When one of the tiniest pension funds imaginable — for Citrus Pest Control District No. 2, serving just six people in California — decided last year to convert itself to a 401(k) plan, it seemed like a no-brainer.

After all, the little fund held far more money than it needed, according to its official numbers from California’s renowned public pension system, Calpers.

Except it really didn’t.

In fact, it was significantly underfunded. Suddenly Calpers began demanding a payment of more than half a million dollars.

“My board was somewhat shocked,” said Larry Houser, the general manager of the pest control district, whose workers tame the bugs and blights that threaten their corner of California citrus country. It is just a few miles down the road from Joshua Tree National Park.

It turns out that Calpers, which managed the little pension plan, keeps two sets of books: the officially stated numbers, and another set that reflects the “market value” of the pensions that people have earned. The second number is not publicly disclosed. And it typically paints a much more troubling picture, according to people who follow the money.

The crisis at Citrus Pest Control District No. 2 illuminates a profound debate now sweeping the American public pension system. It is pitting specialist against specialist — this year in the rarefied confines of the American Academy of Actuaries, not far from the White House, the elite professionals who crunch pension numbers for a living came close to blows over this very issue.

But more important, it raises serious concerns that governments nationwide do not know the true condition of the pension funds they are responsible for. That exposes millions of people, including retired public workers, local taxpayers and municipal bond buyers — who are often retirees themselves — to risks they have no way of knowing about.

“One of the first things I think you should do is publish that number for every city,” said William F. Sharpe, professor emeritus of finance at Stanford University’s Graduate School of Business who won the Nobel in economic science in 1990 for his work on how the markets price financial instruments. He is also a California resident who voluntarily helped his city, Carmel-by-the-Sea, crack the secret pension code — figuring out the market value of its debt to its retirees in 2011 before Calpers resolved to start divulging the information later that year.

“We just about nailed it, which made us feel very good for ourselves — but very bad for the city,” Professor Sharpe said. On a market basis, the city turned out to be $48 million short of what it owed retirees, or four times what the official numbers showed.

The two competing ways of valuing a pension fund are often called the actuarial approach (which is geared toward helping employers plan stable annual budgets, as opposed to measuring assets and liabilities), and the market approach, which reflects more hard-nosed math.

The market value of a pension reflects the full cost today of providing a steady, guaranteed income for life — and it’s large. Alarmingly large, in fact. This is one reason most states and cities don’t let the market numbers see the light of day.

But in recent years, even the more modest actuarial numbers have been growing, as populations age and many public workers retire. In California, some struggling local governments now doubt they can really afford their pension plans, and have told Calpers they want out.

In response, Calpers has calculated the heretofore unknown market value of their pension promises — and told them that’s the price of leaving, payable immediately. Few have that much cash, so it’s welcome to the Hotel California: You can check out anytime you like, but you can never leave.

Calpers says it must bill departing governments for every penny their pensions could possibly cost because once they cash out, Calpers has no way of going back and getting more money from them if something goes wrong. Calpers keeps that money in a separate “termination pool.”

Things went differently for Citrus Pest Control District No. 2. It withdrew first, before realizing the shortfall. Then, four months later, it got the unexpected bill from Calpers.

“I was opening the mail and thinking, ‘Can this be right?’ I thought they put an extra zero on it,” said Tim Hoesterey, one of the district’s two employees.

The bill came just as the district was building up a war chest to fight a virulent new citrus blight, a disease that had already devastated groves in Florida. The directors had armed themselves by raising a growers’ tax per acre fivefold. Suddenly, paying Calpers would wipe out the whole citrus blight reserve.

Some wondered if they should just declare bankruptcy.

“There are people selling their farms, trying to get out of the business, because they can’t make a profit anymore,” Mr. Hoesterey said. He called Calpers to see if the district could get a break, an extended due date, or even stay with Calpers after all. Calpers said no. It was a done deal.

A Calpers spokeswoman, Amy Morgan, said such questions suggested “a misunderstanding of the purpose of Calpers.”

“Calpers does not exist to make money,” she said. “Calpers exists to fully pay out benefits that are promised to its members.” She said the law required Calpers to perform a complete valuation after the termination date had passed, and to recover all the money needed to ensure that the retirees would be paid in full.

Today in California, both the market values and the actuarial pension values for many places are available on a website run by the Stanford Institute for Economic Policy Research. But for the 49 other states, the market numbers remain unknown.

The market-based numbers are “close to the truth of the liability,” Professor Sharpe said. But most elected officials want the smaller numbers, and actuaries provide what their clients want. “Somebody just should have stopped this whole charade,” he said.

For years, people have been trying to do just that. In 2003, the Society of Actuaries, a respected professional body, devoted most of its annual meeting to what was called “the Great Controversy” — the notion that the actuarial standards for pensions were fundamentally flawed, causing systemic underfunding and setting up a slow-moving train wreck when baby boomers retired. It drew a standing-room-only crowd.

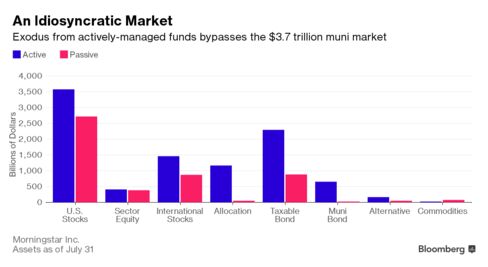

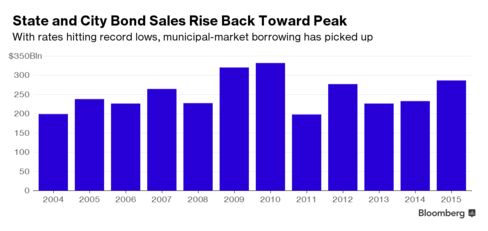

The problem reaches far beyond pensions, and into the $3.7 trillion municipal bond market. The reason is that municipal bond ratings take into account the strength (or weakness) of government pension plans. If those numbers have been consistently wrong, as dissidents argued, then actuaries were helping mislead the investors buying municipal bonds.

Arguably, the flawed standards worsened the problem with each passing year: Actuarial values determine the annual contributions that states and local governments make to their pension plans, so if the target numbers are too low, the contributions will always be too small. Shortfalls will be compounding, invisibly.

Much of the debate surrounded the routine practice of translating future pension payments into today’s dollars, which is called discounting. The tiny pension plan at Citrus Pest Control District No. 2 shows clearly what the problem is.

With everybody either retired, or about to be (Mr. Houser will retire later this year), there is no guesswork in determining everybody’s pensions. The actuaries at Calpers project each of the future monthly payments due to Mr. Houser and the other five retirees, assuming they will live to age 90. (Mr. Hoesterey is not included because his retirement benefit is the new 401(k) plan.) Then, they translate all those future payments into today’s dollars with a rate — often called a discount rate. This is exactly how a lender would calculate a home mortgage.

The problem is, which rate should be used? An economist would say the right rate for Calpers is the one for a risk-free bond, like a Treasury bond, because public pensions in California are guaranteed by the state and therefore risk-free. And that’s what Calpers does when it calculates market values. It used 2.56 percent when it calculated the bill for the pest control district, producing a $447,000 shortfall.

But the rest of the time, Calpers and virtually all other public pension funds use their assumed annual rate of return on assets, now generally around 7.5 percent. Presto: This makes a pension appear to have a much smaller liability — or even a surplus.

That was the case with the pest control district for years. And since there seemed to be a surplus, Calpers said the district owed no annual contributions. Calpers’s numbers hid it, but the six members’ pensions were going unfunded.

“Every economist who has looked at this has said, ‘It’s crazy to use what you expect to earn on assets to discount a guaranteed promise you have made. That’s nuts!’” Professor Sharpe said.

But what he calls crazy is enshrined in the actuarial standards. And since adhering to the standards makes public pensions look affordable, there is a powerful incentive to preserve those standards.

“Actuaries shamelessly, although often in good faith, understate pension obligations by as much as 50 percent,” said Jeremy Gold, an actuary and economist, in a speech last year at the M.I.T. Center for Finance and Policy. “Their clients want them to.”

Mr. Gold was also a ringleader of that stormy professional meeting in 2003. Since then, there have been more conferences, monographs, speeches, blue-ribbon panels and recommendations — to say nothing of an unusual spate of municipal bankruptcies and insolvencies in which ailing pension plans have played starring roles. And yet little has changed.

Even as Citrus Pest Control District No. 2 was scrambling to find the cash to pay its unexpected bill this year, another fight broke out within the American Academy of Actuaries, which represents the profession in Washington, over the same issues.

An academy task force had commissioned a paper on how financial economists would measure public pensions. But during the peer review process, the opus was spiked, the task force disbanded and the four authors — Mr. Gold among them — barred from publishing the work elsewhere.

Accusations of censorship flew. The four authors said the academy’s copyright claims were false. The academy’s president, Thomas F. Wildsmith IV, said in a statement to members on the academy’s website that the paper “could not meet the academy’s publication standards.”

In a separate email message to The New York Times he said the academy was committed to helping the public understand the different measurements, and provided a position paper concluding that both measures are useful, but for different purposes.

Then the Society of Actuaries, which handles the education and testing of actuaries, joined the fray. It posted the suppressed paper on its own website, albeit with the authors’ names removed. It claimed to hold the copyright jointly with the academy. It also added a statement that the paper did not reflect the position “of any group that speaks for the profession” but called the authors “knowledgeable.”

The society’s president, Craig W. Reynolds, sent an email message citing other efforts “to develop strong funding programs that are responsive to a rapidly changing environment.”

The four authors then issued a revised version of their paper, with their names on the front — and a claim that they held the copyright. The paper, which runs 19 pages, says in brief: Use market values for public pensions.

Professor Sharpe noted that Calpers’s market-based method was “virtually the precise approach advocated in this paper.”

Almost, but not entirely.

At Citrus Pest Control District No. 2, Mr. Hoesterey said Calpers added a final twist. It took so long to calculate the district’s final payment that the bill arrived four months after the district’s withdrawal date — and then it charged four months’ interest, at 7.5 percent, on the late payment.

Ms. Morgan, the spokeswoman, said the four-month lag was “unfortunate but unavoidable.”

Mr. Hoesterey said Calpers should have warned the district well in advance how big the bill might be, to give it time to find the money. “I kept asking: ‘Does this seem fair to you? What other organization conducts business like this?’” he said.

Seeing no way out, the district paid the whole thing.

THE NEW YORK TIMES

By MARY WILLIAMS WALSH

SEPT. 17, 2016