Kate Smith, a reporter at Bloomberg Brief, talks with Joe Mysak about this week’s municipal market news.

May 14, 2015

Kate Smith, a reporter at Bloomberg Brief, talks with Joe Mysak about this week’s municipal market news.

May 14, 2015

CHICAGO — Chicago began an uphill battle in court on Wednesday to keep its cost-saving pension reform law from meeting the same fate as an Illinois law that was declared unconstitutional last week by the state supreme court.

The city is trying to salvage a 2014 law aimed at stopping two of its four retirement systems from running out of money. It is also dealing with the aftermath of Tuesday’s credit rating downgrade to “junk” by Moody’s Investors Service.

Cook County Circuit Court Judge Rita Novak set a July 9 hearing on motions by lawyers for city unions and retirees to toss out the 2014 law based on the high court’s sweeping ruling that found the state constitution gives public sector workers iron-clad protection against their pension benefits from being cut.

Michael Freeborn, an attorney who filed one of the two lawsuits challenging the law, said a ruling by Novak could come soon after the July hearing, adding that Friday’s supreme court ruling leaves “little if any wiggle room” to keep Chicago’s law alive.

At a Wednesday status hearing on the lawsuits, Novak acknowledged that no matter how she rules, her decision will be appealed to the Illinois Supreme Court.

Chicago’s top staff attorney, Stephen Patton, urged the judge to hear the case quickly, saying a prolonged process would be “extremely harmful to the city.”

“We need certainty no later than the end of this year,” Patton said.

Chicago contends its law, which boosted pension contributions by the city and its workers to the municipal and laborers’ retirement funds and reduced benefits, differs from the now-voided 2013 law aimed at easing Illinois’ $105 billion unfunded pension liability for state workers and educators. Illinois argued its so-called police powers to fund essential services allowed it to cut retirement benefits, but the supreme court disagreed.

“(Chicago’s law) doesn’t diminish and impair pensions, it saves pensions,” Patton told the judge. “That argument has not been addressed.”

Without additional funding and reforms, Chicago’s municipal and laborers’ retirement systems are projected to run out of money in 2026 and 2029. Meanwhile, the city must increase payments to its police and fire funds by $550 million next year.

Moody’s downgrade triggered $2.2 billion in accelerated debt payments and fees related to Chicago’s debt that banks could force the city to make.

Richard Prendergast, an attorney representing Chicago, said the city was engaged in “time-sensitive” negotiations with banks over those payments.

By REUTERS

MAY 13, 2015, 2:14 P.M. E.D.T.

(Editing by Matthew Lewis)

SAN BERNARDINO, Calif. — The Southern California city of San Bernardino wants to repay its pension bondholders just a penny on the dollar while paying the state pension fund Calpers in full under its long-awaited bankruptcy exit plan released on Thursday.

Under the bankruptcy plan, called a plan of adjustment, San Bernardino also intends to virtually eliminate retiree health insurance costs, and outsource its fire, emergency response and trash services.

Gary Saenz, San Bernardino’s city attorney, said of the offer to the pension bondholders: “It’s obviously a tiny offer. From a fairness point of view, it looks like an insulting offer. But it is not an insult. Given the city’s circumstances, it is all the city can afford.”

San Bernardino’s bankruptcy blueprint follows the approach taken in the recent bankruptcies of Detroit, Michigan and Stockton, California, where bondholder debt and retiree healthcare costs were slashed or eliminated, while pensions emerged relatively unscathed.

In Detroit, general obligation bondholders received between a 22 percent and 66 percent cut to their debt.

The move could likely make capital market lenders more wary about loaning money to struggling cities, and could increase borrowing costs for cities already in debt.

“The city needs a workforce. And you can’t have a workforce without pensions,” Saenz told Reuters in January.

That issue was the driving force underpinning the bankruptcy plan, another city official said on the condition of anonymity, noting the city has a daily relationship with its workers that it needs to maintain for survival as a municipality, while its Wall Street lenders are wealthy absentee creditors.

San Bernardino proposes paying the Luxembourg-based bank EEPK, holder of $50 million in pension obligation bonds and the city’s second largest creditor, a fraction of its original debt, according to the plan, posted on the city’s website.

EEPK, along with Ambac Assurance Corp, which insures a portion of the pension bonds, and Wells Fargo, the bond trustee, have the $50 million principal amount of their debt slashed to just $500,000, or a penny on the dollar, under the bankruptcy plan.

Vincent Marriott, a legal representative for EEPK, said the bank would have no comment until it had fully read and considered the plan.

Under San Bernardino’s plan, the city also asks that any creditor, including its pension bondholders, who object to its terms be forced to a judicial “cramdown”, where the judge overseeing the case orders that the city’s debt cutting wishes be met.

Final approval of a bankruptcy plan, which must be ratified by U.S Federal Bankruptcy Judge Meredith Jury, is likely to take months. Negotiations with city firefighters, who are suing San Bernardino over contract issues, have broken down. The police union still has not signed off on parts of the bankruptcy deal affecting its members. Bondholders are likely to vigorously fight the virtual elimination of their debt under the plan.

In March, San Bernardino revealed terms of a deal with the California Public Employees’ Retirement System (Calpers), its largest creditor.

Calpers, which administers San Bernardino’s pensions, is America’s largest public pension fund, with assets of $300 billion. It is the administrator of pensions for more than 3,000 California state and local agencies, and has long argued that pensions cannot be touched or renegotiated, even in a bankruptcy.

The judges overseeing the bankruptcies of Detroit and Stockton both stated that pension rights are not inviolate in a bankruptcy. But city leaders in Stockton, and now San Bernardino, have chosen not to take on Calpers, despite the fact that the pension giant is hiking city contribution rates by up to 50 percent over the next 10 years.

Under San Bernardino’s bankruptcy exit plan, the city under covenant pledges to pay Calpers all arrears and to continue paying Calpers in full in the future.

San Bernardino, a city of 205,000 that is 65 miles east of Los Angeles, declared bankruptcy in August 2012 with a $45 million deficit. Along with Detroit and Stockton, its bankruptcy is one of a handful that have been closely watched by the $3.6 trillion U.S. municipal bond market.

By REUTERS

MAY 14, 2015, 7:41 P.M. E.D.T.

(Editing by Bernard Orr)

When is a triple-B bond safer than a triple-A? The answer, based on historical default rates, is when the triple-B is a municipal bond and the other is a corporate security.

The ratings divergence isn’t only a consideration for investors trying to choose between munis and corporates. On June 15 a Dodd-Frank Act rule goes into effect that requires rating agencies to adopt procedures designed so credit ratings weigh default risk “in a manner that is consistent” for all rated obligors and securities.

The approaching deadline “creates an imperative to get everything lined up,” said Mark Adelson, a former chief credit officer at Standard & Poor’s.

S&P and Moody’s spokesmen said they were taking the rule seriously.

“We’ve been making preparations for this for years,” a Moody’s spokesman said. “Most of the preparations are pretty much done. We’ve already made most of the changes.”

In the long run, the new rule “will only help the municipal upgrade trend,” said Municipal Market Analytics managing director Matt Fabian. “Historically municipal ratings have been too low and have exaggerated the risk of default.”

An attorney with experience in SEC regulatory compliance, speaking anonymously, said he was skeptical the current ratings for munis and corporates would be acceptable to the SEC.

“There is no way that is a uniform scale, and all it really takes to get the ball rolling is a complaint to the SEC that points out that disparity in default statistics,” he said.

As for the investor implications, since BBB munis offer higher yields than AAA corporates as well as a tax exemption that the corporates lack, some may ask: why should anyone or any entity own corporates?

Default Rates and Yields

Studies published by Moody’s Investors Service and Standard & Poor’s show that the default rates of munis 10 years after being rated BBB are lower than the default rates of corporates 10 years after being rated AAA.

According to a Moody’s report “US Municipal Bond Defaults and Recoveries, 1970-2013,” the 10-year cumulative default rate for munis rated Baa1, Baa2 or Baa3 was 0.32%. According to the same study, the rate for Aaa corporates was 0.49%.

S&P Wednesday released its latest default report. The study by analyst Lawrence Witte found that in the 10 years after municipal bonds were rated BBB-plus, BBB, or BBB-minus, 0.42% defaulted. A March 2014 study by S&P managing director Diane Vazza and several others found that in the 10 years after corporate bonds were rated AAA, 0.87% defaulted.

If that history provides guidance, then Chicago (Baa2) is a safer investment over the long-term than Microsoft (Aaa). Moody’s dropped the city’s general obligation rating in February, citing the city’s high levels of debt and pension obligations and expected growth in unfunded pension liabilities. S&P rates Chicago A-plus.

Even with lower default rates, investors in the munis are getting higher yields. On April 27, according to S&P Global Fixed Income, the average yield for a triple-A corporate bond with a 10 year maturity was 2.69%.

By comparison, according to Municipal Market Data on that date the average yield for a BBB general obligation municipal bond with a 10-year maturity was 2.94% and for a BBB taxable municipal bond with this maturity it was 4.13%. The BBB-rated muni yields are the average for BBB-plus, BBB, BBB-minus, Baa1, Baa2, and Baa3 bonds.

The interest of the GO would be tax-free while the interest from the corporate would be taxable.

After federal taxes, for those in the highest federal tax bracket, a corporate 10-year AAA bond bought on April 27 would have yielded 1.51% and the taxable muni would have yielded 2.31%. For those in a more moderate federal 25% tax bracket, these same bonds would have yielded 2.02% and 3.10% after federal taxes, respectively. These after-tax yields take into account federal taxes but not state or local taxes, which would normally lower the effective yield further.

Triple-B category GO muni bonds have consistently had more yield than AAA corporates. One year ago the spread was 31 basis points, five years ago 43 basis points, and 10 years ago nine basis points. None of these spreads take into account the impact taxes have in lowering corporate bonds’ effective yields.

At any given point on the rating scale, munis have far less history of default than do corporates. In the 10 years after being rated Aaa 0.00% of the munis defaulted, while 0.49% of corporates defaulted, according to Moody’s. Ten years after being rated Baa1, Baa2, or Baa3, 0.32% of munis defaulted, while 4.61% of corporates defaulted. Finally, in the 10 years after being rated Ba1, Ba2, or Ba3, 3.53% of munis defaulted, but 19.27% of corporates defaulted.

The Differences’ Origin and Significance

Given munis’ apparent superiority over corporates in terms of both yield and safety, The Bond Buyer asked several investment firms about the wisdom of holding corporates instead of munis. Citi, JPMorgan, Franklin Templeton, OppenheimerFunds, and Bank of America Merrill Lynch declined to answer.

MMA’s Fabian said munis were frequently less liquid and less transparent than corporates. As for the liquidity issue, many munis “lack price discovery or ready markets,” he said. Corporate bonds “often have a homogenous security pledge while municipal deals are essentially bespoke financings requiring that investors fully read the documents to know what they own.”

“Lenders will look past these problems with municipals only because the default rates are so low,” Fabian said.

At Charles Schwab, managing director Rob Williams and director Collin Martin wrote in an email that the default studies looked backward not forward. The migration of ratings upward by Moody’s and S&P in the munis space in recent years may make their default rates more closely compare to corporates in the future. “Still, we expect that the default rate, on average, for investment-grade munis should remain lower than the default rate on investment-grade corporates,” they wrote.

The Schwab officials also said there are fewer high-yield munis to choose from, compared with the selection of corporates. For investors who want to buy higher-yield bonds, corporates offer a wider choice, they said.

Corporate bonds can also be a wise choice for investors who plan to put them into tax-deferred accounts, like 401(k)s, they said.

“While default and recovery statistics appear better for municipal than like-rated corporate debt, that is based on historical information,” said Howard Cure, director of municipal research at Evercore Wealth Management. “We are in a new era where we can see more municipal defaults going forward.”

Alexandra Lebenthal, chief executive officer of Lebenthal Holdings, said she assumed that most corporate bonds are held in tax-deferred accounts, and people generally want to spread their eggs around.

The default rates and returns “show why munis make more sense,” she said.

The U.S. Securities and Exchange Commission provision requiring comparability of ratings within an agency is paragraph (b)(3) of Rule 17g-8 on Nationally Recognized Statistical Rating Organizations.

In the final rule the SEC noted that the divergence between ratings’ default rates at ratings agencies are not just between safer munis and riskier corporates. According to one study up to 2005, the five-year default rates of collateralized debt obligations at the lowest investment grade ratings from one ratings agency was about 10 times higher than the five-year default rates for corporate bonds, the SEC said.

The 2010 Dodd-Frank Act requires the SEC to examine each nationally recognized statistical rating organization once a year and issue an annual report summarizing the examination findings. The annual report to Congress is required by the Credit Rating Agency Reform Act of 2006.

In a December 2014 story on the SEC’s increased demands on the ratings agencies, Moody’s said in a statement to The Bond Buyer, “Moody’s continues to enhance our policies and procedures in light of regulatory developments, and the SEC staff’s findings and recommendations are helpful in that effort.”

Ratings Agencies Respond

How the new rule affects ratings agencies’ ratings remains to be seen.

In recent years both Moody’s and S&P have engaged in recalibrations or applied new criteria to U.S. public finance, leading to broadly higher ratings for munis.

On average the changes were subtle. For example, in 2013 and 2014 S&P introduced a new local government rating criteria. This led to an approximately average 0.4 notch increase in the local government credits. Local government credits are 28% of all credits that S&P’s U.S. Public Finance Group handles. So the changes to the local government rating criteria led to an average increase in ratings of about 0.1 notch across all the credits.

In 2010 Moody’s did a recalibration of some of its municipal issuer ratings to address the category’s comparative lack of risk at different rating levels. In categories closest to government, like general obligation and public water and sewer utility bonds, it raised ratings about one notch in the Aa category, two in the A category, and about three in the Baa category. Speculative grade ratings were left unchanged. For non-utility enterprise, public university, mass transit and a few other categories, S&P raised the ratings by one notch around the Aa and A categories. It left ratings unchanged for several other categories like nonprofits and public electric power utility bonds.

Neither S&P nor Moody’s provided details on the overall average shift in their ratings due to these broad-based rating shifts.

One reason the ratings agencies maintain different levels of credit risks for given ratings between munis and corporates is that, “if you call [all municipal bonds] AAA then one is not creating a lot of value,” for the user of municipal ratings, said Adelson, the former S&P chief credit officer, who now is chief strategy officer at BondFactor.

In response to queries from The Bond Buyer about the divergent default histories at a given rating between munis and corporates, S&P and Moody’s gave similar answers.

“Comparability of ratings across asset classes and geographies is one of Standard & Poor’s main goals and one of the benefits of our global ratings scale,” S&P said in an email. “To accomplish this goal, we’ve adjusted all of our ratings to a common set of stress scenarios and definitions, which are embedded in all of our criteria.

“Our criteria are subject to regular periodic review across sectors to provide additional transparency and comparability. These improvements are intended to help market participants understand our approach to assigning ratings, enhance the forward-looking nature of these ratings, and enable better comparisons across ratings.”

Moody’s vice president Al Medioli said, “This is why Moody’s underwent its recalibration back in 2010, which put all our ratings on a single, universal scale.” He added, “Muni default rates are rising although still very low, and recovery rates are now similar to corporates in recent bankruptcies.”

Both S&P and Moody’s have known that default risks of their ratings diverge between corporates and munis since at least the early 1990s, Adelson said. They have shifted their responses back and forth over time but have never gone beyond making small adjustments to the ratings, he said.

THE BOND BUYER

BY ROBERT SLAVIN

MAY 6, 2015

Kyle Glazier contributed to this article.

Seven years after their ranks were decimated by the housing crisis, bond insurers are back in the spotlight as Puerto Rico struggles to stave off default.

Companies including Assured Guaranty Ltd., MBIA Inc. and others insure more than $14 billion out of the $72 billion in debt outstanding by the commonwealth’s government, utilities and other agencies, according to financial documents from the insurers.

But investors and analysts say the lack of detailed disclosure has made it hard to assess the insurers’ capacity to pay potential Puerto Rico claims should the territory default. While companies disclose principal and interest owed across their entire portfolios, sizable interest costs aren’t disclosed for individual bonds in some cases–including certain Puerto Rico debt.

Insurance-company financial statements are “more complex than looking at your average government,” said Bill Bonawitz, director of municipal research at PNC Capital Advisors, which oversees $6.5 billion in municipal debt. “There’s a lot more moving parts.”

Puerto Rico has been burdened for years with a sluggish economy and a high debt load, and warned in a report this month that it “may lack sufficient resources” to fund government programs and pay its debt in the upcoming fiscal year. Puerto Rico has been negotiating with creditors, but it is unclear whether the talks will allow the island to avoid what could rank as one of the largest municipal defaults ever.

Puerto Rico bonds are widely held by U.S. mutual funds and individual investors, in part because of generous tax advantages. If an issuer such as Puerto Rico defaults, insurers agree to make the scheduled principal and interest payments.

The island’s financial problems represent a major test for a bond-insurance industry that is still recovering from the financial crisis. Insurers lost billions of dollars during the crisis on the default of mortgage-backed securities and some have stopped writing new policies.

Investors have penalized surviving bond insurers in part for the difficulty of analyzing their books. Shares of Assured Guaranty and MBIA trade below their adjusted book value, a measure of net worth. Assured Guaranty stock closed Friday at $27.07, a 50% discount to adjusted book value, according to brokerage firm BTIG. MBIA closed at $8.74, a 65% discount.

“The stock prices of the bond insurers are where they are in part because of the complexity discount,” said Mark Palmer, an equity analyst at BTIG.

Assured’s stock is up 4.2% on the year and MBIA is down 8.4%, compared with a 2.8% advance on the S&P 500. Both companies’ shares, however, are trading higher than they were during the depths of the downturn. From 2007 to 2009, MBIA’s stock fell 94% to $4.50, while Assured Guaranty’s fell by 58% to $11.29.

Some insurers are planning to improve their disclosures, making it easier for investors to assess their claims-paying abilities. National Public Finance Guarantee Corp., a unit of MBIA, said it plans on Monday to update its website to include both principal and interest exposure for individual bond issues. Currently, only the principal amount is listed.

The distinction is important because bond insurers are on the hook for both principal and interest payments if an issuer defaults.

Assured Guaranty doesn’t provide a full list of individual bonds it insures across its various subsidiaries. But a spokesman said it provides principal and interest exposure on specific issuers “where we feel that may be useful to the market.” A breakdown of its principal and interest exposure to Puerto Rico entities is available on its website.

For a report in January, research firm CreditSights had to estimate certain figures regarding the insurers’ principal and interest exposure to Puerto Rico.

The firm concluded that Assured Guaranty and MBIA are strong enough to withstand defaults from Puerto Rico public agencies that were subject to a restructuring law passed last year. The law has been struck down by a federal court, but is on appeal.

Rob Haines, senior insurance analyst at CreditSights, said it would be “very helpful” if insurers offered more information on both their principal and interest exposure.

“I don’t see why the companies can’t disclose this themselves,” Mr. Haines said. “It won’t violate any kind of conflict of interest they have or any kind of confidentiality that they have.”

Of particular concern to some investors are so-called zero-coupon or capital-appreciation bonds, which pay no interest until they mature and can cost municipalities more in interest than regular bonds. Puerto Rico has sold billions of dollars of these bonds, including $2.6 billion tied to sales tax revenue in 2007.

Ambac Financial Group Inc., another large insurer, backs $808 million of that. When interest is factored in, Ambac is actually responsible for roughly $7.3 billion. The numbers were disclosed in a special report regarding Ambac’s Puerto Rico exposure. In a separate spreadsheet, Ambac lists the principal amount for every bond issue it insures, but it doesn’t provide the interest.

“A more accurate disclosure would be to provide full principal and interest,” Mr. Bonawitz said. “The issue is more acute when you have a zero, because the difference between the principal and interest is so much greater.”

A recent report by Kroll Bond Rating Agency showed insurance policies can still be beneficial, saying bond insurers paid claims in full and on time in 26 of 29 insured municipal-bond defaults between 2008 and the present.

Bond insurance “has some value,” said Doug Benton, an analyst at Cavanal Hill Investment Management, which oversees roughly $6 billion in assets. “But anybody that’s lived through ’07 through ’09, you’ve got to discount it.”

THE WALL STREET JOURNAL

By MIKE CHERNEY

MAY 10, 2015

The Florida Supreme Court is debating a 2010 clean energy measure allowing homeowners to fund improvements through special assessments. Challengers are attacking the process itself and the agency that administers it.

In 2010 the state Legislature passed the PACE act. The measure allows local governments to set up a program funding home improvements for clean energy or storm preparedness through the Florida Development Finance Corporation, or FDFC. But rather than extending money for the improvements in the form of a loan—which would follow the borrower, this program is funded through the special assessment process. FDFC attorney Raoul Cantero explains.

“This allows a homeowner—let’s use an example, to spend $20,000 on solar panels, and later, three years later, if the homeowner sells the house they’re not responsible for that $20,000. It stays with the house, so homeowners are more comfortable making these kinds of improvements,” Cantero says.

The idea is that homes that can better withstand a storm or place a lighter burden on the power grid provide benefits to the entire community. So to encourage homeowners to make those improvements, liability is tied to the property, and repayment is made through an increase tacked on to the homeowner’s property tax.

Justice Fred Lewis says the system could provide an important tool for improving blighted areas.

“You know I could look at this, and I could say Detroit and some of the blighted cities, this could be a way that they could come right back,” Lewis says

But he’s also skeptical of employing special assessments, which are primarily used for public improvements, to fund projects for private homes.

“You know just because somebody puts a name on something, you know as well as I do you can call it anything,” Lewis says. “I have never seen a case where it is benefits to an individual home that are being made like a home improvement loans, and it is qualified as a special assessment.”

Those assessments have the Florida Bankers Association upset. While the program looks an awful lot like a loan, it’s treated differently in the event of a foreclosure, with repayment of the tax assessment taking priority over the mortgage. Association attorney Ceci Berman says this violates the state constitution.

“And we know that under Florida law that it is an immediate contract impairment when you supersede a lien position,” Berman says, “I meant that’s been in the law for many years.”

The FDFC came up again in the next case Justices heard Thursday; this time the complaint focused on bonding. The money homeowners use for their improvements has to come from somewhere, and Florida’s program raises funds by selling municipal bonds. But attorney James Dinkins, argues only local governments can issue bonds—not the state-backed FDFC.

“The reason that these bonds are not valid is not because of any infirmity in section 163.08,” Dinkins says, “but instead because Florida Development Finance Corporation is simply not a local government that’s authorized to impose these assessments, to enter into financing agreements as is specified in that statute.”

“They didn’t follow the statute,” Dinkins concludes, “therefore the bonds are not valid.”

But the lawyer for the finance corporation says it simply administers the program on the municipality’s behalf.

WFSU

By NICK EVANS • MAY 7, 2015

Investors wondering about the U.S. government’s role in the Puerto Rican debt crisis are hearing echoes of Detroit.

In 2013, lawmakers opposed a federal bailout of the auto-producing hub, and the Obama administration didn’t step in to prevent the largest municipal bankruptcy in U.S. history, in July of that year. The Treasury has a similar no-rescue approach with the Caribbean island beset by unsustainable debt.

What Treasury officials are offering Puerto Rico is advice on how to help ease its fiscal burdens and ensure the U.S. territory receives all federal funding it’s eligible for — about $6 billion a year. More extensive aid such as loan guarantees requiring Congressional approval is unpopular with lawmakers, and it’s unlikely the federal government will aid Puerto Rico after refusing to help Detroit, investors said.

“I can’t see any way that they would do that when they didn’t do it for Detroit,” said Brandon Barford, partner at Beacon Policy Advisors LLC in Washington and a former Senate Banking Committee staffer. “Treasury could ask, but it would only exacerbate market disruptions if prices spiked and then fell even further after an inevitable congressional defeat.”

Instead, the Obama administration is making a special effort to support the $100 billion Puerto Rican economy by helping the commonwealth and its residents take full advantage of aid that’s available to it through programs such as Social Security and Medicaid, and funds for nutrition, education and agriculture.

Infrastructure Funds

Another channel is financing for infrastructure expenditures with federal money that allows the Puerto Rican government to use its own funds elsewhere, said Daniel Hanson, an analyst at Height Securities LLC, a Washington-based broker-dealer.

Puerto Rico and its agencies owe $73 billion. The U.S. municipal debt market, which includes securities of states, cities and counties, is worth $3.6 trillion. While debt sold by the commonwealth and its agencies has lost 2.3 percent this year through Tuesday, the broader municipal market has gained about 0.3 percent.

Even though the law allows the Fed to buy municipal bonds in durations of up to six months, “it would be extraordinarily unlikely that the Fed would take such action on any muni debt, much less that of Puerto Rico,” Hanson said in an e-mail Tuesday.

‘Political Fallout’

“The Fed would need to be comfortable establishing such a precedent” and “be able to stomach the political fallout,” he said.

While Puerto Rico’s debt is tax-exempt and was once popular among traditional buyers of municipal bonds such as mutual funds, its financial troubles are pushing more of the securities into the hands of alternative asset managers and distressed buyers speculating on price swings.

As a result of the shift, the Fed no longer sees a Puerto Rico default as a threat to the broader U.S. financial system, Barford said.

A Fed spokesman declined to comment.

The Government Development Bank of Puerto Rico, which acts as the island’s fiscal agent, financial adviser on bond sales and handles the same debt-management functions local treasury officials perform in the U.S. states, is not federally regulated and doesn’t have access to Fed’s discount window, a lending facility aimed at boosting liquidity, according to Hanson.

Weiss Visits

As the crisis dragged on, Treasury officials have traveled to the territory since at least 2013 to discuss its finances. Antonio Weiss, counselor to the Treasury secretary, and Kent Hiteshew, who runs the office of state and local finance, met with officials in San Juan earlier this year.

Secretary Jacob J. Lew spoke by phone with Puerto Rico Governor Alejandro Garcia Padilla, Senate President Eduardo Bhatia and House of Representatives President Jaime Perello Borras on April 28. Lew urged the officials to develop a “credible” budget and implement a long-term fiscal plan.

Treasury spokesman Daniel Watson reiterated on Monday that “federal policy experts are sharing their expertise with the Puerto Rican officials that are leading the Commonwealth’s economic policies, but these efforts should not be interpreted as any kind of federal intervention.”

Options such as the federal government possibly guaranteeing a Puerto Rico financing haven’t been offered by the U.S. Treasury or the Federal Reserve, Senator Jose Nadal Power, said in an interview May 5 in San Juan.

‘Helpful’ Advice

“So far they haven’t been open to that,” said Nadal Power, who chairs the Senate Finance Committee in the Puerto Rican legislature. “They’ve been very helpful in terms of advice. And they’ve been very aware of what is going on on the island.”

The U.S. Treasury’s efforts may include crisis planning and facilitating talks with investors, Barford said.

Another option would be to help Puerto Rico’s electric authority by seeking legislation that would allow it to bypass some federal regulations, said Richard Larkin, senior vice president and director of credit analysis in Boca Raton, Florida, with Herbert J. Sims & Co.

Matt Fabian, a partner at Concord, Massachusetts-based Municipal Market Analytics, said the only situation in which the administration would be willing to provide aid to Puerto Rico would be to help keep order if a default leads to social unrest.

Cash Crunch

Puerto Rico, which has struggled to grow since 2006, faces a cash crunch and has been unable to pass a tax overhaul that would have paved the way for a $2.9 billion debt sale.

Standard & Poor’s, which downgraded Puerto Rico to CCC+ in April, doesn’t expect any extraordinary federal assistance.

“Our general-obligation rating on the commonwealth does not assume any federal intervention to either improve the island’s economy or to provide extraordinary financial assistance,” S&P analyst David Hitchcock said in an e-mail Monday. “To the extent there was extraordinary federal assistance, it would be a positive rating development, but one that we do not expect.”

After the financial crisis of 2008, Congress took some tools away from Treasury. For instance, the Exchange Stabilization Fund, which had been used to help Mexico during the 1990s, can no longer be tapped for emergency purposes, Barford said.

“Beyond asking for Congress to appropriate money or the Fed purchasing bonds — highly unlikely due to politics — there are no other pots of money that could be used for direct and unrestricted fiscal relief,” he said.

Bankruptcy Bill

Even a bill that would allow Puerto Rico to file for Chapter 9 bankruptcy protection is unlikely to pass, according to analysts including Robert Donahue at Municipal Market Analytics in Concord, Massachusetts.

Intervening to rescue the island’s finances could actually spook markets, signaling that problems are larger than investors now believe, Hanson said.

“If Treasury were to take such extraordinary steps, the types of steps that are supposed to be reserved for a Lehman-style crisis, to bail out Puerto Rico, that would send the wrong message,” he said, referring to the $613 billion collapse of investment bank Lehman Brothers Holdings Inc. in 2008.

Bloomberg

by Kasia Klimasinska

May 6, 2015

1. Standard & Poor’s Ratings Services is requesting comments on proposed changes to its methodology for assigning stand-alone credit profiles (SACPs), issuer credit ratings (ICRs), and issue credit ratings to not-for-profit public and private colleges and universities globally.

2. The request for comment (RFC) proposes changes that are intended to provide additional transparency to help market participants better understand our approach in assigning ratings to not-for-profit public and private colleges and universities globally, to enhance the forward-looking nature of these ratings, and to enable better comparison between these ratings and ratings in other sectors and asset classes.

3. If adopted, these criteria will supersede “Approaches To Rating U.K. Universities Amid Growing Credit Diversity,” published March 28, 2003. These criteria would also partially supersede the “Higher Education” criteria, published June 19, 2007. Specifically, the sections “Private College and University Credit Ratings”, “Management and Governance”, “Debt”, and “Rating Public Colleges and Universities” would be superseded by these criteria. This methodology is related to our criteria article: “Principles Of Credit Ratings”, published on Feb. 16, 2011.

08-Apr-2015

Standard & Poor’s Ratings Services’ U.S. Public Finance Housing Enterprise Group assigned and released its ‘AA’ issuer credit rating (ICR) on Clearinghouse CDFI, Calif. on April 2, 2015. Subsequently, on April 28, 2014, Standard & Poor’s assigned and released its ‘AA-‘ ICR on Housing Trust Silicon Valley (HTSV), Calif. For both ratings, despite comprising a very minimal sample, Standard & Poor’s found some common trends within the community development finance institution (CDFI) industry involving strategy and management (impact) and financial performance. In particular, we found CDFIs have minimal loss exposure that can typically be absorbed through reserves and unrestricted equity. Moreover, the debt profiles of those assessed, and the first two CDFI entities we rated publicly, have low-risk debt, with little long-term liabilities. In addition, we found the history of loan performance for publicly rated CDFIs has historically been positive, with very few delinquencies. We believe the ratings for Clearinghouse and HTSV are solid and present a level of stability in line with the ‘AA’ rating category.

Standard & Poor’s began analyzing the industry using its housing finance agency (HFA) criteria to assess various CDFIs nationwide, where public financial statements were made available via their respective public websites. We concluded with a small sample of five distinct CDFIs using three to five years of financial statements to assess common trends. We subsequently found each CDFI to be a unique entity, despite having similar core social missions. Each has their own distinct lending activity, ranging from housing finance (first-time homebuyers and affordable multifamily housing) and commercial/small business lending to charter school lending. We determined that our state “Housing Finance Agencies” criteria (published June 14, 2007) was most applicable to form an appropriate credit opinion for each CDFI, factoring core missions, portfolio, credit risk, and management. We also used “Criteria: Principles of Credit Ratings” (published Feb. 16, 2011) to apply U.S. Public Finance ICR criteria for this analysis. As a result, we view CDFIs as similar to HFAs, albeit with a broader range of lending activity for community development, rather than mortgage loan programs, posing the greatest risk.

In our initial financial analysis using the above-mentioned criteria, we found from our publicly rated CDFIs and the small sample assessed that the CDFIs’ liquidity ratios tend to be similar to those of state HFAs — and, in some scenarios, with equity ratios in line with or above our rating categories for social lending issuers. In our view, funding sources and equity levels go hand-in-hand. For example, CDFIs with more reliance on federal grants may have more annual revenue volatility. In some instances, however, prudent risk management allows for a gradual increase in equity, leading to very stable financial performance. While some CDFIs’ equity may be lower than those of publicly rated social lending institutions, their total equity-to-total debt tends to be either extremely high (representing little debt, with adequate equity), or very steady, coupled with stable financial performance. Despite the size of the CDFIs’ balance sheets and overall loan portfolios, their assets and liabilities tend to be adequate or have appropriate ratios.

07-May-2015

Municipal Market Analytics | May 5

States and localities are afraid to take on new debt these days, missing a golden opportunity to invest in infrastructure and other long-term projects.

As states and localities have adjusted to a slow-growth economy, one of the main casualties of the shift has been investments in infrastructure and other long-term programs. In other words, governments aren’t taking on new debt these days. It’s a surprising development since interest rates are at historic lows, making it cheaper than ever to borrow.

State debt has slowed so much that Iowa State Treasurer Michael Fitzgerald is urging cities, counties and the state to borrow more. “Our infrastructure continually needs to be improved, whether it’s schools, roads, even prisons,” Fitzgerald told the Des Moines Register earlier this year. “With interest rates as close to zero as you’re ever going to find them, we could be missing an opportunity.”

Still, by all indications, the debt shrinkage will continue in 2015 as governments focus much of their bonding efforts on refinancing rather than issuing new debt. “We’ve seen a political anti-debt sentiment build up in parts of the country,” said Emily Raimes, a state government analyst with Moody’s Investors Service. “It’s partly due to the federal debt ceiling that’s made people very aware of the issues around having a lot of debt and partly due to the mood around pensions and issues of funding being a real long-term burden.”

So has debt become a four-letter word for states and localities?

While there are many kinds of healthy debt, there’s also no such thing — despite Fitzgerald’s pleadings — as too little debt from a credit perspective, said Raimes. “To the extent states pay for projects with cash on hand and not with long-term debt,” she said, “we do not see that as any kind of credit negative.”

Different kinds of long-term debt can mean different things for a government’s health and outlook. Most of this debt is viewed as reasonable in the sense that it is typically issued for a public institution or a project that will continue to be a benefit to the community over the lifetime of the debt. And, of course, there are nuances. For example, Moody’s last month downgraded Bristol, Va., largely because the agency saw the city as over-leveraged in risky debt.

But there is one kind of debt that many agree is the equivalent to sending out a distress flare: long-term debt to cover budget shortfalls, also called deficit financing. Governments that take on this type of debt are usually doing so under extreme duress. It’s not unusual for governments to issue short-term debt to cover cash flow throughout the year. That process is akin to a consumer using a credit card to cover payments, then paying off the card at the end of the month when his paycheck comes in. But deficit financing can mask systemic problems with a government’s budget.

Chicago issued roughly $9.8 billion in bonds between 2000 and 2012. An investigation by The Chicago Tribune found that less than a third went to fund capital improvements while nearly half went to meet short-term budget needs like equipment purchases and one-time legal expenses. Chicago’s money troubles have led to multiple downgrades and a deteriorating pension system.

A big unfunded pension liability can also entice lawmakers to issue bonds to pay down that liability. But such a move carries the risk that the government could pay more in bond interest than that investment will earn in the pension system.

What’s important when it comes to debt is what a government can handle financially and politically. California suffered downgrades during the Great Recession as the state faced a budget crisis with little wiggle room to fix it. The state has a volatile income tax revenue stream, a tax hike requires a two-thirds approval from the legislature and it has statutory school funding requirements. Since then, California has passed two major ballot measures that raised taxes and established a new funding formula for its rainy day fund that manages against the state’s revenue volatility. Both of these have significantly contributed to the state’s improved credit picture.

It’s also important not to take on too much debt. Generally analysts like to see states leverage no more than 15 to 20 percent percent of their general fund to service debt. But there are exceptions. A decade ago, Loudoun County, Va., had a substantially higher debt burden, says Moody’s local government analyst Julie Beglin. But it was also the fastest-growing county in the country. “It was clear that a lot a developments were going in and they had a very high debt burden because of that,” she said. “But we did not take down their rating because we thought they could afford it.”

GOVERNING.COM

BY LIZ FARMER | APRIL 30, 2015

The Illinois Supreme Court rejected the state’s solution for its worst-in-the-U.S. $111 billion pension shortfall, handing organized labor a victory while deepening a crisis with national implications.

The court unanimously struck down a 2013 law, saying cuts in cost-of-living increases and a higher retirement age violate the state constitution’s ban on reducing worker retirement benefits.

Across the nation, state and local governments grapple with pension deficits that exceed a combined $2 trillion, according to a Moody’s Investors Service report last year. Closing that gap by reducing payments to retirees would abrogate union contracts in many states and even constitutional guarantees. In Illinois, Chicago is grappling with $20 billion in unfunded pension liabilities that threaten its solvency.

“Crisis is not an excuse to abandon the rule of law,” the seven-member Illinois court ruled. “It is a summons to defend it.”

State constitutions have been invoked elsewhere to prevent cuts to public pensions. In Rhode Island, unions settled with the state over cuts before their constitutional challenge could be put to the test. In municipal bankruptcy cases in Detroit and California, judges ruled that federal law can override state bans on cutting pensions.

Illinois Governor Bruce Rauner said he wasn’t surprised by Friday’s ruling. The Republican told reporters in Chicago that the measure “violates basic contract law.” His own pension proposal, which is central to his budget for the coming fiscal year, is legal, Rauner said. He said his plan wouldn’t reduce currently promised benefits.

Downgrade Threat

Friday’s ruling raised the prospect of further downgrades by credit-rating firms. Investors already have been punishing Illinois. Its 10-year bonds yield about 3.7 percent, the highest since November and the most among the 20 states tracked by Bloomberg.

The Illinois bill was signed by former Governor Pat Quinn, a Democrat, in late 2013. A judge blocked the measure before it took effect after public-worker unions sued. Attorney General Lisa Madigan in March asked the high court to resurrect it.

During arguments before the court in March, Solicitor General Carolyn Shapiro argued the state should be able to make laws to protect public welfare and safety during fiscal crisis.

But the judge who voided the law concluded it violated a provision of Illinois’s constitution that bars the diminishment of public-worker retirement benefits. The seven-member high court agreed.

“We do not mean to minimize the gravity of the state’s problems or the magnitude of the difficulty facing our elected representatives,” Justice Lloyd Karmeier wrote. “It is our obligation, just as it is theirs, to ensure that the law is followed.”

Natalie Bauer Luce, a spokeswoman for Madigan, said in an e-mailed statement that, “The Court has provided a definitive interpretation of the Constitution that must now guide the legislature and the Governor.”

Chicago Mayor Rahm Emanuel, a Democrat, drew a distinction between the rejected law and a separate agreement his administration negotiated with some city unions whose members will pay more for fewer benefits.

“That reform is not affected by today’s ruling, as we believe our plan fully complies with the State constitution because it fundamentally preserves and protects worker pensions,” Emanuel said in a statement.

Illinois Republicans lamented the court’s action.

“I respect the Illinois Supreme Court, but disagree with the ruling,” House of Representatives Republican Leader Jim Durkin said in an e-mailed statement. “I am prepared to continue working on meaningful legislative reforms to save our public pension systems.”

Retiree ‘Victory’

Democratic Senate President John Cullerton called the ruling “a victory for retirees, public employees and everyone who respects the plain language of our constitution.”

The outcome, he said, “should be balanced against the grave financial realities we will continue to face without true reforms.”

We Are One Illinois, a coalition of public-worker unions that pressed the legal challenge, applauded the decision.

“With the Supreme Court’s unanimous ruling, we urge lawmakers to join us in developing a fair and constitutional solution to pension funding,” state AFL-CIO President Michael T. Carrigan said Friday in a coalition statement. “We remain ready to work with anyone of good faith to do so.”

The case is In Re Pension Reform Litigation, 111585, Illinois Supreme Court (Springfield).

Bloomberg

by Andrew M Harris and Elizabeth Campbell

May 8, 2015

Pre-refunded munis, which are tax-exempt bonds whose repayment is guaranteed by holdings of U.S. government debt, yield about 0.9 percent on average, the same as similar-maturity Treasuries, Bank of America Merrill Lynch index data show. The munis typically yield less than Treasuries because investors aren’t taxed on the income. In February, the gap was as much as 0.26 percentage point.

That difference disappeared for the first time in 17 months after a jump in refinancings caused muni prices to tumble. Bank of America and Municipal Market Analytics recommend buying pre-refunded munis, anticipating they will outperform and provide a hedge against bond-market losses as the Federal Reserve prepares to raise interest rates.

“This is a way for people who want Treasury credit to buy it extremely cheap,” said Phil Fischer, head of muni research at Bank of America in New York. “There are a lot of investors who are concerned that rates are going to rise. You have the benefit of tax-exempt revenue on a Treasury bond.”

Bond Rout

U.S. government-bond investors have lost more than $195 billion since mid-April on speculation borrowing costs will increase. Fed Chair Janet Yellen said Wednesday that investors “could see a sharp jump in long-term rates” once the central bank raises its benchmark rate from near zero, where it’s been since 2008.

The slide in the price of pre-refunded munis relative to Treasuries is the result of a rush by states and localities to borrow while interest rates are still close to five-decade lows. They’ve issued $145 billion of debt in 2015, the most to start a year since at least 2003, when Bloomberg data begin. More than two-thirds of the deals have refinanced higher-cost debt, an amount not seen in more than two decades.

Pre-refunded bonds are created by advance refundings, which allow municipalities to refinance securities before their call dates. Municipalities sell bonds and use the proceeds to buy Treasuries or other federally backed debt. The income from the government securities is used to pay off the higher-cost munis as they mature.

The refinanced bonds typically gain in price because repayment is assured. Moody’s Investors Service even has a separate rating for debt backed by escrow funds holding U.S.- guaranteed obligations: #Aaa. A rally hasn’t happened because public officials have saturated the market with debt.

Honolulu Haven

Pre-refunded Honolulu bonds maturing in July 2018 traded last month at an average yield of 0.95 percent, data compiled by Bloomberg show. Treasury notes with the same maturity traded at a 0.96 percent yield.

The comparable yields mask the fact that the interest rate on the municipal bond is equivalent to 1.68 percent on taxable debt for those in the highest federal tax bracket.

That differential should provide a buffer for investors if fixed-income yields continue to rise, Municipal Market Analytics, a Concord, Massachusetts-based advisory firm, said in a May 4 report. Even if rates don’t increase, pre-refunded bonds will probably rally as market demand catches up with the pace of issuance, according to the report.

Ten-year Treasuries yield about 2.23 percent, compared with about 2.2 percent for benchmark munis.

“From a relative value standpoint, why not buy a pre-re?” said Dawn Mangerson, who helps oversee $8 billion of munis at McDonnell Investment Management in Oakbrook Terrace, Illinois. “There’s no credit risk. They got cheap.”

Bloomberg

by Brian Chappatta

May 6, 2015

Assured Guaranty Ltd. fell the most since June 2013 after the Puerto Rico House of Representatives rejected a tax-overhaul bill that would have paved the way for a $2.9 billion debt sale needed to avert a cash crunch.

Assured Guaranty shares plunged 4.3 percent to close at $25.99 at 4 p.m. in New York, the lowest price since March 27. The Bermuda-based bond insurer’s subsidiaries Assured Guaranty Municipal Corp. and Assured Guaranty Corp. backed a combined $3.6 billion of Puerto Rico obligations as of Dec. 31, company filings show.

The odds of Puerto Rico defaulting on general obligations increased to 50 percent after lawmakers struck down the bill championed by Governor Alejandro Garcia Padilla, according to Daniel Hanson, an analyst at broker-dealer Height Securities. Bond investors agreed on the increased risk, with debt maturing in July 2035 trading Thursday at the lowest price since it was issued in March 2014, data compiled by Bloomberg show.

The Caribbean island and its agencies have $73 billion of bonds, whose interest is tax-exempt nationwide and which are held by mutual funds, hedge funds and individuals.

Shares of MBIA Inc., whose subsidiary National Public Finance Guarantee Corp. also insures Puerto Rico debt, fell 4.5 percent to close at $8.75, the lowest since March 27.

Bloomberg

by Brian Chappatta

April 30, 2015

Taylor Riggs, an editor at Bloomberg Brief: Municipal Market, talks with Natalie Cohen, head of municipal research at Wells Fargo Securities.

April 30, 2015

Taylor Riggs, an editor at Bloomberg Brief, talks with Joe Mysak about this week’s municipal market news.

May 7, 2015

New York, May 07, 2015 — In the first quarter of 2015, upgrades for US public finance rating revisions continue to outpace downgrades, Moody’s Investors Service says in a new report. As well, the quarter saw the most rating upgrades in nearly seven years.

There were 148 upgrades in the first quarter compared to 115 downgrades in the public finance sector owing to continuing economic stabilization, strengthening financial operations and balance sheet metrics as well as solid managerial oversight. Moreover, upgrades as a percent of total rating revisions was the highest since Q3 2008 at 56.2%.

Among the quarterly upgrades were four obligors raised to the Aaa-rating level, Moody’s says in “Upgrades Continue to Lead Downgrades in Q1 2015; Debt Affected by Downgrades is Larger.”

“We typically change the rating of only a small number of public finance entities each quarter, but the number of rating revisions in Q1 had a larger number of rating revisions than the past few quarters. We changed the rating on approximately 2.1% of public finance obligors in the first quarter 2015. In contrast, the 924 rating revisions in all of 2014 represented only 7.3% of the public finance rated universe,” author of the report and Moody’s AVP — Analyst Mark Lazarus says.

However, the dollar value of downgraded debt surged to $89.1 billion compared to$18.1 billion in upgraded debt. The disparity is attributable to the obligor downgrades of the Commonwealth of Puerto Rico (Caa1 negative), the City of Chicago, IL (General Obligation Baa2 negative), Chicago Public Schools, IL (Baa3 negative) and Catholic Health Initiatives (A2 negative), which accounted for $73 billion of the affected debt.

In addition, the publication of an updated methodology for utility revenue bonds resulted in 35 rating revisions subsequent to the completion of Moody’s surveillance reviews in the first quarter. From these reviews, 11 obligors were downgraded compared to 24 upgrades, and 14 were confirmed at existing ratings.

The methodology-driven downgrades reflected 9.6% of the first quarter’s total downgrades. Conversely, methodology-driven upgrades represented 16.2% of the period’s tally.

Even without the methodology-driven revisions, first quarter upgrades still surpassed downgrades.

The report is available to Moody’s subscribers here.

The Illinois Supreme Court declared in a ruling Friday that the state’s landmark 2013 pension overhaul violates the state constitution, unraveling an effort by state lawmakers to rein in benefits for a public-sector pension system they have consistently underfunded over the years.

The current pension shortfall is estimated at $111 billion, one of the largest nationally.

The high court affirmed a decision in November by a state circuit court that the legislative changes violated pension protection measures written into the state constitution. The decision sided with public-sector unions, who challenged the law. The ruling said the constitution is unambiguous on the issue and dismissed the state’s argument that so-called police powers in place to protect public safety and welfare give lawmakers the authority to cut retirement benefits.

“From the beginning of our pension reform debates, I expressed concern about the constitutionality of the plan that we ultimately advanced as a test case for the court,” said John Cullerton, Illinois’s Senate president and a Democrat. “Regardless of political considerations or fiscal circumstances, state leaders cannot renege on pension obligations.”

Last month, the Oregon Supreme Court reversed a core element of that state’s controversial 2013 pension overhaul, concluding that annual cost-of-living adjustment cuts to its retired workforce were unconstitutional.

State and local governments have tried to remedy their growing pension-funding gaps by curbing benefits—some for current employees. Those pension cuts have faced legal challenges in more than a dozen states, including Illinois and Oregon, according to the Center for Retirement Research at Boston College.

The Illinois law would have reduced future retirement costs by shrinking cost-of-living increases for retirees, raising retirement ages for younger employees and capping the size of pensions.

Union leaders hailed the victory. “The court’s ruling confirms that the Illinois Constitution ensures against the government’s unilateral diminishment or impairment of public pensions,” said Michael Carrigan, president of the Illinois ALF-CIO, speaking on behalf of the We Are One Illinois coalition of unions.

But the rejection of the law as unconstitutional poses a huge challenge for the state’s new Republican governor, Bruce Rauner, who also faces a looming budget deficit after a special recession-era tax increase expired at the end of last year.

A spokesman for Mr. Rauner said the governor’s office planned to issue a statement soon.

Meanwhile, the city of Chicago also faces its own pension and budget woes. A spokesman for Mayor Rahm Emanuel, who was re-elected last month to a four-year term, also didn’t immediately respond to a request for comment.

Justices acknowledged that the state is in a financial fix, but that doesn’t allow lawmakers to violate the constitution. “The financial challenges facing state and local governments in Illinois are well known and significant,” the high court said. “In ruling as we have today, we do not mean to minimize the gravity of the state’s problems or the magnitude of the difficulty facing our elected representatives. It is our obligation, however, just as it is theirs, to ensure that the law is followed.”

THE WALL STREET JOURNAL

By JOE BARRETT And BEN KESLING

Updated May 8, 2015 1:30 p.m. ET

Write to Joe Barrett at [email protected] and Ben Kesling at [email protected]

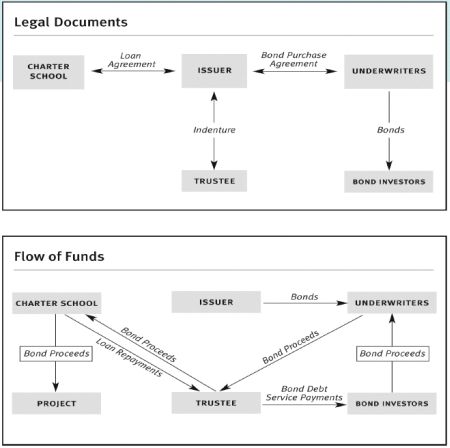

Successful Investing In Charter School Bonds

Finding Best Practices in a High-Yielding Sector

Bond Buyer Web Seminar – June 5, 2013

OVERVIEW

STATE LAW DIFFERENCES

43 states permit the formation and operation of charter schools under statutory schemes that are fundamentally similar in purpose, though often differing in ways that are relevant to bond financing.

Charter Authorization

Organization and Independence

Corporate Powers

Charter Revocation

Charter School Funding

EXEMPLAR TRANSACTIONS

Bronx Charter School for Excellence (Bronx, NY) (2013)

Structure

Observations

Rocketship Alma Academy (San Jose, CA) (2011)

Structure

Observations

Aspire Public Schools (multiple cities, CA) (2010)

Structure

Observations

New Plan Learning (Dayton and Lorraine, OH; Chicago, IL) (2011)

Structure

Observations

Tri-Valley Learning Corporation (Livermore, CA)

Structure

Observations

Last Updated: April 29 2015

Article by Eugene H. Clark-Herrera

Orrick

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.

U.S. lawmakers are renewing efforts to expand the use of municipal bonds to attract private investment in the nation’s crumbling roads and bridges.

Senator Ron Wyden, the Democrat who backed legislation creating the $188 billion market for Build America Bonds, introduced a bill Monday with Republican Senator John Hoeven of North Dakota that would facilitate the use of private-activity debt for transportation projects. Separately, Republican Representative Todd Young wants to double the limit on the securities for transportation and allow their use for facilities such as courthouses. Companies use private-activity bonds to borrow in the municipal market.

The plans may face an uphill battle because of their cost and gridlock on Capitol Hill. Yet increasing financing options for public-private partnerships would be a boon for municipalities and help fill a void, the lawmakers said. Authorization for federal highway funding is set to expire May 31, and Congress has been unable to agree on a plan to address what Treasury Secretary Jacob J. Lew says is a $1 trillion backlog of infrastructure work.

“You can come up with bipartisan approaches to get private-sector money off the sidelines and into transportation,” Wyden, 66, the ranking Democrat on the Finance Committee, said in a phone interview. “The transportation system needs more than a face lift; it basically needs full re-constructive surgery.”

Debt Limit

States and localities issue private-activity bonds on behalf of companies that build and operate facilities such as airports, ports and highways. There’s a limit to how much of the debt can be sold: as of April 15, $11.1 billion of the $15 billion allotted for transportation had been issued or approved, including for the replacement of the Goethals Bridge between New York City and New Jersey.

Municipalities nationwide sold Build America Bonds, taxable debt with a federal subsidy on interest costs, for infrastructure. Wyden, who represents Oregon, has tried unsuccessfully to revive the program, which debuted in 2009 and expired at the end of 2010.

The senator calls his latest proposal the “Move America” program. It would authorize as much as $180 billion of tax-exempt bonds over 10 years and provide as much as $45 billion in new infrastructure tax credits to match private-equity investment.

Cost Consideration

Interest on the bonds wouldn’t be subject to the alternative minimum tax, which limits the tax benefits and exemptions that high-earning individuals can claim. The plan would change other rules, including allowing use of the bonds for privately owned public infrastructure, such as highways.

The proposal would cost as much as $15 billion in foregone tax revenue over 10 years, Wyden’s office said.

“Move America bonds and tax credits are an effective way to leverage private-sector dollars to build the infrastructure we need across the country to grow America’s economy and create jobs,” Hoeven said in a release.

Young, a member of the House Ways and Means Committee, said he’d double the cap on issuance of private-activity bonds for transportation work to $30 billion and expand their use, including for public buildings.

“It’s almost inevitable that this will be part of the solution,” the 42-year-old Indiana representative said in a phone interview. “There’s no reason we should be lagging behind countries like Canada in bringing in private-sector expertise as well as capital to ensure we build more of these projects.”

‘Uphill Slog’

Young acknowledged hurdles, including resistance to the cost. He said he’s exploring introducing his proposal or incorporating it with other plans.

In January, President Barack Obama proposed tax-exempt debt, dubbed Qualified Public Infrastructure Bonds, that would have no issuance cap and wouldn’t be subject to the alternative minimum tax.

At the time, it had a low probability of being enacted by the Republican-controlled Congress, said Matt Posner, a managing director at Municipal Market Analytics, a Concord, Massachusetts-based research firm.

While getting approval to expand the use of private-activity bonds would be “an uphill slog,” interest is picking up, he said.

The debt might expedite work on badly needed projects, Christopher Leslie, New York-based chief executive officer of Macquarie Infrastructure Partners Inc., said in an interview last week at a Bloomberg Government event in Washington. He oversees almost $9 billion in three funds dedicated to investments in the U.S. and Canada.

“The private sector remains keen to invest and, in fact, sees itself potentially as part of the solution to the slowness of Congress,” Leslie said.

Bloomberg Muni Credit

Mark Niquette

May 3, 2015 9:01 PM PDT

California’s drought is starting to spread to the market for bonds issued by water utilities, long considered one of the safest types of debt sold by state and local governments.

Some investors are steering clear of the bonds from hard-hit areas of the U.S. west, amid concerns that restrictions on water use will drive down water-authority revenue. Some authorities may have a tough time raising rates to offset that lost income.

If shortages persist, credit ratings may weaken and prices for outstanding bonds fall, according to analysts and rating firms.

California water and sewer bonds lost value in April for the second month in three, falling 0.61% after Gov. Jerry Brown imposed mandatory water restrictions. All California municipal bonds posted a 0.55% decline for the month, counting price moves and interest payments, according to Barclays PLC.

California is in its fourth year of drought, one of the worst on record for the nation’s most populous state. It is costing billions of dollars in losses in its agricultural sector and prompting the first-ever mandatory statewide cutbacks in water use.

It is also a rare fissure in one of the most-secure and widely traded sectors of the $3.7 trillion municipal-bond market. During last year’s rally in bonds, water and sewer debt nationwide outperformed the market, rising 9.7% compared with 9% for tax-exempt bonds overall, according to Barclays. California water and sewer agencies have issued about $28.8 billion in bonds since 2010, according to Thomson Reuters.

Water-utility bonds seldom default because they’re typically backed by residents’ payments on an essential service. And so far the drought hasn’t kept water authorities from tapping the debt market.

But the persistent water shortages show how a market prized for safety and stability can contain hidden pockets of risk, some investors said.

“The way investors have looked at water in California in the past needs to go through some evolution,” said Michael Johnson, co-chief investment officer at Gurtin Fixed Income Management LLC, in Solana Beach, Calif.

Mr. Johnson said heavy investor demand for California debt of all types has raised the prices of most water bonds. That means investors may be overpaying for debt from districts with growing but unacknowledged financial problems.

His firm, which manages about $9 billion, has avoided some authorities facing challenges such as limited water storage or small financial reserves.

An April report by Moody’s Investors Service warned investors that the state’s water restrictions could curb revenue at water agencies. While rate increases can offset declining water use, utilities have little time to make them, and such increases may further discourage consumption.

Fitch Ratings said downgrades could occur if policy makers hesitate to make rate increases.

California isn’t the only place these bonds are under scrutiny. Robert Fernandez, director of environmental, social and governance research at Boston-based Breckinridge Capital Advisors, said his firm sold bonds from at least one water authority in Texas because of inconsistent revenue and water supplies.

Breckinridge, which manages about $21.4 billion, uses 11 indicators to analyze how water availability, demand and oversight can affect an agency’s ability to repay debt, looking for factors including adequate backup supplies and contingency planning, Mr. Fernandez said.

“We’re not looking to say, ’we want to avoid all water systems in this area,’” he said. “We want to look for the ones that are well managed and know how to manage through these issues.”

Sharlene Leurig, who directs the sustainable water infrastructure program at Ceres, a nonprofit group that promotes sustainable investing, said that while bondholders are beginning to pay more attention, the threat posed by water shortages is still poorly understood.

“I think we have a long way to go before those risks are properly disclosed and priced,” she said.

‘I think we have a long way to go before those risks are properly disclosed and priced.’

—Sharlene Leurig of Ceres

Maintaining investor demand will be important in California, where officials are accelerating parts of a voter-approved plan to sell more than $7 billion in general obligation bonds to pay for new water projects. That plan includes grants to local authorities, who may sell their own bonds.

Gary Breaux, chief financial officer for the Metropolitan Water District of Southern California, a consortium of 26 cities and water authorities that provide drinking water to about 19 million people in cities including Los Angeles and San Diego, said he’s spoken with investors to reassure them that the triple-A-rated agency has plenty of sources for water and isn’t foreseeing effect on its budget. Several water agencies’ recent bond sales were well received, he added.

“I think investors feel reassured that we’re watching all these different variables and we’ll take them into account when we set our next budget, as well as the rates,” he said.

Jamison Feheley, head of banking for public finance at J.P. Morgan Chase & Co., said California issuers are well prepared by prior droughts and haven’t had to adjust bond offerings, though investors are paying attention.

“There are a lot of discussions with investors and rating agencies about `what’s the plan? How do you expect to manage the drought issue?’” he said.

Demand for water utility debt has grown nationwide since Detroit’s bankruptcy, because those investors proved better-protected than those holding tax-supported bonds, said Matt Fabian, partner at Concord, Massachusetts-based research firm Municipal Market Analytics. And while water bills may go up as the drought goes on, they’re still a small portion of most households’ expenses.

“Frankly, they just need to charge more for it,” he said. “Once they start laying in new capital, either to fund conservation, or reuse, or desalination or whatever, it’s just going to cost a lot more money.”

THE WALL STREET JOURNAL

By AARON KURILOFF

May 4, 2015 2:19 p.m. ET

Write to Aaron Kuriloff at [email protected]

WASHINGTON – Sens. Ron Wyden, D-Ore. and John Hoeven, R-N.D., on Monday introduced legislation that would create Move America Bonds, which would generally be treated as exempt-facility, private-activity bonds but would have fewer restrictions and separate state volume caps that could be converted into tax credit allocations.

The bill, called Move America Act of 2015, would also allow states to convert volume cap for the bonds to allocations for tax credits. The Senators’ proposal, which is designed to increase private investment in infrastructure, has some similarities to, and also differences from, the Obama administration’s proposal for qualified public infrastructure bonds (QPIBs).

“Move America will turbocharge investment and give states and localities the flexibility they need to quickly and efficiently break ground on projects,” Wyden, the top Democrat on the Senate Finance Committee, said in a news release. “An injection of private capital, in addition to sustainable funding for transportation programs, will help get America’s economic engine running at full speed.”

Move America Bonds could be used to finance airports, docks and wharves, mass commuting facilities, railroads, highways and freight transfer facilities, flood diversion projects and inland waterway improvements.

The bonds would generally follow the same rules as exempt-facility bonds, with some exceptions.

Move America Bonds would not be subject to the alternative minimum tax. Exempt-facility bonds for airports, docks and wharves and mass commuting facilities have to be governmentally owned, but Move America Bonds used for those purposes could be privately owned. Up to 50% of the proceeds of Move America Bonds could be used for land acquisition, compared to 25% for most types of PABs. Also, certain rules for exempt-facility bonds for high-speed rail facilities and for highway and freight transfer facilities would not apply to these new bonds.

Move America Bonds would be subject to new, separate state volume caps equal to 50% of the state volume caps for PABs. As with PABs, states could carry forward unused volume cap for up to three years, but with Move America Bonds any volume cap unused after the three years could be reallocated to states that fully used their cap.

Wyden and Hoeven’s bill would also authorize Move America Credits — tax credits aimed at attracting private investment in infrastructure. The credits could be used on projects financed with Move America Bonds and they could be combined with the bonds and other federal and state funding.

States would have to trade in some of their Move America Bond volume cap to get allocations for the credits. They would receive $0.25 of credit allocation for every $1 of volume cap converted. The amount of credits on a project could not be more than 20% of the project’s estimated cost and could not be more than 50% of the project’s total private investment.

States could sell the credits or allocate them to sponsors of projects. The sponsors could claim the credits themselves or sell them to raise capital. The credits would be available to taxpayers once projects are placed into service, and taxpayers could claim the credit at 10% for 10 years.

Move America Bonds would be similar to Obama’s proposed QPIBs in that both would be new types of PABs used to finance infrastructure projects that would be exempt from the AMT. However, QPIBs would have to be used for governmentally-owned projects and would not be subject to any volume caps. Also, there would be no tax credits associated with QPIBs.

Municipal bond experts were generally positive about the bill.

“Tax-exempt bonds have been a cost-effective way to finance critical infrastructure and community investment projects for more than 100 years,” said Bond Dealers of America chief executive officer Mike Nicholas. “Creating additional opportunities to use these bonds will increase their benefits to the small issuers that regional and middle-market dealers work with and, particularly, to taxpayers and local communities.”

“Senator Wyden’s proposal represents a creative and thoughtful approach to bridging the gap between infrastructure funding needs and available resources,” said Michael Decker, managing director and co-head of municipal securities at the Securities Industry and Financial Markets Association. “We are particularly encouraged that Senator Wyden’s bill proposes to leverage the existing and well-proven tax-exempt bond market, which is the single most important tool for funding infrastructure in the U.S.”

Susan Collet, president of H Street Capitol Strategies, said that the goal of the bill appears to be to provide as much flexibility as possible to private investors for infrastructure projects. “It’s great to see a thought-provoking, bipartisan bill” on this topic, she said.

Micah Green, a partner at Squire Patton Boggs, said that while he’s not prepared to comment on the specifics of the bill, “this is yet another example of the broad based bipartisan support that exists to not only infrastructure finance, but also for ideas utilizing the municipal bond market as a mechanism for delivering lower cost financing for this needed public investment.”

THE BOND BUYER

BY NAOMI JAGODA

MAY 4, 2015 3:52pm ET

CHICAGO – Chicago will phase out the use of scoop-and-toss debt restructuring, convert $900 million of floating-rate debt to fixed rate and exit the attached interest rate swaps under measures announced by Mayor Rahm Emanuel Wednesday.

The city also plans over the next four years to reduce its reliance on debt to cover operating expenses like judgments and legal settlements and continue rebuilding reserves partially drained before Emanuel took office four years ago.

“They are the right steps” for the financial well-being of the city, Emanuel said during an address to the Chicago Civic Federation, a government research organization that follows the city’s budgeting and fiscal policies and has chided some of its borrowing practices.