cover for additional costs. A similar approach is usually followed for pre-existing environmental conditions and third-party release of hazardous substances, but the calculation of the compensation for additional costs arising from these circumstances in some cases is different.

Third party risk

How is risk for acts of third parties customarily allocated between parties to a PPP agreement?

Depending on the type of project, the government party typically assumes responsibility for some matters, such as access rights to real estate property or the performance of work by other contractors. However, PPP agreements sometimes make the private party responsible for obtaining some access rights or cooperation from third parties (including in connection with additional property (not originally contemplated for the project)). To the extent that the government party has assumed such a responsibility, any failure to provide access, lack of cooperation or failure to perform by third parties typically entitles the private party to relief, including in the form of economic compensation or extensions to the schedule.

Political, legal and macroeconomic risks

How are political, legal and macroeconomic risks customarily allocated between the parties? What protection is afforded to the private party against discriminatory change of law or regulation?

Risk of political actions (including discriminatory changes in laws and regulation) that occur because of the government of the state to which the government party to the PPP agreement belongs is assumed by the government party. The occurrence of such events typically entitles the private party to extension of time and economic compensation for additional costs. However, in the case of non-discriminatory actions by the state, the economic downside is shared between the state and the private party to varying levels.

Mitigating events

What events entitle the private party to extensions of time to perform its obligations?

See questions 33 to 37.

What events entitle the private party to additional compensation?

See questions 33 to 37.

Compensation

How is compensation calculated and paid?

The calculation of compensation is determined on a case-by-case basis by the PPP agreement, and to a large extent is dependent on the model of PPP used. In revenue risk projects, it is customary to see an allowance for increase in tolls or extensions of the term of the PPP agreement. In availability payment transactions, it is customary to find increases in the availability payment. In both cases, it is common to find an obligation to pay a lump sum by the government party, which, in some cases, is intended to restore the private party to the situation it would have been in but for the occurrence of the relief event, and in other cases, it is intended to restore the private party to the situation it projected in the financial model used for commercial close (in some cases as updated from time to time).

Insurance

Are there any legal or customary requirements for project agreements to specify a programme of insurance? Which party mandatorily or customarily bears the risk of insurance becoming unavailable on commercially reasonable terms?

Customarily, PPP agreements include a programme of insurance that each party must carry. Typically, unavailability on commercially reasonable terms entitles the party obliged to maintain the affected insurance to some form of relief, which may take different forms on a case-by-case basis.

Default and termination

Remedies

What remedies are available to the government party for breach by the private party?

Typically, PPP agreements in the United States allow the government party to collect liquidated damages or apply deductions on the payments due to the private party. To the extent of repeated or material breaches, the government party typically may terminate the PPP agreement. Additionally, the government party has the right to order the suspension of work, to enter into the site and correct any wrongful use or to step-in and perform actions that the project company fails to perform.

Termination

On what grounds may the PPP agreement be terminated?

This varies on a case-by-case basis, but some of the most common termination events that are included in PPP agreements include material or repeated breach (including violations of laws and governmental approvals), abandonment of the project, failure to achieve substantial completion by a certain longstop date, insolvency of the project company or, while its equity commitments remain outstanding, of an equity member, and changes of control.

Is there a possibility of termination for convenience?

PPP agreements in the United States typically provide for termination for convenience, subject to payment of compensation.

If the PPP agreement is terminated, is compensation available?

Customarily, compensation is available in the event of termination of the PPP agreement, including in the case of termination owing to default by the government party or the private party, convenience and extended relief events. Depending on the cause of termination, the termination payment typically includes a combination of amounts due to lenders and, as long as termination is not owing to default by the private party, a component to compensate the private party for its equity in the project. Most commonly, the calculation of the portion of the termination payment that corresponds to the private party involves a determination of the present value of the amounts that the private party was projected to receive during the remaining time of the agreement or a fair market value calculation, depending on the PPP model used for the particular project.

Financing

Government financing

Does the government provide debt financing or guarantees for PPP projects? On what terms? Which agencies are responsible?

States may have different incentive programmes that can apply to different projects. However, the most common debt financing and guarantee programmes for PPP projects are the TIFIA, RRIF, WIFIA and INFRA federal programmes described in question 5. In addition, states and their instrumentalities sometimes agree to issue private activity bonds (a type of tax-exempt bond), and on-lend the proceeds for such an issuance to the project company, to be used for the construction of the relevant PPP project.

Privity of contract

Are lenders afforded privity of contract with the government party through direct agreements or similar mechanisms? What rights will lenders typically have under these agreements?

Typically, PPP agreements in the United States provide for lender rights, naming such lenders as third-party beneficiaries. In addition, it is common for the procuring authority to enter into direct agreements with lenders. These rights typically include the right to cure defaults by the project company, or step into the stead of the project company.

Step-in rights

Is there a mechanism under which lenders may exercise step-in rights or take over the PPP project? Are lenders able to obtain a security interest in the PPP agreement itself?

Lenders regularly obtain a security interest in the PPP agreement itself, and are actually entitled to step into the stead of the project company themselves or through a party appointed by them, which must satisfy certain criteria set forth in the PPP agreement.

Cure rights

Are lenders expressly afforded cure rights beyond those available to the project company or are they permitted to cure only during the same period and under the same conditions as the project company?

This has varied from project to project, depending, in particular, on the jurisdiction procuring the project. In some cases, the cure period is in addition to the cure period of the project company, and in others, the lenders are afforded only the same period as the project company.

Refinancing

If the private party refinances the PPP project at a lower cost of funds, is there any requirement that the gains from such refinancing be shared with the government? Are there any restrictions on refinancing?

This term is not necessarily addressed by PPP statutes. However, PPP agreements that have recently achieved commercial close, or that are currently in the procurement stage, have included an obligation to share any refinancing gain, or even give it all up.

Governing law and dispute resolution

Local law governance

What key project agreements must be governed by local law?

Several jurisdictions deem construction agreement terms to be matters of public order. As such, construction contracts may be required to be governed by the law of the state where the project is located.

Government immunity

Under local law, what immunities does the government party enjoy in PPP transactions? Which of these immunities can be waived by the government?

Generally, states have adopted sovereign claim acts that allow for the state to be sued for liability subject to the satisfaction of certain procedural formalities, in some cases having to prosecute the claim before specific (in some cases, special) courts. However, the scope of immunities that states have retained varies from state to state, and may include immunity from exemplary or punitive damages.

Availability of arbitration

Is arbitration available to settle disputes under the project agreement between the government and the private party? If not, what regime applies?

Arbitration is generally available for the resolution of disputes. Some PPP statutes expressly provide that the granting authority may submit disputes to arbitration. However, many states have been reticent to accept binding arbitration, making PPP agreements subject to the jurisdiction of local courts. Some states have accepted the inclusion of non-binding arbitration clauses into their PPP agreements, where the state has the option to remove an action and have it heard by a court or reject the award and have the dispute further resolved by a competent court.

Alternative dispute resolution

Is there a requirement to enter into mediation or other preliminary dispute resolution procedures as a condition to seeking arbitration or other binding resolution?

There is no specific approach that can be deemed uniform throughout jurisdictions in the United States. This has varied from project to project, but it is common to find PPP agreements providing for the requirement of engaging in prior negotiations or mediation as a condition for submitting a dispute for binding determination by an arbitrator or court.

Special mechanisms

Is there a special mechanism to deal with technical disputes?

PPP agreements generally include mechanisms to deal with technical disputes through determination by technical experts. However, there is no particular mechanism that is uniform throughout jurisdictions.

Updates and trends

We continue to see the most US PPP activity in the transportation infrastructure sector, and there is growing interest in applying the PPP model to the social infrastructure sector. The LaGuardia Airport Central Terminal Building (CTB) project and the Maryland Purple Line light rail transit project were both long-awaited, marquee transportation infrastructure projects that achieved financial close in 2016. The University of California Merced Campus Expansion also achieved financial close in 2016, and will test the viability of the PPP model for delivering social infrastructure projects.

We have also seen a notable increase in the airport sector, notwithstanding the limitations in the Federal Aviation Administration’s (FAA) airport privatisation pilot programme that have hindered PPPs at US airports. Financial close for the Denver International Airport Great Hall project and for the Los Angeles International Airport’s Automated People Mover PPP project was achieved in 2017 and 2018, respectively, Indianapolis International Airport tendered a storm and waste water treatment PPP in 2016, and the Illinois Department of Transportation is currently evaluating a PPP structure to develop, finance, operate and maintain a new South Suburban Airport. In addition to the LaGuardia CTB project, the Port Authority of New York and New Jersey is pursuing the redevelopment of Terminal A at Newark Airport through a modified PPP structure, which will involve multiple separate contracts for different aspects of the project, and the redevelopment of Terminals C and D at LaGuardia Airport, largely from private-sector investment.

In terms of procurement structure, one trend we are seeing is the ‘beauty contest’ procurement. In these procurements, the shortlisted bidders are asked to submit indicative proposals for a conceptual project, instead of a substantively complete concession, and the procuring authority will pick the team that it wants to directly negotiate the detailed terms and provisions of the project. Essentially, the preferred proponent wins a pre-development agreement and the right to negotiate the project with the procuring authority. Both the Indianapolis International Airport waste water project and the Denver Airport Great Hall project were procured on this basis, and it is expected that the newly announced South Suburban Airport in Illinois will also be procured this way.

Broadband network PPP projects is a new category that has attracted particular interest in the past few years. Starting with Kentucky’s KentuckyWired project, which achieved commercial close in 2015 and was the result of an unsolicited bid, several broadband projects have come to market in the past three years. Currently, there are more than half-a-dozen projects in procurement process or about to start their procurement process, including proposed projects by the Pennsylvania Turnpike, Riverside County and City of San Francisco in California, the Georgia Department of Transportation and Oakland County, Michigan. Each of these projects seeks to implement the PPP model to either use and improve existing assets or build completely new networks that will serve the needs of the procurement authority (in some cases allowing incremental capacity to be used and marketed by the concession company) or create public access networks. The diversity in the scope of works and services to be provided, assets being allocated and goals pursued make it interesting to follow and see if and in which cases the PPP model will prove adequate for this type of infrastructure.

The current Trump administration has put forward a plan to invest up to $200 billion dollars in federal funds in infrastructure with the goal of stimulating at least $1.3 trillion dollars in new investment by states, local government and private investors over the next 10 years. A number of practical questions have been raised about the plan, and in any event, it is considered unlikely that Congress will implement it. Therefore, it is unclear whether existing incentives will continue in the longer term and what if any new incentives will be put in place. In the current market, TIFIA funding remains vitally important and, historically, the TIFIA Joint Programme Office (JPO) (the office at the US Department of Transport that administered the programme) worked hard to ensure a level playing field among all bidders for any project eligible for TIFIA financing. It is worth noting that the administration of the TIFIA loan programme has now been consolidated under the new Build America Bureau with other loan and grant programmes, namely the RRIF loan programme, Private Activity Bonds (PABs) and INFRA grant programme under a single agency. The hope is that by consolidating these programmes in a single office, federal resources will be deployed more effectively.

Debevoise & Plimpton LLP

by Armando Rivera Jacobo and Ivan E Mattei

USA March 26 2019