As you may be aware, the basic idea of the securities business is: Buy Low, Sell High. What with the law of one price, advances in modern information technology, etc., this is not always easy to do. If you are a bond trader, there just aren’t that many opportunities to buy a bond from one customer for a low price and turn around and sell it to another customer at a much higher price. That’s good! For the customers.1 But for the traders, at least part of the job is to create those opportunities. Some ways of doing that are totally fine. Some are a bit unseemly, but legal. Some are illegal, or at least, so prosecutors think.

I find this a very murky area. It’s easy to see why outsiders and prosecutors and customers might be offended when they find out that bond traders bought low from one customer and sold high to another customer with shall we say imperfect disclosure of those facts. But that is kind of the job. And the lines between how you are and are not allowed to do it don’t seem totally clear to me. It’s okay to sell bonds to a customer who doesn’t know what you paid for them, probably, most of the time.2 It’s not okay to lie to the customer about the price you paid for them, probably, most of the time. Other complexities abound.

It seems to me that these lines are drawn mostly by custom. If you nudge and omit and shade the truth in ways that are blessed by longstanding industry custom, then no one in the industry will be that mad at you, though prosecutors still might be. If you just go around lying where everyone else tells the truth, no one will sympathize when you get in trouble. That is the essential substance of the Jesse Litvak case: Was Litvak, convicted last year of criminal fraud in selling mortgage bonds, lying about stuff that everyone lies about? Were his lies just “puffery” that his counterparties knew to discount? Or was he breaking new ground in bond-deception creativity, lying to his customers about things they weren’t expecting to be lied to about?

Yesterday brokerage firm Edward Jones and its former head of municipal underwriting Stina Wishman agreed to settle Securities and Exchange Commission charges that they did this:

In certain co-managed, negotiated transactions during the Relevant Period as further detailed below, Wishman and the municipal syndicate desk at Edward Jones improperly offered out particular bonds to customers from its inventory at prices above the initial offering prices while syndicate restrictions remained in effect. In these instances, Wishman and Edward Jones’ municipal syndicate desk typically placed orders with the lead underwriter for specific maturities for the firm’s own inventory during the order period, but did not give their customers an opportunity to similarly participate. Once Edward Jones’ municipal syndicate desk obtained an allocation of those bonds and took them into inventory, and while syndicate restrictions remained in effect, the firm offered the securities to customers from its own inventory at prices above the initial offering prices in these transactions.

They settled “without admitting or denying the findings”; Edward Jones agreed to pay more than $20 million. According to the SEC order, Edward Jones would sign up to be an underwriter of municipal bonds. It wouldn’t lead the underwriting, but would be a co-manager, involved in the syndicate so that it could sell some of the bonds to its “well-known, geographically-dispersed retail customer base.” But instead of doing what underwriters do — take orders from customers, put those orders into the order book, get allocated some bonds and sell those bonds to the customers at the offering price of the bonds — Edward Jones would (sometimes, from 2009 through 2012) just buy the bonds for itself at the offering price,3 and then sell them to customers at a higher price.

That is bad!4 Underwriters are supposed to distribute their bonds to customers, not hold on to them and hope they go up. And Edward Jones’s behavior seems to have been even worse than that: It didn’t just put the bonds in inventory, wait until they started trading, and hope to flip them for a profit (which would be bad!); it actually sometimes sold bonds to customers at prices above the offering price while the offering was still going on.5 As far as I can tell, this worked mostly because customers didn’t know any better, and Edward Jones didn’t tell them.6 (There’s no suggestion that Edward Jones lied to the customers about the price it paid, though.)

All of this strikes me as shocking, but there’s a reason that I’m shocked. The reason is that I used to work as a bond underwriter, and I know from experience that this sort of thing is just not done. Here is the SEC trying to explain why:

During the Relevant Period, underwriters that used the template AAUs for negotiated municipal offerings were obliged, under those agreements, to make a public offering of all bonds at the initial offering price in effect at the time they were allocated bonds by the issuer and senior manager. Market participants have long understood the AAU to place an obligation on the syndicate members, as parties to the agreement, to offer and attempt to sell the bonds at the initial offering prices negotiated with the issuer before the bonds begin trading.

In addition to the agreed-upon terms of the AAU, municipal underwriters adhere to a well-established industry practice in negotiated offerings that requires them, when part of a syndicate, to offer and attempt to sell all of the bonds at the initial offering prices for a certain period of time. These limitations are known as “syndicate restrictions,” and are generally in effect until the expiration of those restrictions. Among other things, syndicate restrictions ensure that the bonds are sold at the price which the issuer and the syndicate have agreed to sell them.

An “AAU” is an “Agreement Among Underwriters,” and I confidently assert that no bond syndicate manager has ever read one. (Here’s the standard master AAU for municipal underwritings in effect at the time, and I am not 100 percent convinced that it says all of what the SEC says it says, though its powerful mojo repelled me from reading it too.)7 The real point here is that there is a “well-established industry practice” that, if you’re an underwriter for municipal bonds, and you buy bonds from the issuer at the offer price,8 you have to re-sell them to customers at the offer price. You just can’t do what Edward Jones did.

The SEC grasps at some specific written authorities that sort of say that — the AAU and bond purchase agreements for these deals, and some Municipal Securities Rulemaking Board9 rules — but it’s clearly leaning heavily on custom, and on the industry understanding of what those authorities actually mean. Underwriting is a complex process that grew up organically and that is governed not so much by clear specific rules as it is by broadly shared understandings of how underwriters are supposed to behave. Some behaviors are fine, even though outsiders find them puzzling. Other behaviors are wildly illegal, even though, when the SEC gets around to punishing them, it has a bit of a tough time pointing to the actual words that say they’re illegal. It’s just … you know … you can’t do that.

But while Edward Jones’s alleged behavior here was very bad, it was not a priori bad. Buying bonds from a seller at 100 and re-selling them for 103 is not self-evidently evil, even if you don’t tell your customer that you paid 100. What makes it bad is the set of customer expectations and industry traditions that provide context for the basic buying and selling behavior.

Here’s the Wall Street Journal on this case:

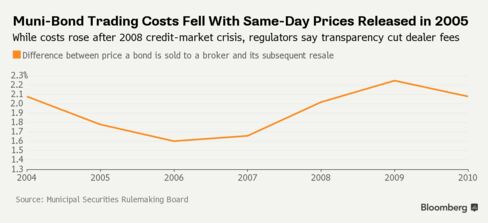

Some analysts said the case opens a new front for the SEC’s enforcement efforts in the sale of bonds backed by state and local government-related entities, showing a changing focus from problems related to disclosure to those related to pricing. SEC commissioners Luis Aguilar, Daniel Gallagher, Kara Stein and Michael Piwowar said in a statement the case illustrates the need for better rules on transparency in bond pricing.

“The Commission’s recent enforcement action against [Edward Jones] involving the offer and sale of municipal bonds to retail investors highlights the need for clear rules requiring the disclosure of mark-ups and mark-downs,” they wrote, urging the Financial Industry Regulatory Authority and the Municipal Securities Rulemaking Board to complete rules mandating increased price transparency. “If not, we believe the Commission should propose rules to address this important issue,” they wrote.

Maybe, sure, why not. Perhaps transparency solves everything. But to me the problem here was less about pricing transparency and more about the violation of expectations. After all, Edward Jones didn’t violate the clear rules requiring disclosure of mark-ups, since those rules don’t exist. The SEC found instead that it violated general anti-fraud rules.10 It deceived investors, not by lying to them, exactly, but by not behaving in the way they reasonably expected. And you can’t extend from this case to other cases about “pricing,” of municipal bonds or otherwise. The pricing and disclosures that customers expect are a function of specific contexts and rules and industry practices. The fact that Edward Jones shouldn’t have sold these bonds to its customers for 103 is a fact about underwriting of primary offerings, which doesn’t necessarily tell you anything about disclosure requirements in secondary trading.

When people get in trouble for fraud, in mortgage bonds or Libor manipulation or anything else, they are often scolded with words to the effect of “It’s no excuse to say that everyone is doing it.” But it is! Fraud is only fraud if it deceives.11 If everyone is used to operating without transparency, it’s no fraud on them to be a bit shady. If everyone is expecting transparency, then opacity can be fraud. As the SEC knew in this case, industry custom can be the best indication of what is and isn’t fraud. And if the custom looks a little fraudy, well, maybe the fact that it’s customary makes it okay?

1. Except insofar as they are worried about dealers providing insufficient liquidity. As Dan Davies has argued, if the buy-side wants dealers to cushion them against a liquidity shock, maybe they should pay dealers more? Though of course that would guarantee nothing.

2. Nothing is ever legal advice, but this is particularly not legal advice. TRACE exists, etc., and in many trading contexts you are required to give the customer transparency about what you paid. In others you aren’t.

3. Minus, of course, underwriting fees:

The municipal issuer usually compensates the syndicate for its services in distributing the bonds by selling the bonds to the syndicate at a discount to the “initial offering price,” the price at which the bonds are offered to the investing public by the syndicate at the time of original issuance. The difference between the initial offering price and the discounted price for the syndicate is the “underwriters’ discount” or “underwriters’ spread.”

4. I feel like I’m saying that a lot this week. It’s been a big week for SEC actions! (As promised!) I like to joke sometimes about the national obsession with golf-based insider trading, but the news release hacking, the ITG order-flow misuse and the Edward Jones muni-underwriting abuses all strike me as really serious problems, so nice work by the SEC to address all of them.

5. I’m not totally clear on the timing but here’s one example from the SEC order:

45. The senior manager filled Edward Jones’ entire orders for NPPD BABs on June 10 at par. The senior manager informed Edward Jones that it had been allocated $100,000 of the 2026 maturity and $10 million of the 2035 maturity, and that the initial offering price was 100 (i.e., par).

46. On the afternoon of June 10, after the BABs order period closed but before syndicate restrictions were lifted, Wishman informed Edward Jones’ Nebraska FAs of the NPPD BAB allocations and instructed them to offer those bonds out to customers at prices higher than the initial offering prices. Edward Jones offered the 2026 maturity of NPPD BABs at 102 and the 2035 maturity of NPPD BABs at 103, both above the initial offering price.

47. On June 11, 2009, the senior manager sent a final pricing wire to the syndicate that set the initial trading time of NPPD bonds for 2:15 p.m. Eastern Time (“ET”) that day. At 2:36 p.m. ET that day, the senior manager sent a free-to-trade wire to the rest of the syndicate regarding the NPPD taxable bonds and BABs which read: “Effective immediately all syndicate terms and price restrictions are removed and the bonds are free to trade.”

6. From the order:

Generally, the syndicate is the only source of pricing and other information about the bonds to be issued before and during the order period(s). Retail investors, in particular, must rely on communications from their broker-dealer, acting in the capacity of underwriter, to learn about pricing and other offering details before the bonds begin trading. Ultimately, the initial offering prices are printed on the cover page of the final disclosure document, known as the Official Statement (“OS”), which typically is released days after the bonds begin trading.

7. That’s from this Sifma page (the 2002 Version “MAAU Master Standard Terms and Conditions – Negotiated Offerings of Municipal Securities”). The key language seems to be on page 14:

You agree to make a public offering of all Securities confirmed to you by us (other than for carrying purposes) at the public offering price in effect at the time of such confirmation and to offer all other Securities acquired by you prior to the time we have advised you that no Securities are held for the account of the Account at not less than the public offering price as from time to time in effect. You may, however, (i) hold Securities that cannot be sold at the public offering price, for later sale at such prices whether above or below the public offering price in effect at the time of confirmation, as you determine, and (ii) reserve Securities for retail sale in customary amounts, even if unfilled orders from nonretail purchasers have been received.

What does that last clause (ii) mean? I think it means that the co-managers can keep customary amounts of bonds for sale to retail customers, but the actual operation of the clause seems to be left to custom to work out.

8. Again, less fees (see footnote 3). It is perhaps clarifying to pretend that banks buy bonds at the offer price and re-sell at the offer price and get paid a fee separately, though the actual legal operation is that they buy at a discount and sell at the offer price.

9. For the AAU, see footnote 7, above.

For the bond purchase agreements, see paragraph 20 of the SEC order, which says that “Many BPAs include an explicit agreement by the syndicate to offer all of the bonds to be issued at the final offering price negotiated with the issuer.” But as a co-manager, Edward Jones wouldn’t sign the purchase agreement, which was executed by “the senior manager on behalf of the syndicate.”

For the MSRB rules, see paragraphs 71-81 of the SEC order. Some of these rules (G-17 and G-30(a)) are about general fairness and excessive markups, but one, Rule G-11(b), does require syndicate members to identify the person for whom the order is submitted, and the SEC says that Edward Jones fudged that identification to get bonds for itself. This sort of thing does seem to be what Rule G-11(b) is meant to prevent; on the other hand, you can’t really say that the harm that Edward Jones did came from improper identifications on syndicate forms. And even this comes down to questions of custom; see paragraph 31 of the order (“Pursuant to industry practice and MSRB rules, a group net order can be placed for a dealer’s own account, but it would have to be disclosed that the order was for stock, that is, for the dealer’s own account.”).

10. See paragraphs 65-70 of the SEC order, particularly 65-66:

Section 17(a)(2) of the Securities Act makes it unlawful “in the offer or sale of any securities … directly or indirectly … to obtain money or property by means of any untrue statement of a material fact or any omission to state a material fact necessary in order to make the statements made, in light of the circumstances under which they were made, not misleading.” Section 17(a)(3) of the Securities Act makes it unlawful “in the offer or sale of any securities … directly or indirectly … to engage in any transaction, practice, or course of business which operates or would operate as a fraud or deceit upon the purchaser.” Negligence is sufficient to establish a violation of Sections 17(a)(2) and 17(a)(3); no finding of scienter is required. Aaron v. SEC, 446 U.S. 680, 696-97 (1980).

An underwriter “occupies a vital position” in a securities offering because investors rely on its reputation, integrity, independence, and expertise. Municipal Securities Disclosure, Exchange Act Release No. 26100, 1988 WL 999989 at 20 (Sept. 22, 1988). “By participating in an offering, an underwriter makes an implied recommendation about the securities.” Id. “An underwriter must investigate and disclose material facts that are known or reasonably ascertainable.” Dolphin and Bradbury, Inc. v. SEC, 512 F.3d 634, 641 (D.C. Cir. 2008) (citing Municipal Securities Disclosure, Exchange Act Release No. 26100, 1988 WL 999989 at 20). “Although other broker-dealers may have the same responsibilities in certain contexts, underwriters have a ‘heightened obligation’ to ensure adequate disclosure.” Id.

11. I mean, not really, I’m being rhetorical here. (Another super-not-legal-advice sentence.) But, materiality, reliance, blah blah blah.

Bloomberg

By Matt Levine

15 AUG 14, 2015 4:01 PM EDT

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

To contact the author on this story:

Matt Levine at [email protected]

To contact the editor on this story:

Zara Kessler at [email protected]